In 1986, a boy wonder entrepreneur became the youngest person in American history to IPO a company, building a net worth of over $100 million in the process.

Three years later, he was sentenced to 25 years in prison.

Who's up for a story?

👇👇👇

Three years later, he was sentenced to 25 years in prison.

Who's up for a story?

👇👇👇

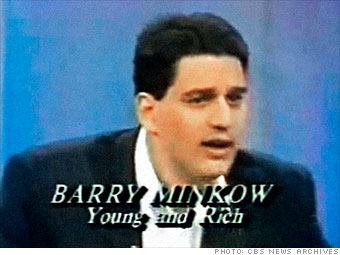

1/ Barry Jay Minkow was born on March 22, 1966 to a Jewish family in Inglewood, California.

He grew up in the Reseda area of the San Fernando Valley.

His first job was at 9-years-old, serving as a telemarketer for the carpet cleaning business where his mother worked.

He grew up in the Reseda area of the San Fernando Valley.

His first job was at 9-years-old, serving as a telemarketer for the carpet cleaning business where his mother worked.

2/ An entrepreneur at heart, at 16, he started ZZZZ Best, a carpet cleaning and restoration business, from his family's garage.

Barry Minkow was a dreamer. He envisioned himself among the other garage startup legends of the era.

He was determined to make it big.

Barry Minkow was a dreamer. He envisioned himself among the other garage startup legends of the era.

He was determined to make it big.

3/ But from the start, ZZZZ Best ran into business and financial troubles.

With bills mounting, Minkow started to employ "creative financing mechanisms" for his business - including check fraud, credit card fraud, and stealing/selling his grandmother's jewelry.

With bills mounting, Minkow started to employ "creative financing mechanisms" for his business - including check fraud, credit card fraud, and stealing/selling his grandmother's jewelry.

4/ Perhaps realizing that the carpet cleaning business was not his ticket to stardom, Minkow launched an insurance restoration business at ZZZZ Best.

Importantly, unlike the carpet cleaning business, the insurance restoration business was entirely fraudulent from the start.

Importantly, unlike the carpet cleaning business, the insurance restoration business was entirely fraudulent from the start.

5/ He and an associate faked thousands of documents, claiming ZZZZ Best was involved in various restoration projects for insurance companies across California.

He then used these documents to raise real cash - factoring the accounts receivable for work that was "under contract."

He then used these documents to raise real cash - factoring the accounts receivable for work that was "under contract."

6/ Fresh from his high school graduation, Barry Minkow was running a large, growing, and seemingly successful business.

In January 1986, at age 19, he decided to take the company public. Auditors from the famed Ernst & Whinney signed off on the books and operations.

In January 1986, at age 19, he decided to take the company public. Auditors from the famed Ernst & Whinney signed off on the books and operations.

7/ ZZZZ Best went public in December 1986, making Minkow the youngest entrepreneur in American history to take a company public.

By April 1987, Barry Minkow's shares were worth over $100 million (~$250 million today).

He had made it. But under the surface, trouble was brewing.

By April 1987, Barry Minkow's shares were worth over $100 million (~$250 million today).

He had made it. But under the surface, trouble was brewing.

8/ The scrutiny of being a public company came as an unexpected and unwelcome surprise.

Minkow had a plan.

When allowed to by securities law, he would to sell a portion of his stake, use the proceeds to clean up the business, and become a completely legitimate operation.

Minkow had a plan.

When allowed to by securities law, he would to sell a portion of his stake, use the proceeds to clean up the business, and become a completely legitimate operation.

9/ He pursued a merger with KeyServ, the carpet cleaner for Sears, believing this would provide legitimacy and a much needed cash infusion.

He also looked into a hostile takeover of ServiceMaster, a much larger business.

Sadly for Minkow, none of this was meant to be.

He also looked into a hostile takeover of ServiceMaster, a much larger business.

Sadly for Minkow, none of this was meant to be.

10/ Days before the merger with KeyServ was set to close, the press began reporting on findings of suspicious credit card and check activity in Minkow's past.

As a public company, the news of potentially fraudulent activity hit the stock hard, sending it spiraling down by ~30%.

As a public company, the news of potentially fraudulent activity hit the stock hard, sending it spiraling down by ~30%.

11/ As with most frauds, it unraveled much more quickly than it had been spun up.

Within days, bankers called in their loans, the Drexel-backed bond offering supporting the merger was pulled, its auditor discovered "anomalies" in its reporting, and short sellers pounced.

Within days, bankers called in their loans, the Drexel-backed bond offering supporting the merger was pulled, its auditor discovered "anomalies" in its reporting, and short sellers pounced.

12/ On July 2, 1987, Barry Minkow resigned, citing "health reasons."

On July 6, ZZZZ Best's board sued Minkow, alleging he had stolen $23 million from the company.

On July 8, the LAPD raided the headquarters and Minkow's home.

By now, the stock had fallen ~80% from its highs.

On July 6, ZZZZ Best's board sued Minkow, alleging he had stolen $23 million from the company.

On July 8, the LAPD raided the headquarters and Minkow's home.

By now, the stock had fallen ~80% from its highs.

13/ In January 1988, Barry Minkow was indicted by a federal grand jury on 54 counts of racketeering, securities fraud, money laundering, embezzlement, mail fraud, tax evasion, and bank fraud.

He was convicted and sentenced to 25 years.

The fall of the boy wonder was complete.

He was convicted and sentenced to 25 years.

The fall of the boy wonder was complete.

14/ In the end, one is left to wonder whether Barry Minkow was a pure calculating fraudster or simply a naive teenager, blinded by ambition, who got over his skis and couldn't find a way out.

As with most things in life, perhaps the answer is somewhere in the middle.

As with most things in life, perhaps the answer is somewhere in the middle.

15/ The tale of Barry Minkow and ZZZZ Best is remembered as one of the greatest accounting frauds and Ponzi schemes in history.

There is a docuseries in the works on the story, which is sure to be a fascinating one. deadline.com/2020/08/barry-…

There is a docuseries in the works on the story, which is sure to be a fascinating one. deadline.com/2020/08/barry-…

16/ I hope you enjoyed this story as much as I did!

And for more educational threads on business, money, finance, and economics, check out my meta-thread below.

And for more educational threads on business, money, finance, and economics, check out my meta-thread below.

https://twitter.com/SahilBloom/status/1284583099775324161

• • •

Missing some Tweet in this thread? You can try to

force a refresh