1/6

Good article, but worrying. Albert Hirschman argued that once a developing country reaches the maximum level of investment it can absorb productively, which I'd argue China did in the past two decades, it must implement the financial, legal, and...

ft.com/content/582411…

Good article, but worrying. Albert Hirschman argued that once a developing country reaches the maximum level of investment it can absorb productively, which I'd argue China did in the past two decades, it must implement the financial, legal, and...

ft.com/content/582411…

2/6

political reforms that allow its workers and businesses to operate productively at higher investment levels. This, he always said, was the hard part, as it always involved changes in the distribution of wealth and political power away from the incumbents.

political reforms that allow its workers and businesses to operate productively at higher investment levels. This, he always said, was the hard part, as it always involved changes in the distribution of wealth and political power away from the incumbents.

3/6

I think Hirschman is right. The main difference between advanced economies and developing economies is the nature of their institutions, not the amount of capital invested (it is the former that should determine the latter).

I think Hirschman is right. The main difference between advanced economies and developing economies is the nature of their institutions, not the amount of capital invested (it is the former that should determine the latter).

4/6

I would argue that if Beijing really is determined to exercise greater economic control over the private sector, as this article argues (although the jury is still out), it would represent institutional regression in the ability of the economy to use that...

I would argue that if Beijing really is determined to exercise greater economic control over the private sector, as this article argues (although the jury is still out), it would represent institutional regression in the ability of the economy to use that...

5/6

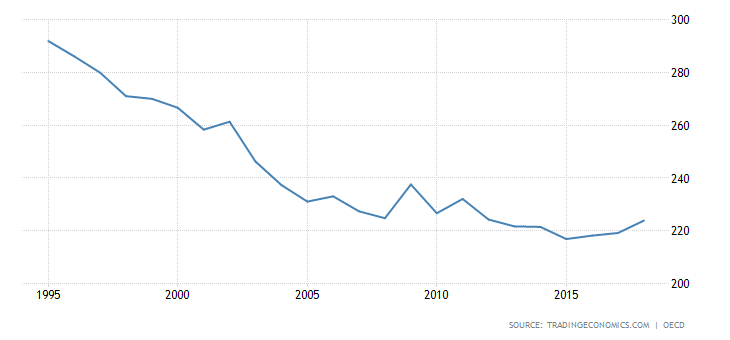

investment productively. Of course it would give Beijing greater control over the investment process, but while this control hugely benefitted China in the 1980s and 1990s, the conditions were radically different then from now. In those days China was massively...

investment productively. Of course it would give Beijing greater control over the investment process, but while this control hugely benefitted China in the 1980s and 1990s, the conditions were radically different then from now. In those days China was massively...

6/6

underinvested for its level of institutional development.

Today it is overinvested. There is no point, in other words, of trying to return to the rapid growth strategies of the first three decades of rapid growth because the conditions are completely different.

underinvested for its level of institutional development.

Today it is overinvested. There is no point, in other words, of trying to return to the rapid growth strategies of the first three decades of rapid growth because the conditions are completely different.

• • •

Missing some Tweet in this thread? You can try to

force a refresh