After 7 years of dreaming about it, discussing it, dismissing it, adjusting it and finally implementing it, @CirclesUBI - "universal basic income on the blockchain" - or just "better money" went live today!

So - what is Circles? It can be seen as many things:

6 examples:

1) A voluntary basic income scheme without the need of a state

2) Fully decentralized money but fair in time and space

3) A mutual credit system where credit lines are set by default to make credit fungible

6 examples:

1) A voluntary basic income scheme without the need of a state

2) Fully decentralized money but fair in time and space

3) A mutual credit system where credit lines are set by default to make credit fungible

4) A p2p form of money to make money and thus ultimately the economy more human centric

5) Crypto currency that is minted only by human life time

6) The original Ripple idea combined with UBI

5) Crypto currency that is minted only by human life time

6) The original Ripple idea combined with UBI

The core rules are simple:

1) Anyone can create an account and start minting their personal Circles. Every account (person) mints different Circles.

2) Minting starts at 8 Circles a day today. This is increased every year by 7%

1) Anyone can create an account and start minting their personal Circles. Every account (person) mints different Circles.

2) Minting starts at 8 Circles a day today. This is increased every year by 7%

3) People can trust each other - which means that they are willing to exchange their Circles 1:1

That's basically it.

I will try to explain the reasoning behind all 3 from the perspective of "fair money" (again there are other ways as well to look at Circles).

That's basically it.

I will try to explain the reasoning behind all 3 from the perspective of "fair money" (again there are other ways as well to look at Circles).

The first rule is simple: Soon after Bitcoin made people see that money outside of a state is possible and that the potentially design space for money is quite large people came up with ideas: "like Bitcoin but coins are distributed equally per person".

The second rule - specifically the 7% increase per year makes sure that newly minted currency also matters in the future compared to already existing currency. (Read here how ~7% can be logically derived from a 80 year live expectancy) vit.free.fr/TRM/en_US/solu…

The third rule does 2 things: a) it is a fully decentralized solution to the sybil attack problem. Almost all other UBI blockchain solutions fall back to a centralized authority that decides who is human/ who can get a UBI.

b) It anchors the value (the trust) of Circles...

b) It anchors the value (the trust) of Circles...

...in human relationships. Money is in my opinion best defined (e.g. by Bernard Lietaer) as a "social contract". Circles makes that explicit and very local. The minimal viable "economy" of Circles is just a group of 3-4 friends that decides to grant each other a UBI via Circles.

Anyhow - you can read more here:

joincircles.net

medium.com/@ConsenSys/bas…

Or a bit more technical stuff here: handbook.joincircles.net/about/whitepap…

joincircles.net

medium.com/@ConsenSys/bas…

Or a bit more technical stuff here: handbook.joincircles.net/about/whitepap…

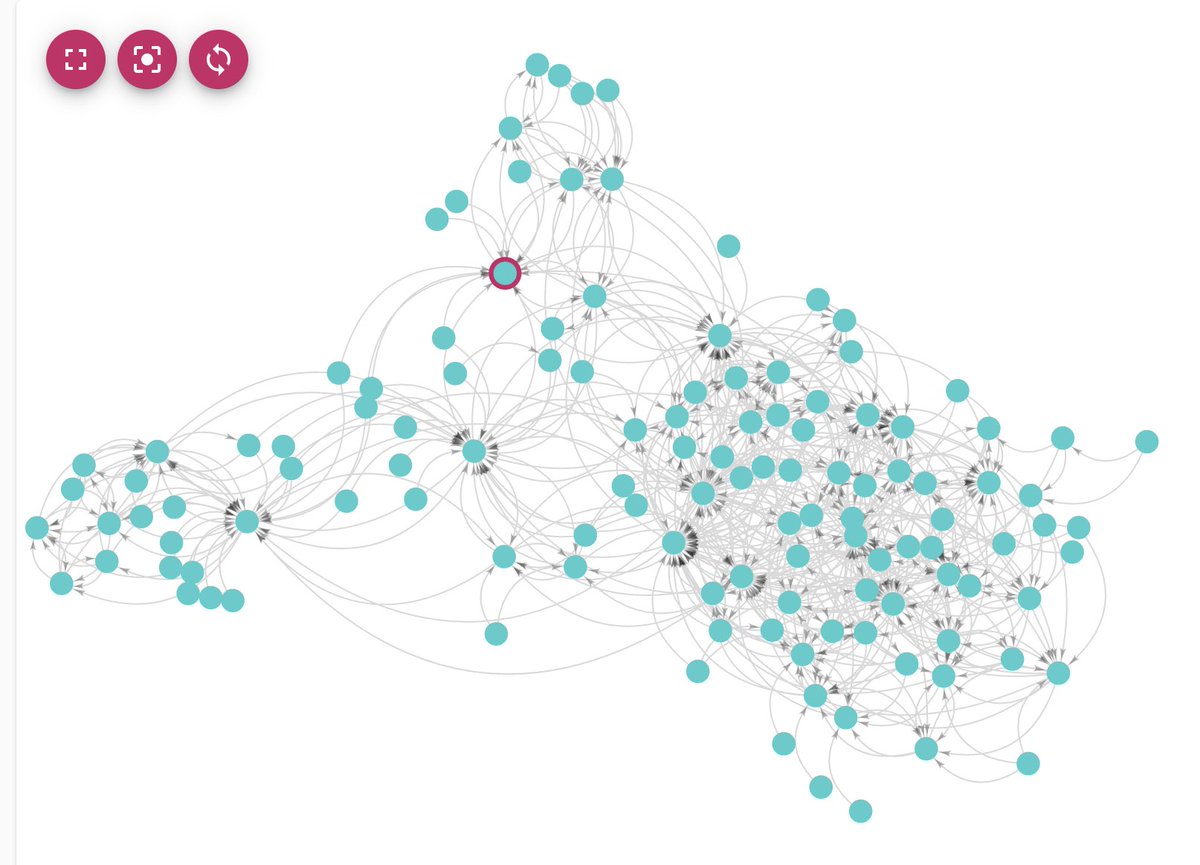

Here you can see the Circles p2p network growing:

dashboard.circles.garden (that is me in the network)

dashboard.circles.garden (that is me in the network)

Closing with some technical notes:

Circles runs on @xdaichain

In the reference implementation (circles.garden) every account (identity) is a @gnosisSafe contract and the key is stored burner style wallet like in the browser.

Circles runs on @xdaichain

https://twitter.com/CirclesUBI/status/1317089774293962753

In the reference implementation (circles.garden) every account (identity) is a @gnosisSafe contract and the key is stored burner style wallet like in the browser.

The circles.garden wallet uses also a transaction relay service where users don't need to have xDAI to pay gas costs but can instead pay the relay service via meta transactions in Circles. For onboarding to this services you need to be trusted by at least 3 users.

I want to close with a big thank you to so many people who have been supportive of Circles along the years and especially the current team with @isthisanart_ , @Julio_Linares_, @tw33ttw33t, Andreas and Blanka who finally brought Circles to live.

• • •

Missing some Tweet in this thread? You can try to

force a refresh