17.1 million American households are behind on their housing payment.

5.5 million are very likely or somewhat likely to leave their home due to eviction or foreclosure in the next two months.

This adjusts for item nonresponse @uscensusbureau #HouseholdPulseSurvey for 9/16-9/28.

5.5 million are very likely or somewhat likely to leave their home due to eviction or foreclosure in the next two months.

This adjusts for item nonresponse @uscensusbureau #HouseholdPulseSurvey for 9/16-9/28.

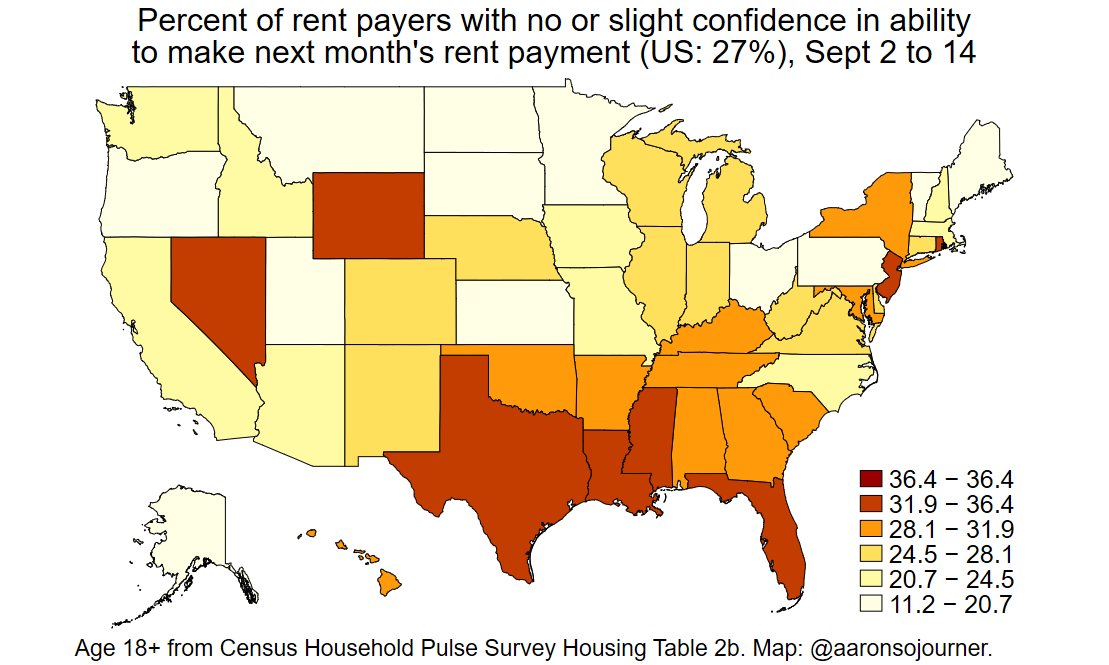

15% of American renters (8.4 million households) are behind on rent.

Among them, 46% (3.9 m) report it very or somewhat likely that they will have to leave their home in the next 2 months due to eviction.

Among them, 46% (3.9 m) report it very or somewhat likely that they will have to leave their home in the next 2 months due to eviction.

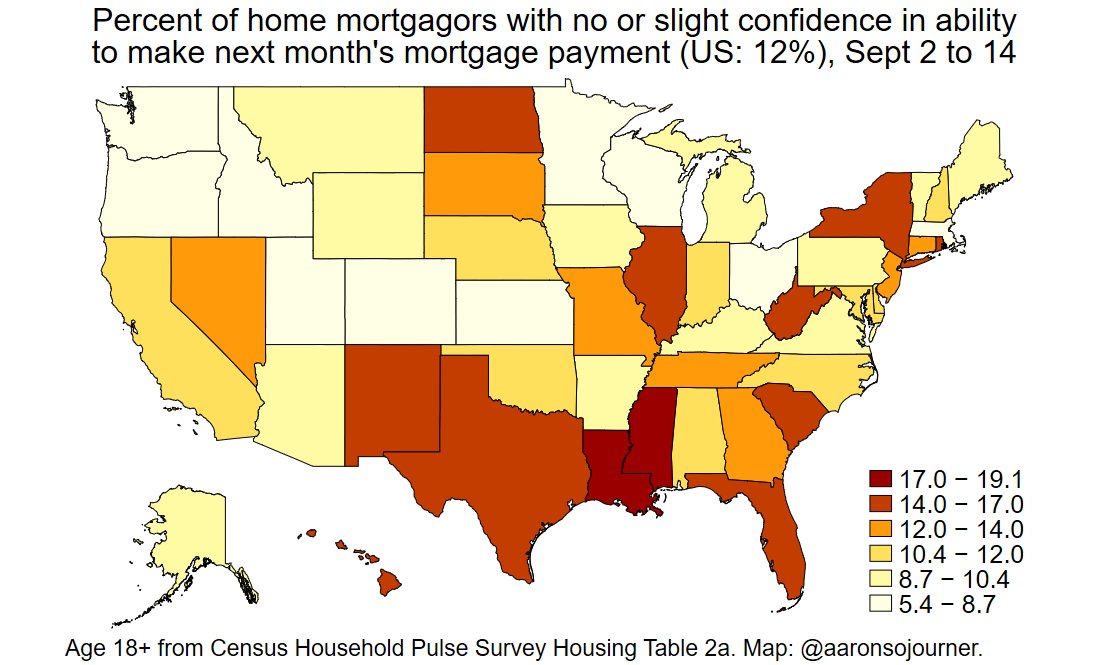

10% of American households with a home mortgage (8.7 million) are behind on their mortgage.

Among them, 19% (1.6 m) report it very or somewhat likely that they will leave their home due to foreclosure in the next two months.

Among them, 19% (1.6 m) report it very or somewhat likely that they will leave their home due to foreclosure in the next two months.

It's likely worse than this now. Survey was in late Sept, so that's people behind at the end of the month & now October brings a new bill.

Also, prospects for federal economic support collapsed yesterday so expectations abt foreclosure & eviction by end of Nov probably worsened.

Also, prospects for federal economic support collapsed yesterday so expectations abt foreclosure & eviction by end of Nov probably worsened.

Using micro-data from Sept 2-14 wave, can dig a bit deeper. Lots of households stressed:

- expecting employment income loss in 4 wks to now,

- can't stop worrying most days,

- lack of confidence in ability to make Oct housing payment,

- & behind on housing bills

- expecting employment income loss in 4 wks to now,

- can't stop worrying most days,

- lack of confidence in ability to make Oct housing payment,

- & behind on housing bills

• • •

Missing some Tweet in this thread? You can try to

force a refresh