😳 I like David. I feel badly you have to sift through that train wreck of replies.

😂 Not a single #DeFi project named on #Ethereum.

🤷♂️ Maxi vapor projects using the word “DeFi” are in vogue!

Here’s a list of projects interacting with hundreds of millions, if not billions...

😂 Not a single #DeFi project named on #Ethereum.

🤷♂️ Maxi vapor projects using the word “DeFi” are in vogue!

Here’s a list of projects interacting with hundreds of millions, if not billions...

https://twitter.com/davidjnage/status/1312000491350622209

1. DEX aggregators like @matchaxyz @1inchExchange @paraswap @DEXAG_TokenWire and now we offer one at @zapper_fi Exchange

2. Decentralized perpetual markets like @MonteCarloDEX @dydxprotocol and soon again @futureswapx

2. Decentralized perpetual markets like @MonteCarloDEX @dydxprotocol and soon again @futureswapx

3. DeFi dashboards @zapper_fi duh, @DeBankDeFi, @zerion_io, @akropolisio Delphi

4. Stablecoin pools @CurveFinance, @SwerveFinance, @Mstable

5. Wallets @argentHQ @Dharma_HQ @rainbowdotme @CoinbaseWallet

6. Swap style DEXs @UniswapProtocol, @BalancerLabs, @SushiSwap @mooniswap

4. Stablecoin pools @CurveFinance, @SwerveFinance, @Mstable

5. Wallets @argentHQ @Dharma_HQ @rainbowdotme @CoinbaseWallet

6. Swap style DEXs @UniswapProtocol, @BalancerLabs, @SushiSwap @mooniswap

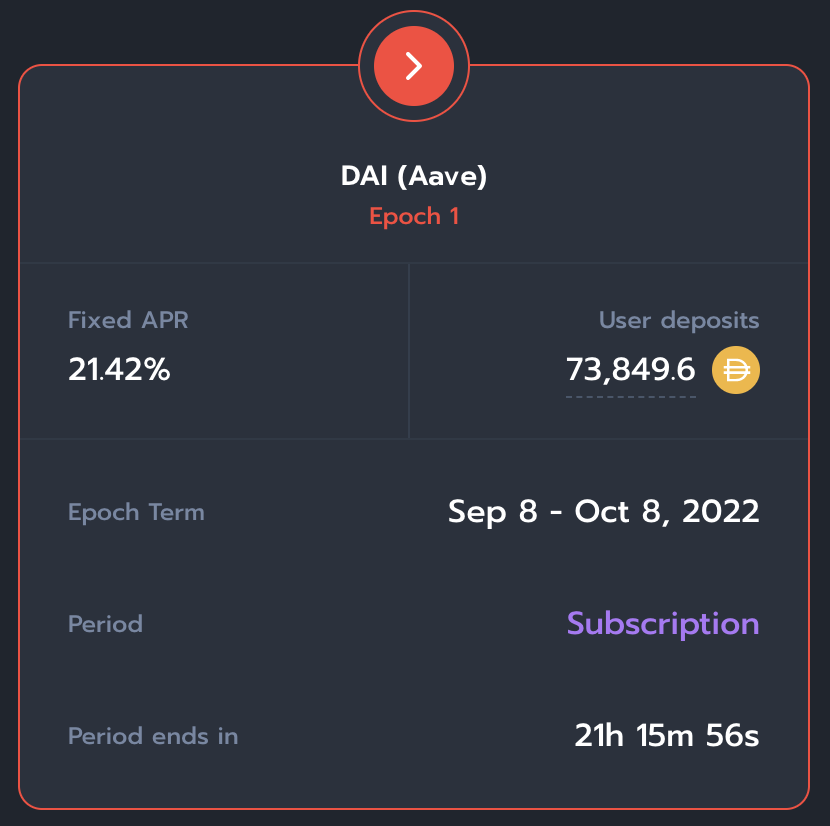

7. Leading lending platforms like @AaveAave and @compoundfinance

8. DeFi insurance / hedging with @NexusMutual, @opyn_ and @HegicOptions

9. Swaps/automated yield-earning assets like yVaults by @iearnfinance, @CreamdotFinance Swaps to yVaults, and @zapper_fi Zaps/Exchange

8. DeFi insurance / hedging with @NexusMutual, @opyn_ and @HegicOptions

9. Swaps/automated yield-earning assets like yVaults by @iearnfinance, @CreamdotFinance Swaps to yVaults, and @zapper_fi Zaps/Exchange

10. Soon @epnsproject will enable decentralized notifications by wallet—enabling marketing and product related notifications without giving up data and based upon what’s in your wallet.

@HAL_team is a cool centralized product of what I described above

@HAL_team is a cool centralized product of what I described above

Lastly highly recommend you get to know Zaps at Zapper.fi/invest which offers 1-2 clicks to automate LP deposits/withdraws within @UniswapProtocol, @BalancerLabs, @iearnfinance and @CurveFinance.

Watch @Yield_TV today at 1 pm EST and I’ll have @MickdeG010 of @PieDAO_DeFi on to show off how they create baskets of exposure using @BalancerLabs at tv.zapper.fi.

Oh and I left off NFTs but that’s obviously an incredible rabbit hole to go down.

@opensea

@DontBuyMeme

@mintbase

@rariblecom

@ZooToken

@cryptovoxels

@token_smart (great community to join!)

Barely the tip of the iceberg above!

@opensea

@DontBuyMeme

@mintbase

@rariblecom

@ZooToken

@cryptovoxels

@token_smart (great community to join!)

Barely the tip of the iceberg above!

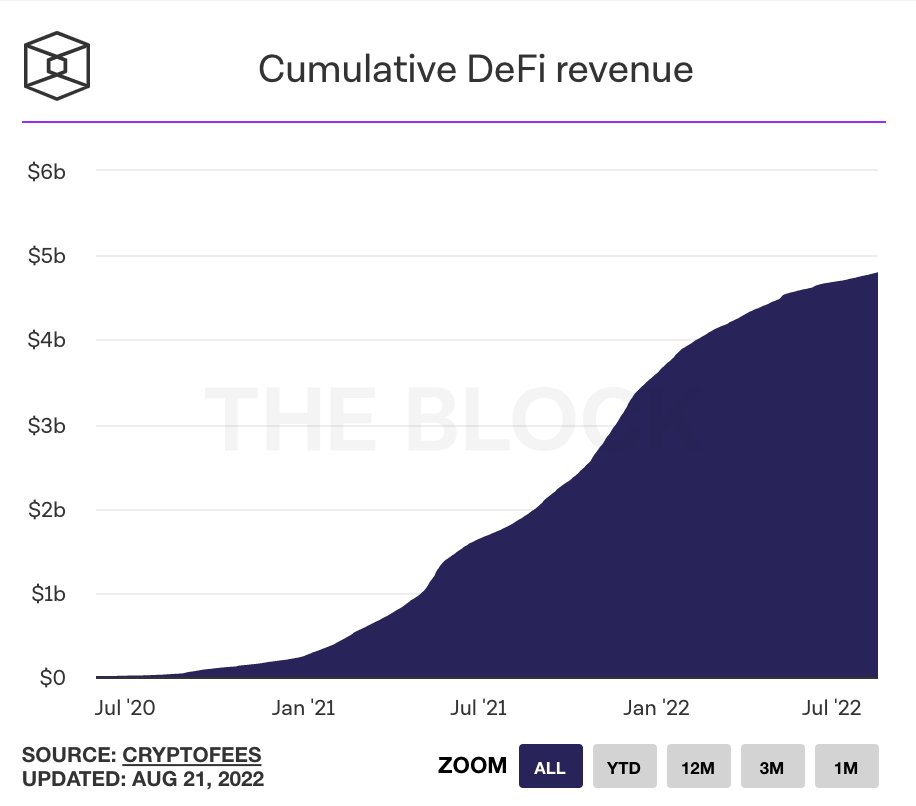

Just for the hell of it and I know you know @synthetix_io but for the #DeFi newbies there’s $120M of derivatives trading on Synthetix.exchange with $620M TVL.

https://twitter.com/defi_dad/status/1311697248955305984

• • •

Missing some Tweet in this thread? You can try to

force a refresh