(1/12) From the very start of his presidency, Donald Trump has found small ways to convert power into profit. To better understand this, let’s take a look at the numbers inside the Trump International Hotel in Washington, D.C.

(2/12) We’ll start with the 58th Presidential Inaugural Committee, the group that raised money to celebrate the inaugural festivities. It was headed up by Tom Barrack, one of Trump’s old buddies. A bunch of billionaires poured in money. forbes.com/sites/danalexa…

(3/12) “They all want to kiss the rear of whoever wins the election,” explained @RWPUSA, chief ethics lawyer in the W. Bush administration. One danger is it can start to look like a slush fund. “It’s a potential problem that every decent ethics lawyer knows is a huge issue.”

(4/12) Especially if the money ends up going to people in the administration. The committee reportedly spent more than $1.5M at Donald Trump’s hotel. The D.C. attorney general ended up filing a lawsuit, alleging abuse of nonprofit funds.

nytimes.com/2019/01/14/us/…

nytimes.com/2019/01/14/us/…

(5/12) How important was that money to Trump? Well, let’s dig into his hotel’s financials. The Washington Post got the numbers for February 2017. We can do some math on those to figure out the financials for January, the month of the inauguration. washingtonpost.com/news/business/…

(6/12) The year-to-date revenue by the end of February was $8,721,000, and the February revenue was $2,735,000. So that means the January revenue was about $8,721,000 - $2,735,000 = $5,986,000.

(7/12) That suggests, given the $1.5M+ that reportedly flowed from the Presidential Inaugural Committee to the hotel, at least $1,500,000/$5,986,000=25% of the revenue at the Trump hotel in January 2017 came from Trump’s political donors. Turning power into profit, from day 1.

(8/12) That 25% doesn’t include all the other money coming from Trump associates who paid their own bills. Trump’s partner in Vegas, Phil Ruffin, forked over $18K a night for a suite. “We had a great suite,” Ruffin told me. “It wasn’t worth $18,000 a night.”

(9/12) The hotel ended up turning a January 2017 profit of $1.6 million, when it had been projecting a one-month loss of $598,000. During Trump’s first inauguration, it paid to be president.

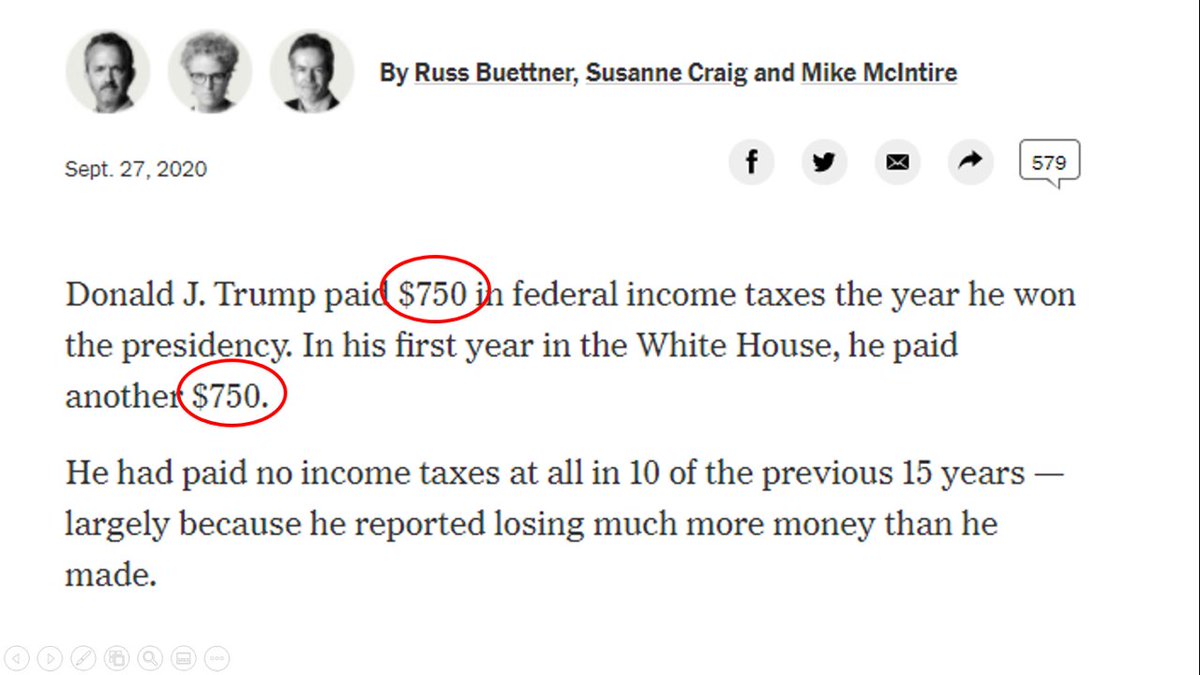

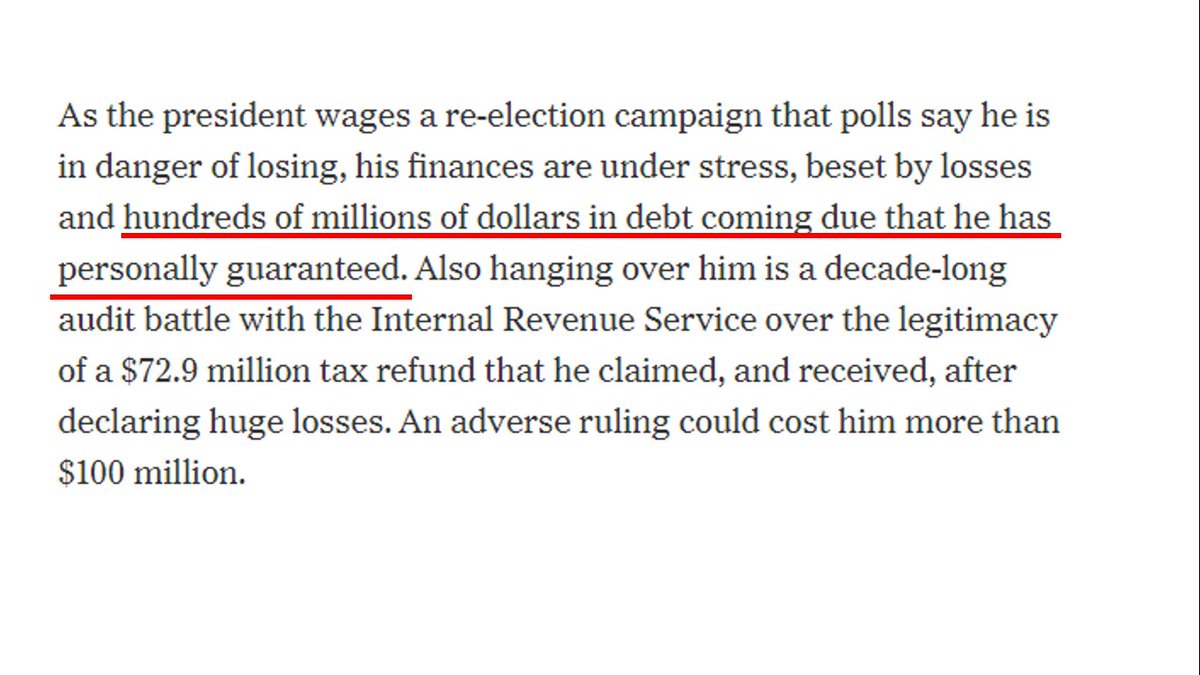

(10/12) Later, being president wasn’t so profitable. Citing tax-return data, the New York Times reported that the hotel ended up declaring tax losses of $55.5 million from the time it opened in 2016 to the end of 2018. nytimes.com/interactive/20…

(11/12) This small story reflects a larger trend across Trump’s businesses. Yes, he has gotten small sums of money in ethically questionable ways. But no, it hasn’t been enough to make up for bigger problems in his empire. Overall, his fortune is down. forbes.com/sites/danalexa…

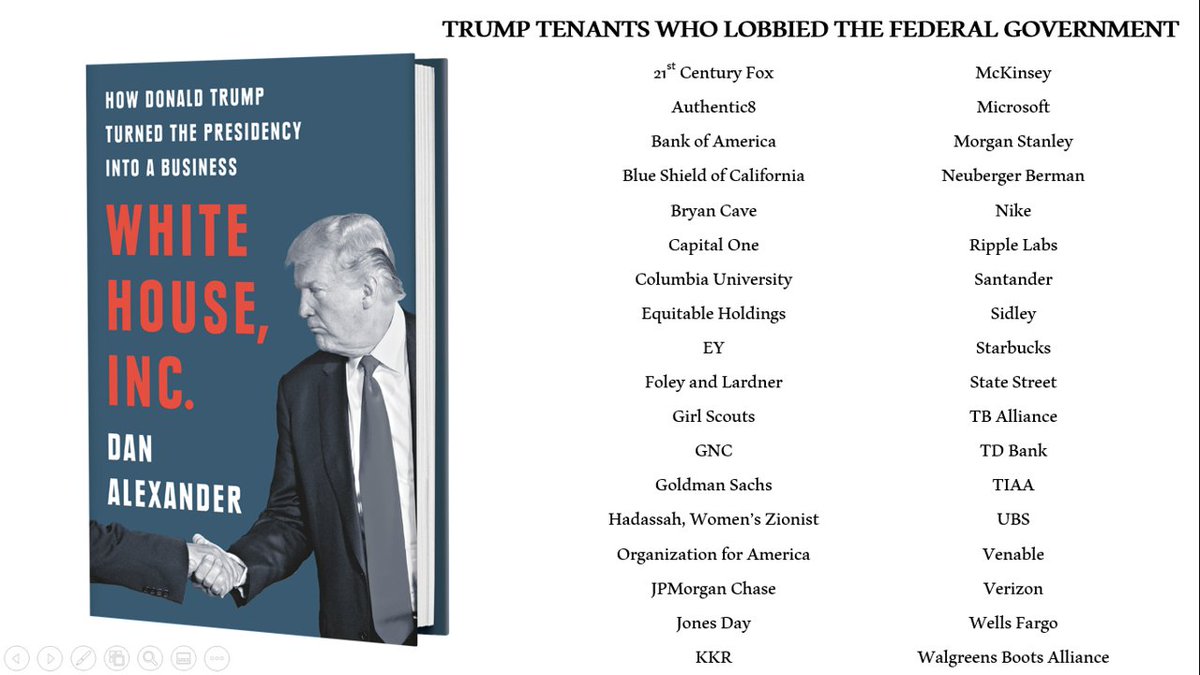

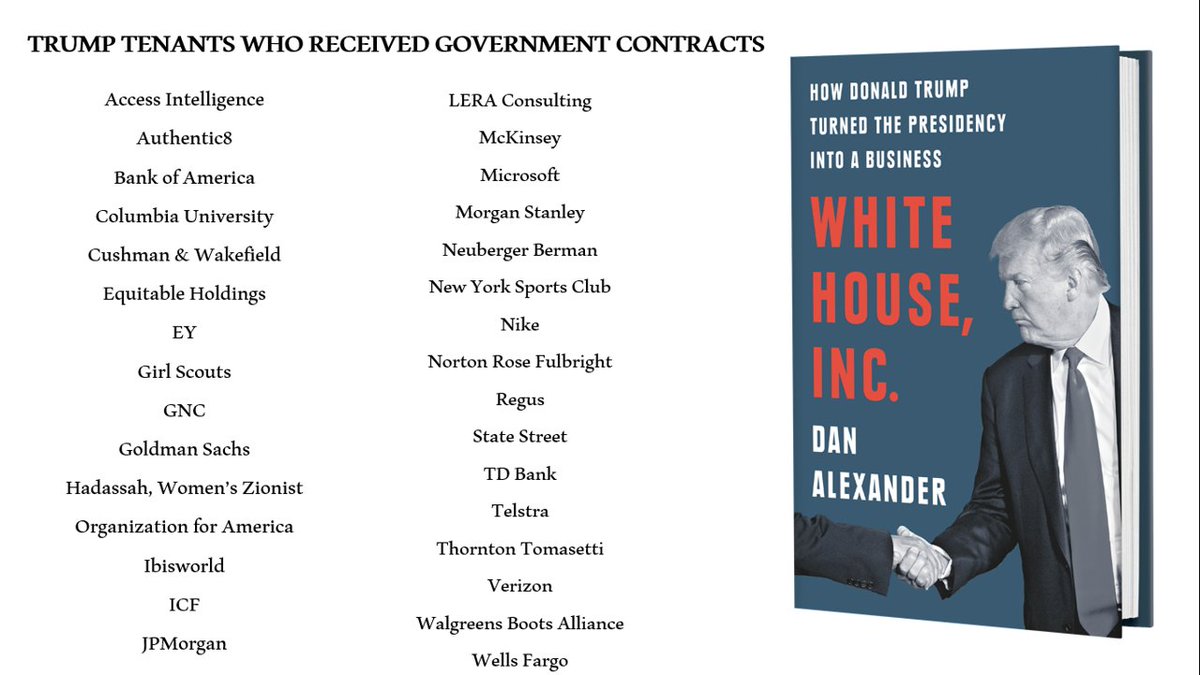

(12/12) To dig deeper into Trump’s finances, check out my new book “White House, Inc.: How Donald Trump Turned the Presidency into a Business.” penguinrandomhouse.com/books/623950/w…

• • •

Missing some Tweet in this thread? You can try to

force a refresh