Do you know how the Federal Reserve was founded?

What if I told you the story involves heavy doses of JP Morgan, an exclusive island, and a secret club?

Check out the whole story 👇🏽

[THREAD]

What if I told you the story involves heavy doses of JP Morgan, an exclusive island, and a secret club?

Check out the whole story 👇🏽

[THREAD]

1/

Let's go all the way back to the infancy of America.

After the Revolution, Alexander Hamilton wanted to create a strong central bank but Jefferson and Madison thought it was unconstitutional.

Against the opposition, Hamilton established the First Bank of the US in 1791.

Let's go all the way back to the infancy of America.

After the Revolution, Alexander Hamilton wanted to create a strong central bank but Jefferson and Madison thought it was unconstitutional.

Against the opposition, Hamilton established the First Bank of the US in 1791.

2/

The First Bank's charter was only 20 years, after which it could be renewed.

Who was in office in 1811?

James Madison, who, of course, decided not to renew.

Until it affected him.

Madison realized how difficult it was to fight the War of 1812 without a central bank.

The First Bank's charter was only 20 years, after which it could be renewed.

Who was in office in 1811?

James Madison, who, of course, decided not to renew.

Until it affected him.

Madison realized how difficult it was to fight the War of 1812 without a central bank.

3/

The Second Bank of the US was established in 1816, where it eventually fizzled out under Andrew Jackson 20 years later.

Without a central bank, "the supply of dollars was tied to private banks’ holdings of government bonds."

Source:

washingtonpost.com/news/wonk/wp/2…

The Second Bank of the US was established in 1816, where it eventually fizzled out under Andrew Jackson 20 years later.

Without a central bank, "the supply of dollars was tied to private banks’ holdings of government bonds."

Source:

washingtonpost.com/news/wonk/wp/2…

4/

The result was a bunch of spiraling panics. Without the ability to print money, liquidity was an issue.

People, unknowingly, would withdraw more from a bank that it had available, causing it to fail.

This failure would lead other people to withdraw their money, etc.

The result was a bunch of spiraling panics. Without the ability to print money, liquidity was an issue.

People, unknowingly, would withdraw more from a bank that it had available, causing it to fail.

This failure would lead other people to withdraw their money, etc.

5/

In fact, there was a panic so severe in 1873 that people dubbed it "The Great Depression" until the 1930's came along.

But the real kicker was the Panic of 1907.

A combination of economic growth & the 1906 San Francisco earthquake put a strain on the supply of dollars.

In fact, there was a panic so severe in 1873 that people dubbed it "The Great Depression" until the 1930's came along.

But the real kicker was the Panic of 1907.

A combination of economic growth & the 1906 San Francisco earthquake put a strain on the supply of dollars.

6/

With banks short on money, people were nervous they would lose their deposits.

So that spiral happened. People started withdrawing their money. Fast.

There was a real liquidity crisis.

But guess who came to the rescue?

With banks short on money, people were nervous they would lose their deposits.

So that spiral happened. People started withdrawing their money. Fast.

There was a real liquidity crisis.

But guess who came to the rescue?

7/

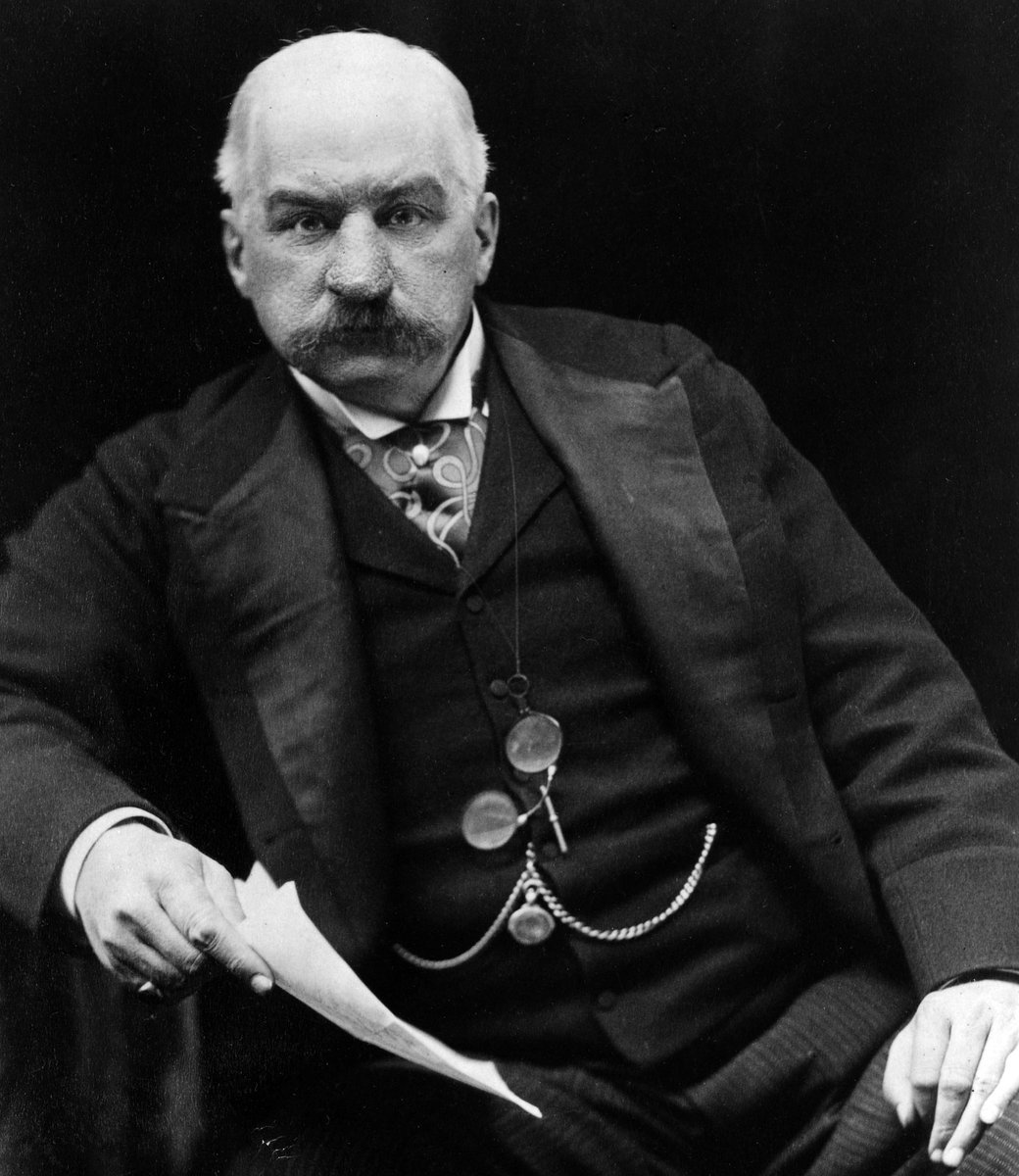

JP Morgan.

On November 2nd at 9 pm, Morgan rounded up 40-50 bankers at his mansion to create a plan.

8 hours later, the group agreed that Morgan would bail out some of the weaker banks, ensuring confidence and solving the liquidity crisis.

JP Morgan.

On November 2nd at 9 pm, Morgan rounded up 40-50 bankers at his mansion to create a plan.

8 hours later, the group agreed that Morgan would bail out some of the weaker banks, ensuring confidence and solving the liquidity crisis.

8/

However, the Panic of 1907 did damage some serious damage.

It was enough to spark Congress into creating the National Monetary Commission (NMC), a group that would travel around Europe, looking for successful national banking models.

A central bank had to be created.

However, the Panic of 1907 did damage some serious damage.

It was enough to spark Congress into creating the National Monetary Commission (NMC), a group that would travel around Europe, looking for successful national banking models.

A central bank had to be created.

9/

And here's where things get interesting.

The chair of the NMC was a senator named Nelson Aldrich.

He had two parties to appease.

The banks and the biggest economic contributors, farmers.

The banks wanted a liquidity backstop but the farmers were wary of Wall Street.

And here's where things get interesting.

The chair of the NMC was a senator named Nelson Aldrich.

He had two parties to appease.

The banks and the biggest economic contributors, farmers.

The banks wanted a liquidity backstop but the farmers were wary of Wall Street.

10/

There had to be a solution.

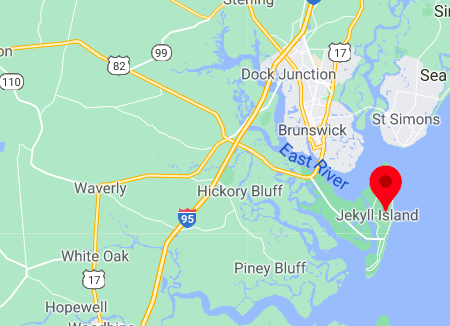

In 1910, Aldrich rounded up a secret group of 6 men, called "The First Name Club."

These 6 men were locked in a room on Jekyll Island, off the coast of Georgia to brainstorm what would become the Federal Reserve.

There had to be a solution.

In 1910, Aldrich rounded up a secret group of 6 men, called "The First Name Club."

These 6 men were locked in a room on Jekyll Island, off the coast of Georgia to brainstorm what would become the Federal Reserve.

11/

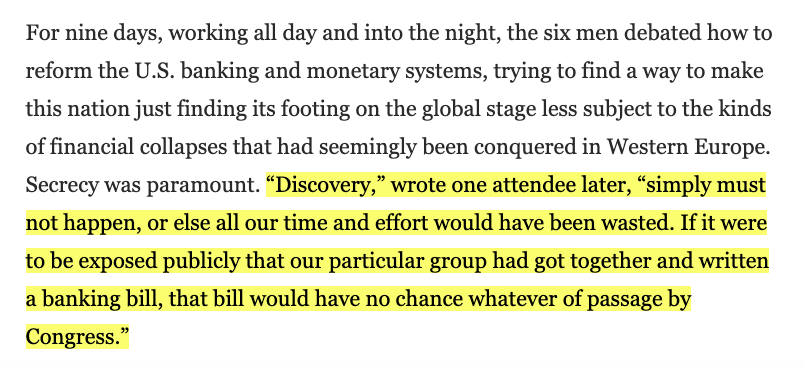

This is a great snippet about the Jekyll Island meeting (note that JP Morgan was a member of the Jekyll Island club).

en.wikipedia.org/wiki/Jekyll_Is…

This is a great snippet about the Jekyll Island meeting (note that JP Morgan was a member of the Jekyll Island club).

en.wikipedia.org/wiki/Jekyll_Is…

11/

1. A.P. Andrews (Asst. Secretary, US Treasury)

2. Paul Warburg (Kuhn, Loeb & Co.)

3. Frank Vanderlip (pres. of the National City Bank of NY)

4. Henry Davison (senior partner of JP Morgan)

5. Charles Norton (pres. of First National Bank of NY)

6. Benjamin Strong (JP Morgan)

1. A.P. Andrews (Asst. Secretary, US Treasury)

2. Paul Warburg (Kuhn, Loeb & Co.)

3. Frank Vanderlip (pres. of the National City Bank of NY)

4. Henry Davison (senior partner of JP Morgan)

5. Charles Norton (pres. of First National Bank of NY)

6. Benjamin Strong (JP Morgan)

12/

Above were 6 men that brainstormed the new central bank, shrouded in secrecy.

The reason for the secrecy ⬇️

Above were 6 men that brainstormed the new central bank, shrouded in secrecy.

The reason for the secrecy ⬇️

13/

With the new ideas in hand, Aldrich put it up to Congress.

However, there were some struggles. Some senators didn't like the new power bankers would have.

Others like President Woodrow Wilson thought it should be more centralized & that politicians would lend legitimacy

With the new ideas in hand, Aldrich put it up to Congress.

However, there were some struggles. Some senators didn't like the new power bankers would have.

Others like President Woodrow Wilson thought it should be more centralized & that politicians would lend legitimacy

14/

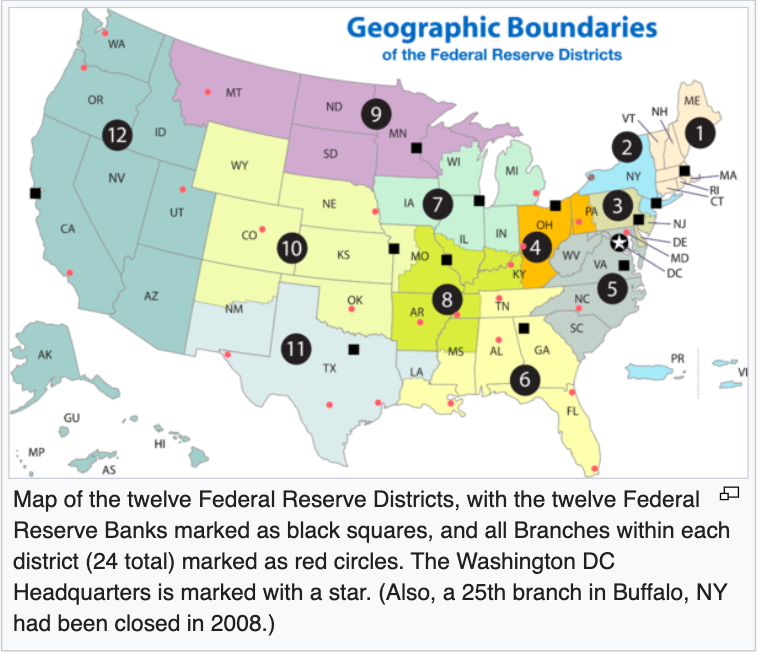

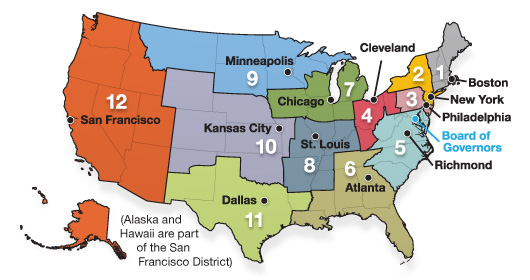

The vote came down to one man, James A. Reed, from Missouri.

Is it any wonder that Missouri, to this day, has 2 out of the 12 Federal Reserve banks? (St. Louis and Kansas City)

The vote came down to one man, James A. Reed, from Missouri.

Is it any wonder that Missouri, to this day, has 2 out of the 12 Federal Reserve banks? (St. Louis and Kansas City)

15/

The solution the 6 Jekyll Island men came to was that the central bank should be distributed because the government couldn't possibly know what was going on in each district.

Those locations haven't changed even as populations have.

The solution the 6 Jekyll Island men came to was that the central bank should be distributed because the government couldn't possibly know what was going on in each district.

Those locations haven't changed even as populations have.

17/

The 12 regions work together with the Federal Reserve Board to oversee inflation, adjust interest rates, etc.

I'm overreaching but is it also a coincidence that the Federal Reserve Board has 7 members to this day (Aldrich + 6 Jekyll brainstormers??)

The 12 regions work together with the Federal Reserve Board to oversee inflation, adjust interest rates, etc.

I'm overreaching but is it also a coincidence that the Federal Reserve Board has 7 members to this day (Aldrich + 6 Jekyll brainstormers??)

End/

The Fed's decisions obviously have big impacts on the US economy and therefore the global economy.

It has a fascinating history and it's crazy how crucial JP Morgan was in its formation (bailout in 1907 and used his resort for the First Name Club).

The Fed's decisions obviously have big impacts on the US economy and therefore the global economy.

It has a fascinating history and it's crazy how crucial JP Morgan was in its formation (bailout in 1907 and used his resort for the First Name Club).

Main sources

Book:

amazon.com/Alchemists-Thr…

Adaptation (short version):

washingtonpost.com/news/wonk/wp/2…

Book:

amazon.com/Alchemists-Thr…

Adaptation (short version):

washingtonpost.com/news/wonk/wp/2…

• • •

Missing some Tweet in this thread? You can try to

force a refresh