How to get URL link on X (Twitter) App

1/ What is $DAI?

1/ What is $DAI?

2/ $DPI token, is based on the DeFi Pulse Index, a digital asset index designed to track the performance of top protocols in #DeFi

2/ $DPI token, is based on the DeFi Pulse Index, a digital asset index designed to track the performance of top protocols in #DeFi

2/ This is the future of fixed rates!

2/ This is the future of fixed rates!

2/ Notional’s users borrow & lend via the protocol’s native liquidity pools.

2/ Notional’s users borrow & lend via the protocol’s native liquidity pools.

2/ Let’s start with some basics:

2/ Let’s start with some basics:

💰 Everyone’s path into crypto has to start somewhere and for most of us that means going from fiat to crypto.

💰 Everyone’s path into crypto has to start somewhere and for most of us that means going from fiat to crypto.

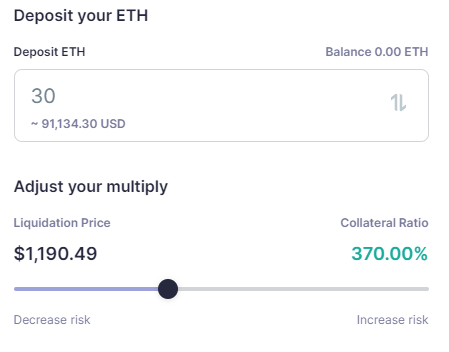

2/ DeFi Saver's recipes make some of the most powerful tools like flashloans available in DeFi accessible to anyone.

2/ DeFi Saver's recipes make some of the most powerful tools like flashloans available in DeFi accessible to anyone.

2/ Some traders will take a bowl of $LINK soup so now you have more $ETH soup.

2/ Some traders will take a bowl of $LINK soup so now you have more $ETH soup.