XELPMOC DESIGN AND TECH LIMITED

AR (2019-20) Notes

Before moving further, look at this video (4-6 mins) to see how uniquely the MD & CEO Sandipan Chattopadhyay defines AI.

Thread follows

AR (2019-20) Notes

Before moving further, look at this video (4-6 mins) to see how uniquely the MD & CEO Sandipan Chattopadhyay defines AI.

Thread follows

1/

~Started in 2015- 24 people

~IPO in 2019

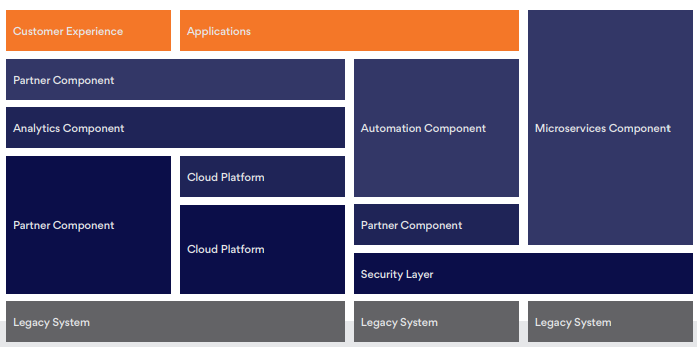

~End-to-end IT service provider

~Product Dev, Data Science & Analytics

~Next Gen Tech: Al & ML

~Core theme: HEAL (Health, Edu, Agri & Livelihood)

~Started in 2015- 24 people

~IPO in 2019

~End-to-end IT service provider

~Product Dev, Data Science & Analytics

~Next Gen Tech: Al & ML

~Core theme: HEAL (Health, Edu, Agri & Livelihood)

2/

A unique business of providing tech solutions in exchange for equity.

Key Partnerships:

~Fortigo Network Logistic Private Limited

~Mihup Communication Private Limited

~Woovly India Private Limited

~Leadstart Publishing Services Private Limited

~Rype Fintech Private Limited

A unique business of providing tech solutions in exchange for equity.

Key Partnerships:

~Fortigo Network Logistic Private Limited

~Mihup Communication Private Limited

~Woovly India Private Limited

~Leadstart Publishing Services Private Limited

~Rype Fintech Private Limited

3/

~Market Cap of Xelpmoc: INR 450 Cr

~Cost of Inv in startups (31.03.20): 3.73 Cr

~Fair Value of Inv (31.03.20): 34.94 Cr

~Market Cap of Xelpmoc: INR 450 Cr

~Cost of Inv in startups (31.03.20): 3.73 Cr

~Fair Value of Inv (31.03.20): 34.94 Cr

4/

The Indian Tech Start-up Landscape

~The number of start-ups based on Deep-tech has been growing at a brisk pace of 40% CAGR since 2014.

~There are more than 1600+ deep-tech Startups in India as of 2019.

The Indian Tech Start-up Landscape

~The number of start-ups based on Deep-tech has been growing at a brisk pace of 40% CAGR since 2014.

~There are more than 1600+ deep-tech Startups in India as of 2019.

5/

Board of Directors

~Sandipan Chattopadhyay – MD & CEO: JUST DIAL, Moneycontrol, Tata Group

~Tushar Trivedi- Chairman: Expertise in Kotak Mahindra and Citi Bank)

~Srinivas Koora – Director & CTO: Deputy CFO at Just Dial

~Jason Jose- WTD: Experience in HR, BD & Operations

Board of Directors

~Sandipan Chattopadhyay – MD & CEO: JUST DIAL, Moneycontrol, Tata Group

~Tushar Trivedi- Chairman: Expertise in Kotak Mahindra and Citi Bank)

~Srinivas Koora – Director & CTO: Deputy CFO at Just Dial

~Jason Jose- WTD: Experience in HR, BD & Operations

6/

A must-read discussion with the founder:

~Cost Plus Equity Model

~No cash investment, only intellectual capital invested

~Focus sectors: HEAL

~Aspire to be always at the cutting edge of innovation and not just of technology

A must-read discussion with the founder:

~Cost Plus Equity Model

~No cash investment, only intellectual capital invested

~Focus sectors: HEAL

~Aspire to be always at the cutting edge of innovation and not just of technology

7/

Notes from MDA

~Overview of IT Industry

~Investment landscape

~Government Policy

~COVID -19 Impact

Notes from MDA

~Overview of IT Industry

~Investment landscape

~Government Policy

~COVID -19 Impact

8/

Notes from MDA

Notable Trends in the IT Industry

~New Technologies

~Changing Business Dynamics

~Promotion of R&D

~Infra

~AI

Notes from MDA

Notable Trends in the IT Industry

~New Technologies

~Changing Business Dynamics

~Promotion of R&D

~Infra

~AI

9/

Top 10 Shareholders

~UNIVERSITY OF NOTRE DAME DU LAC

~THE RAM FUND, LP

~MIRIFIC PARTNERS LLP

~PRAKASH SANKER

~GP EMERGING MARKETS STRATEGIES, LP

~PANCHAGNULA VENKATA LAKSHMI NARAYANA

~ANKUR DINESH GALA

~MASSACHUSETTS INSTITUTE OF TECH

~INDRANIL NANDI

~SHAUNAK JAGDISH SHAH

Top 10 Shareholders

~UNIVERSITY OF NOTRE DAME DU LAC

~THE RAM FUND, LP

~MIRIFIC PARTNERS LLP

~PRAKASH SANKER

~GP EMERGING MARKETS STRATEGIES, LP

~PANCHAGNULA VENKATA LAKSHMI NARAYANA

~ANKUR DINESH GALA

~MASSACHUSETTS INSTITUTE OF TECH

~INDRANIL NANDI

~SHAUNAK JAGDISH SHAH

13/

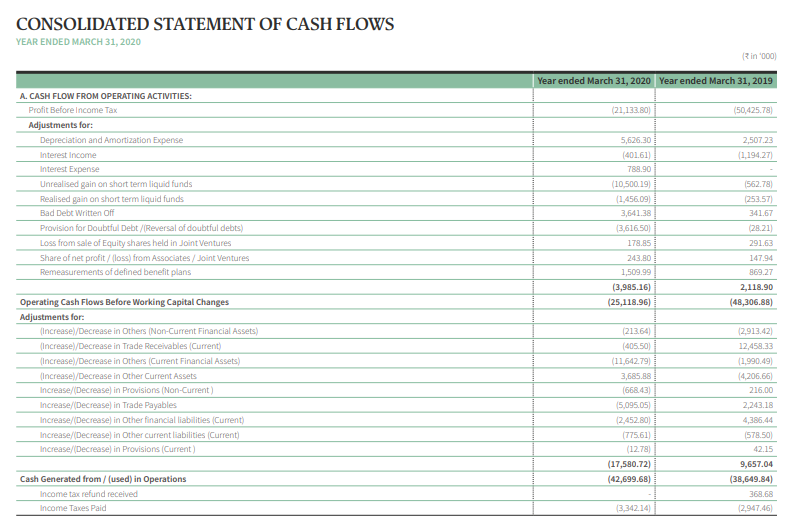

Risks

~Base rate of a start-up's success is very low

~OCF negative

~Lack of clarity on the value Xelp add to the start-ups

~Limited history to bet on the future

~How do you value the company?

Risks

~Base rate of a start-up's success is very low

~OCF negative

~Lack of clarity on the value Xelp add to the start-ups

~Limited history to bet on the future

~How do you value the company?

14/

This brings us to the end of AR 2019-20 Notes

While we try to figure out how to value a unique company like this, you may like to read this post on Sandipan Chattopadhyay

yourstory.com/2017/03/techie…

End

This brings us to the end of AR 2019-20 Notes

While we try to figure out how to value a unique company like this, you may like to read this post on Sandipan Chattopadhyay

yourstory.com/2017/03/techie…

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh