1/ @Facebook, @Twitter and @Google have all built internal tools to implement systematic censorship. The tools are little different to the tools used by China's authoritarian government. They may not be used as frequently (yet) but they are no less chilling.

2/ Large tech companies have been complicit in censorship for a long time. When I was at Google I was asked to implement tools to censor news in China

https://twitter.com/real_vijay/status/1041191476615507968?s=19

3/ As Silicon Valley's largest companies replace legacy media as the primary gateway for information dissemination they have become dangerously powerful in shaping what can and can't be said online.

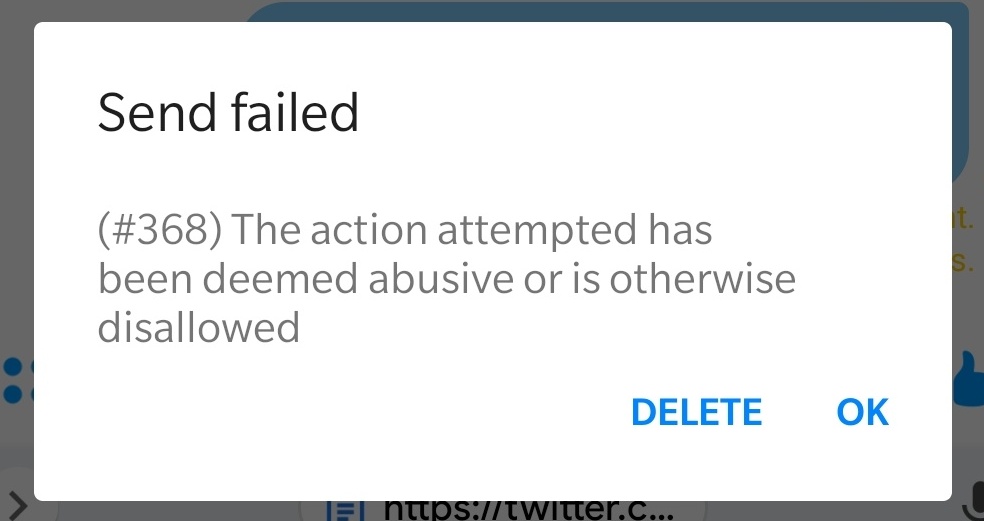

4/ These companies not only censor what can be posted on platforms like YouTube and Twitter, they have also begun to censor their messaging apps.

Earlier this week I tried to use FB messenger to send a completely benign tweet to a family member and was unable to.

Earlier this week I tried to use FB messenger to send a completely benign tweet to a family member and was unable to.

5/ This is particularly chilling because the censorship is very clearly politically biased. Slowly but surely, Silicon Valley is exporting it political values to the entire world. We are headed toward an Internet monoculture overseen by the technocrats in a tiny part of the world

6/ The values of the early internet - freedom of speech, uncensorable communication, unrestricted association - are being systematically dismantled by the world's largest companies.

This MUST stop. I do not pretend to have a solution but we must awaken to the threat.

This MUST stop. I do not pretend to have a solution but we must awaken to the threat.

• • •

Missing some Tweet in this thread? You can try to

force a refresh