(1/9) When Donald Trump became the president of the United States, his brand got bigger, but it didn’t get better. Just take a look at what happened to Trump National Doral, his golf resort in Miami. forbes.com/sites/danalexa…

(2/9) Here’s a video of the Trump Organization’s tax specialist getting sworn in at a local proceeding where she is going to explain the situation in December 2017, 11 months into Trump’s presidency.

(3/9) “I met with the director of finance, as well as the director of development for all of the Trump Organization,” Trump’s tax representative explains here. “And they mentioned that throughout 2016, because of the political climate, there have been severe ramifications.”

(4/9) In the clip above, the tax specialist references the PGA announcing it was moving the World Golf Championships tournament from Doral to Mexico, of all places. Here was the explanation from Tim Finchem, the PGA Tour commissioner, according to ESPN. espn.com/golf/story/_/i…

(5/9) Another issue, explained by the Trump tax representative: “There have been a multitude of charities who throw annual events at the property, and they have canceled, because, they say, ‘We can’t, in good conscience, be associated with this name.’”

(6/9) Charities weren’t the only customers staying away from Trump properties, as the president’s tax rep explains here. “The property was definitely impacted by that, and you’ll see in the financials that there is a significant drop in revenue from last year to this year.”

(7/9) Indeed. Here are the financials. From 2015 to 2016, when Trump won the election, revenues fell 5% to $87.5M and profits dropped 10% to $12.4M. In 2017, Trump's first year in office, revenues dropped to $75.4M, and profits plunged to just $4.3M.

(8/9) “It’s bad,” a former server named Matias Magarinos told me. Not the experience, but the business. “It was very well run,” he explained. “I think they just had the bad luck of their owner becoming president.”

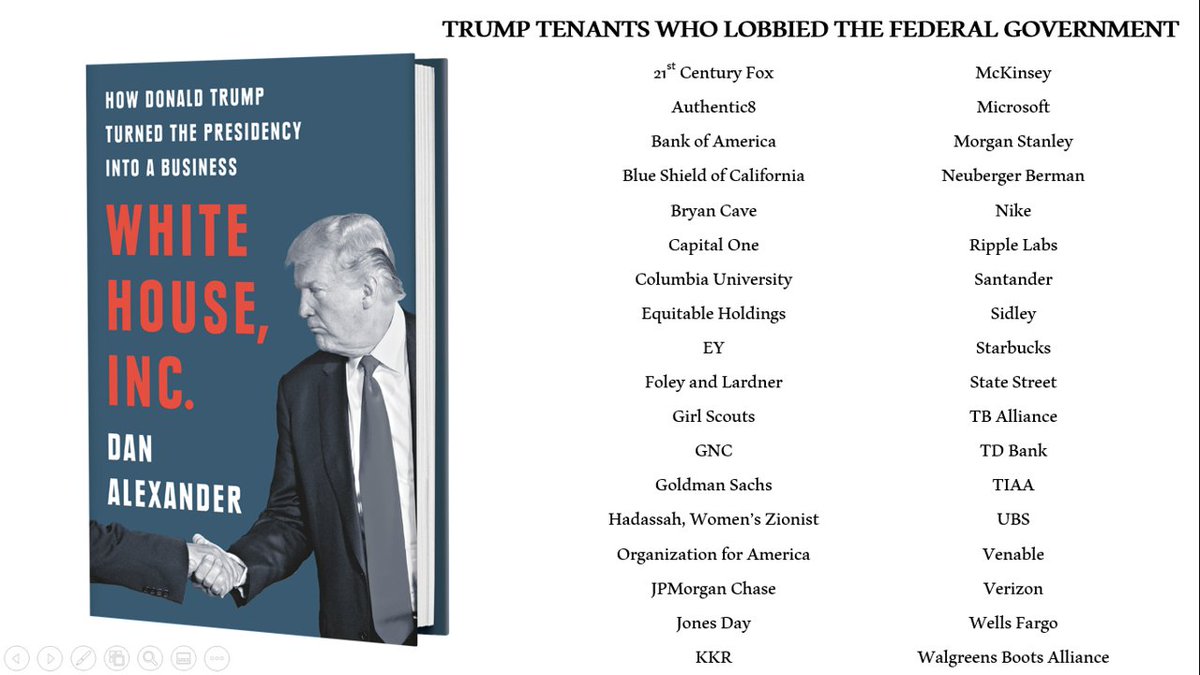

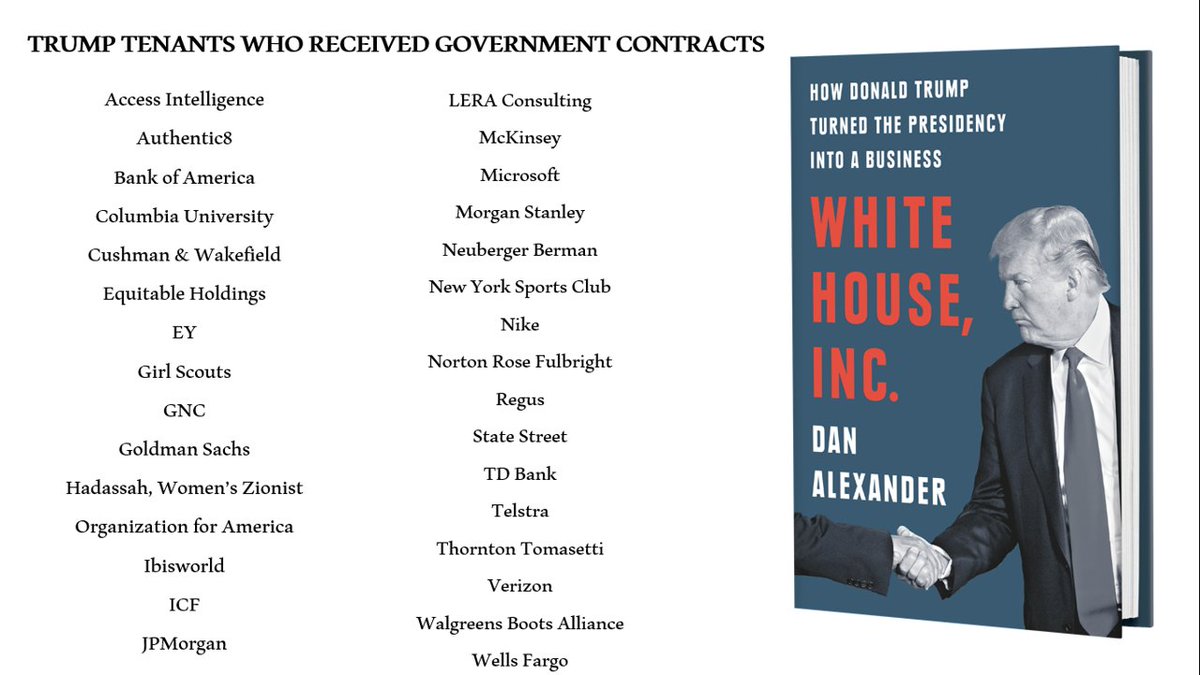

(9/9) For an exhaustive investigation of the president’s finances, pick up a copy of my new book “White House, Inc.: How Donald Trump Turned the Presidency into a Business.” penguinrandomhouse.com/books/623950/w…

• • •

Missing some Tweet in this thread? You can try to

force a refresh