1/ Introducing the DeFi Pulse Economic Safety Grade

Created in partnership with the fine folks at @gauntletnetwork, economic safety grades allow users to more easily quantify and compare the risks they face using on-chain protocols.

Created in partnership with the fine folks at @gauntletnetwork, economic safety grades allow users to more easily quantify and compare the risks they face using on-chain protocols.

2/ Decentralized lending protocols have grown to become essential tools for DeFi users, but with that growth came added complexity.

It can be difficult for the average user to fully understand how they function let alone properly assess the risks they face.

It can be difficult for the average user to fully understand how they function let alone properly assess the risks they face.

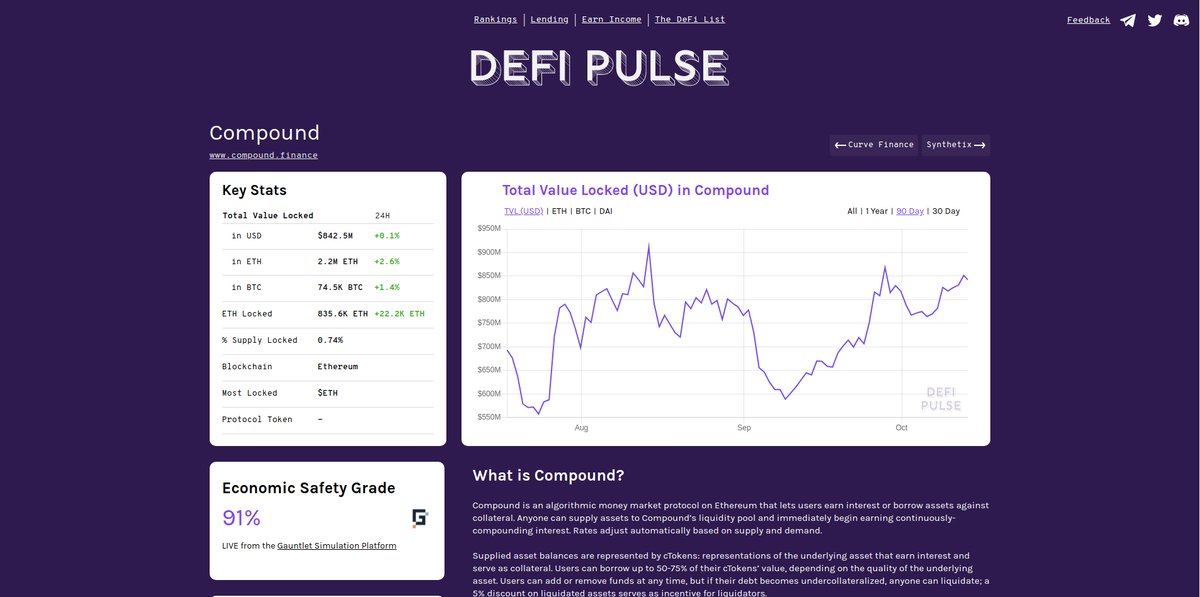

3/ The DeFi Pulse Economic Safety Grade is created by running simulations utilizing data from centralized and decentralized exchanges combined with on-chain user data to estimate market risks.

Grades are focused on the risk of insolvency or in other words the risk to depositors

Grades are focused on the risk of insolvency or in other words the risk to depositors

4/ @AaveAave and @compoundfinance economic safety grades are available now on DeFi Pulse.

In this initial alpha, these grades are formed by analyzing the historical liquidity and volatility data to find the 'riskiest collateral'.

In this initial alpha, these grades are formed by analyzing the historical liquidity and volatility data to find the 'riskiest collateral'.

5/ Then, the risk of the system for users borrowing stablecoins against this collateral is estimated and normalized to create the 1 to 100 grade you see on DeFi Pulse.

See here for a more in-depth explanation of Gauntlet's simulations: medium.com/gauntlet-netwo…

See here for a more in-depth explanation of Gauntlet's simulations: medium.com/gauntlet-netwo…

6/ We're excited to finally unveil this feature to the community and what the future may bring. We believe that safety is key to sustaining DeFi's growth.

Educating and informing users of risks helps them make safer decisions and makes for a healthier ecosystem.

Educating and informing users of risks helps them make safer decisions and makes for a healthier ecosystem.

• • •

Missing some Tweet in this thread? You can try to

force a refresh