It's not always Rainbows and Butterflies in #NFT Land.

There's HIGH Risks, (new market).

And we need to explore them.

1/ Thread 👇

There's HIGH Risks, (new market).

And we need to explore them.

1/ Thread 👇

2/ Projects Run Out of Funding.

NFT Industry is new so there's no 'proven' monetization model for projects.

Marketplace fees can be taken away, (to another NFT marketplace).

Selling more NFTs means you dilute initial investors. So can't keep doing that.

NFT Industry is new so there's no 'proven' monetization model for projects.

Marketplace fees can be taken away, (to another NFT marketplace).

Selling more NFTs means you dilute initial investors. So can't keep doing that.

3/ We've seen some projects fold due to this.

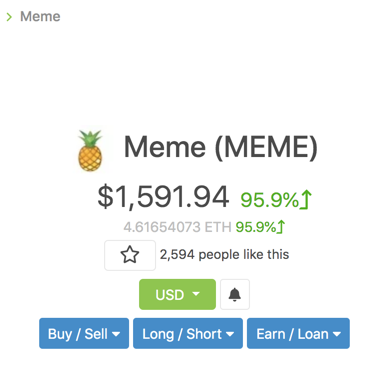

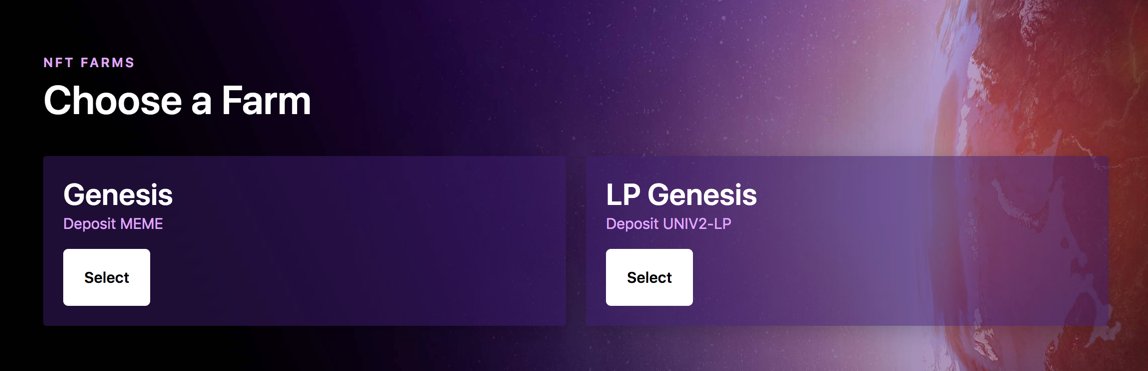

Personally I look for well funded projects, (Presales hit Millions of $, Strong funding partners, Fungible token model), so I know they can survive a dev/bear period.

And not just a 3 month hype cycle.

Personally I look for well funded projects, (Presales hit Millions of $, Strong funding partners, Fungible token model), so I know they can survive a dev/bear period.

And not just a 3 month hype cycle.

4/ Floor Price can be Pumped.

Just coz 'floor' price has 'doubled' in a day doesn't mean it's picking up steam.

Eg, this Gods Unchained card just needs around 1 ETH in volume to 'double' this cards price.

Imagine what 1-3,000 ETH mini-whale can do?

(I love GU - great project)

Just coz 'floor' price has 'doubled' in a day doesn't mean it's picking up steam.

Eg, this Gods Unchained card just needs around 1 ETH in volume to 'double' this cards price.

Imagine what 1-3,000 ETH mini-whale can do?

(I love GU - great project)

5/ Regarding the above.

This is why it's necessary to join discord + conversation and see WHY this is happening and if it's sustainable.

Pumping floor price is easy for ANY project.

(Because there's not much assets at floor price).

1,000-3,000 ETH is less than $1M.

This is why it's necessary to join discord + conversation and see WHY this is happening and if it's sustainable.

Pumping floor price is easy for ANY project.

(Because there's not much assets at floor price).

1,000-3,000 ETH is less than $1M.

6/ Wash Trading.

It happens.

Buying and selling among a handful of wallets to pump volume and get visibility.

Be careful of crazy volume spikes for projects/artists.

Look closer.

New wallets are a dead giveaway.

I like to see multiple, aged wallets, ideally known people.

It happens.

Buying and selling among a handful of wallets to pump volume and get visibility.

Be careful of crazy volume spikes for projects/artists.

Look closer.

New wallets are a dead giveaway.

I like to see multiple, aged wallets, ideally known people.

7/ BTC, ETH or MANA Moons.

Currently we're seeing 30 ETH Art NFT Sales when ETH is $350.

What's going to happen if ETH hits $10,000 USD?

Will the same artists sell for 30 ETH? $300k?

Think 5,000 BTC Pizza scenario.

You decide what you're in this for.

Fiat, BTC, ETH?

Currently we're seeing 30 ETH Art NFT Sales when ETH is $350.

What's going to happen if ETH hits $10,000 USD?

Will the same artists sell for 30 ETH? $300k?

Think 5,000 BTC Pizza scenario.

You decide what you're in this for.

Fiat, BTC, ETH?

8/ BTC, ETH, MANA dumps.

The currencies of some NFTs.

When they dump, some people panic and sell their NFTs cheap to get out of the market.

Previously it has caused a mini dump effect.

Best NFT scenarios have been a stable crypto market.

The currencies of some NFTs.

When they dump, some people panic and sell their NFTs cheap to get out of the market.

Previously it has caused a mini dump effect.

Best NFT scenarios have been a stable crypto market.

9/ Liquidity.

This is a BIG one depending on your size of investment.

Top 10 Project in terms of '7 Day Volume' attached.

Eg, maybe you bought 100 ETH worth of Cryptopunks.

What if volume goes to 5 ETH/week?

And you need to sell?

It'll take ~20+ weeks to sell.

Example.

This is a BIG one depending on your size of investment.

Top 10 Project in terms of '7 Day Volume' attached.

Eg, maybe you bought 100 ETH worth of Cryptopunks.

What if volume goes to 5 ETH/week?

And you need to sell?

It'll take ~20+ weeks to sell.

Example.

10/ Presale Hype.

Easy for new projects to say 'only 100 special cars/lands/pets available'

Then people rush to grab them.

Then what?

How will they return next wave of investors/users?

Easy for new projects to say 'only 100 special cars/lands/pets available'

Then people rush to grab them.

Then what?

How will they return next wave of investors/users?

11/ Then they need to spend 1-2 years building the game.

And initial investors get squeezed out.

Seen at least 10-20 projects do this.

1 year later they fold coz there's nothing more to offer.

Presale hype is real, it happened during ICO stage, and it'll happen with NFTs.

And initial investors get squeezed out.

Seen at least 10-20 projects do this.

1 year later they fold coz there's nothing more to offer.

Presale hype is real, it happened during ICO stage, and it'll happen with NFTs.

12/ NFTs are a New Market/Not much Data.

New market = higher risk.

A lot is experimental.

Those that have found their gold mine rarely share.

So beware of 'guru's, mentors or whatever'.

There is none.

All trying to figure out what's happening, learning and making moves.

New market = higher risk.

A lot is experimental.

Those that have found their gold mine rarely share.

So beware of 'guru's, mentors or whatever'.

There is none.

All trying to figure out what's happening, learning and making moves.

13/ DYOR will save you.

Know exactly why things are happening in NFT land.

It's the only way to protect yourself.

There's a lot of great investments that can be made but you gotta hunt and know what's happening.

Running out of space on this thread.

Stay safe.

Know exactly why things are happening in NFT land.

It's the only way to protect yourself.

There's a lot of great investments that can be made but you gotta hunt and know what's happening.

Running out of space on this thread.

Stay safe.

• • •

Missing some Tweet in this thread? You can try to

force a refresh