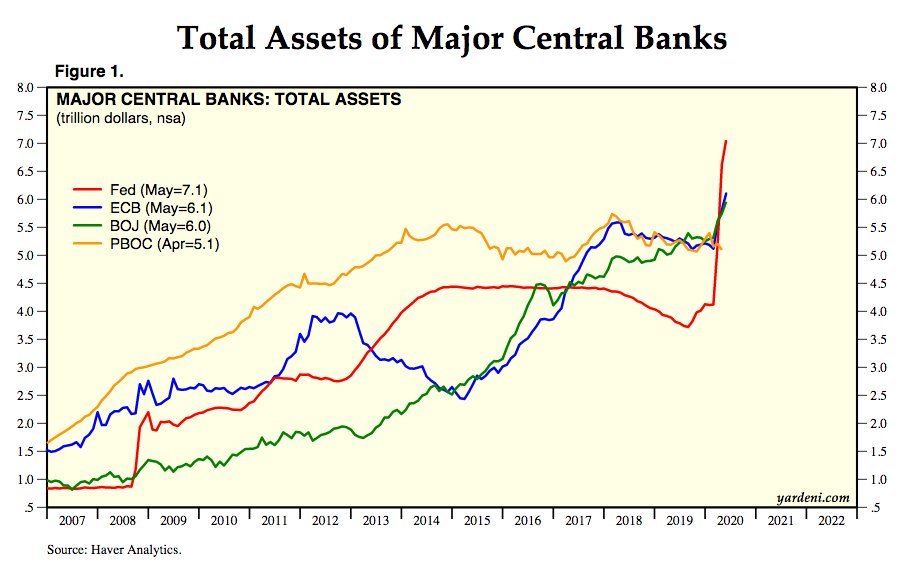

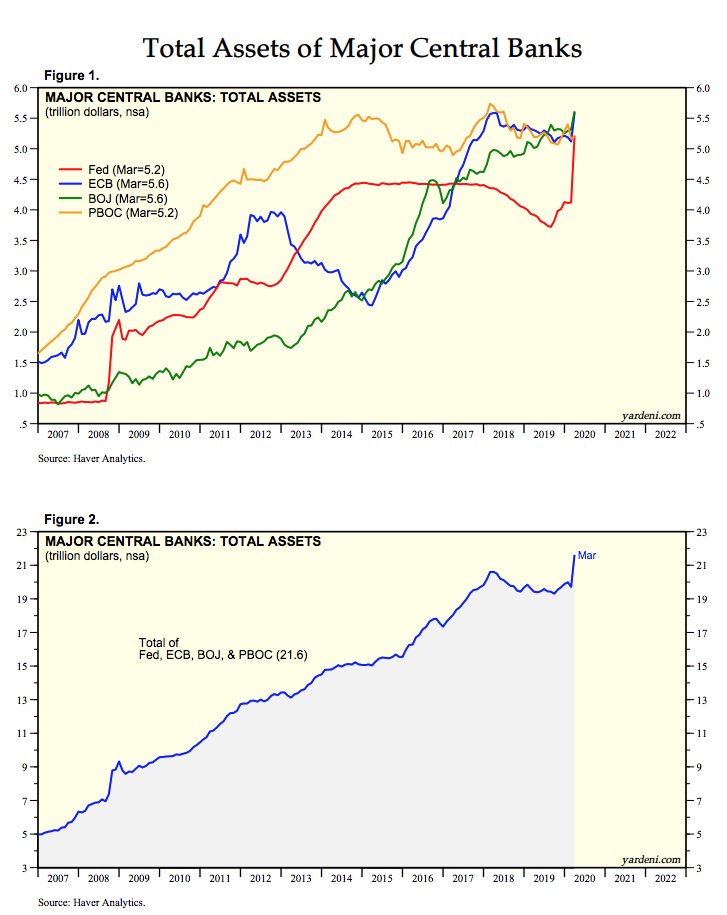

Based on the extreme debasement that's been occurring and that's expected to continue, I would suggest adopting a new unit of measure. Although the world will continue to settle in dollars or other major fiat currencies, that doesn't mean you should measure your growth in... 1/

buying power with fiat units. For people that find Bitcoin to be undesirable, the most common alternative is gold. For example, look at the performance of the S&P 500 if you measure it in gold instead of the US dollar. Down 25% since peaking near the end of 2018. 2/

If measuring the S&P500 with dollars over that same period of time (since late 2018), an investor is up nominally 19% in dollar terms, but relative to gold their buying power (for retained earnings) has diminished by 50%. So, this begs an interesting question, what could be 3/

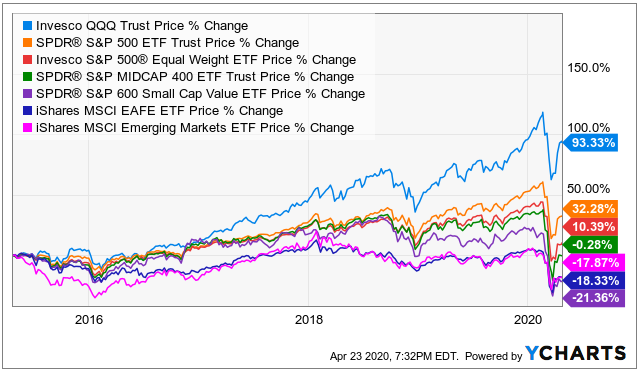

better than gold and why? As we know, the NASDAQ has been on a killer run (nominally) over this same period of time (since late 2018). In fact, here's the chart in nominal fiat terms: Up, 56%. But, wonder what that looks like when we measure in gold instead of fiat dollars? 4/

Well, here it is. When using gold as the unit of measure, even the NASDAQ is down -2.5% over that same period of time. Remarkable when you think about it, because a rock, which does nothing but sorta fixes it's outstanding units, is outperforming companies ... 5/

that are doing some of the most remarkable technological advancements the world has ever seen. How is this possible? Because the fiat currency supply is inflating THAT fast. It's growing at such a pace that the free cash flows these companies are making, can't keep pace with 6/

the debasement the global governments are supplying. So, this brings me to my final point. Earlier I wrote that gold "sorta" acts like a fixed supply money system. The reason it fails (relative to Bitcoin) is because there's no difficulty adjustment for miners. In short, 7/

if the price of gold continues to run higher (in nominal fiat terms) - which I expect - it creates a major incentive structure for miners to increase the production of gold being dropped into the market. Unlike gold, Bitcoin has a difficulty adjustment that regulates 8/

this flow rate. So as the price of Bitcoin runs higher, the two week difficulty adjustment inhibits digital miners from being able to capture more coins being sold into the market. Not only that, but every four years, the amount of coins being mined...9/

gets cut in half. This is equivalent to gold miners finding half as much gold ever four years (no matter what - and it can't be changed). So, in my very humble opinion, this is the chart to watch. Since May 11, 2020, Bitcoin had it's last halving event 10/

where the miners' reward flow was cut in half. Historically, these events are followed by an abrupt run-up in price for the year and a half following such an event. Below is the chart comparing Bitcoin, the S&P500, the NASDAQ, & gold since May 11, 2020 (the BTC halving date). 11/

As you can see, Bitcoin has slightly outperformed the NASDAQ (by 5%), significantly outperformed the S&P (13%), and aggressively outperformed gold (20%). Interestingly, gold has underperformed both equity indexes on this shorter time horizon but I expect it to catch back up 12/

and outperform as we get into 2021. In conclusion, investors need to be hyper-focused on their buying power and not their nominal fiat returns. The measuring stick you are viewing the financial world with can drastically impact your ability to navigate 13/

such an odd and nonstandard environment that doesn't happen but once in a lifetime. I'll continue to track these four indexes/assets from 11 May 2020 to show the results. If you want to learn more about Bitcoin, here's a one pager. 14/ END

https://twitter.com/PrestonPysh/status/1300462461888401409

• • •

Missing some Tweet in this thread? You can try to

force a refresh