1/Today's @bopinion post is about Trump's taxes, and what they show about how America allocates capital.

We appear to have some big problems.

bloomberg.com/opinion/articl…

We appear to have some big problems.

bloomberg.com/opinion/articl…

2/Trump has a bunch of businesses that lose money. Our financial system has lent him money to throw into unsuccessful golf courses, hotels, and so on.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

3/A lot of these loans are loans that Trump hasn't even paid back yet, using loopholes in the tax system to avoid paying taxes on those unpaid debts.

Why would creditors give money to a guy who wastes the money on bad businesses and doesn't even pay them back?

Why would creditors give money to a guy who wastes the money on bad businesses and doesn't even pay them back?

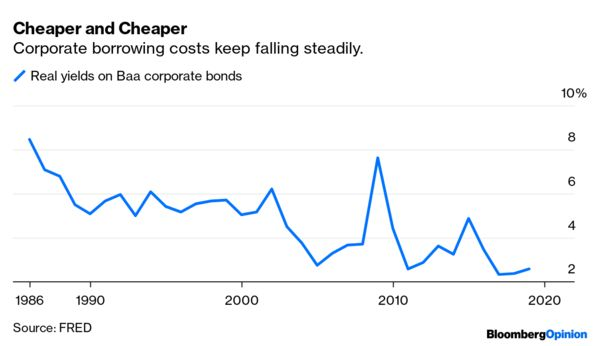

4/One seemingly obvious answer is that capital is just really cheap these days. Companies are able to borrow more easily than at any time in the last few decades.

5/But this presents us with a mystery.

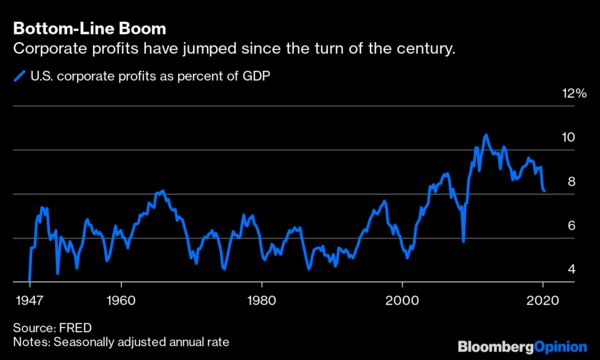

Why hasn't an abundance of cheap capital caused the return on financial capital to fall? Interest rates are low, but stock returns have held up strongly.

Why hasn't an abundance of cheap capital caused the return on financial capital to fall? Interest rates are low, but stock returns have held up strongly.

6/Standard economic theory says this isn't supposed to happen.

When you increase the supply of loanable funds, prices are supposed to go down. In other words, cheap capital should fund a lot of marginal businesses that compete away profits...

When you increase the supply of loanable funds, prices are supposed to go down. In other words, cheap capital should fund a lot of marginal businesses that compete away profits...

8/Economists are starting to notice that capital markets aren't working like an Econ 101 textbook says they're supposed to work.

Simcha Barkai and Matt Rognlie have both written about this:

1. onlinelibrary.wiley.com/doi/full/10.11…

2. mattrognlie.com/kn_comment_rog…

Simcha Barkai and Matt Rognlie have both written about this:

1. onlinelibrary.wiley.com/doi/full/10.11…

2. mattrognlie.com/kn_comment_rog…

9/One possible explanation -- which Barkai prefers -- is that market power is growing in the economy. Meaning that big profitable quasi-monopolies are sucking up all the cheap capital, while all the little guys starve.

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

10/But Rognlie doubts this explanation.

mattrognlie.com/kn_comment_rog…

And it doesn't really explain Trump, does it? He's not a monopolist, and he doesn't even make profit. He's just a huckster who can borrow cheaply because he's famous.

mattrognlie.com/kn_comment_rog…

And it doesn't really explain Trump, does it? He's not a monopolist, and he doesn't even make profit. He's just a huckster who can borrow cheaply because he's famous.

11/An alternative idea is that capital is being RATIONED in the U.S., rather than priced.

Financiers are willing to throw tons of cheap money at big powerful companies or at famous hucksters like Trump, but charge inordinate prices to fund new entrants or marginal businesses.

Financiers are willing to throw tons of cheap money at big powerful companies or at famous hucksters like Trump, but charge inordinate prices to fund new entrants or marginal businesses.

12/If this is true, it means lots of perfectly good companies are probably struggling to get the capital they need, leaving the playing field to the big boys who can borrow cheaply. As a side effect, crappy borrowers like Trump waste some of our nation's savings.

13/Our financial system isn't working the way it's supposed to. Cheap capital should be reducing the return on financial capital, increasing business entry, and competing down profits.

We need to figure out what's going wrong, and fix it!

(end)

bloomberg.com/opinion/articl…

We need to figure out what's going wrong, and fix it!

(end)

bloomberg.com/opinion/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh