The timeline in the Bloomberg story on Hulu is that Hulu presented a plan to go international at the end of 2019. Iger and McCarthy were initially supportive and were to present at a Board meeting in Jan 2020.

Publicly, on the Q3 call in November they were asked about taking Hulu international and said they’d have more to say after the new year and that “we’re working through the formulation of a strategy in terms of what markets...”

On the Q4 call in Feb 2020, after the Jan Board meeting, Iger said

“We are working up a plan to take Hulu internationally. We actually have a lot of specifics around it”

“We do plan to begin rolling Hulu out, I’d say probably in 2021 internationally”

“We are working up a plan to take Hulu internationally. We actually have a lot of specifics around it”

“We do plan to begin rolling Hulu out, I’d say probably in 2021 internationally”

Then in August it’s announced that instead of Hulu, Star will be used as the international general entertainment network.

In October, Uday Shankar who built Hotstar into the market leader it is, said he was leaving variety.com/2020/tv/asia/u…

Meanwhile the argument for Star instead of Hulu is that Hulu doesn’t have a brand name internationally and licenses its content. But that was true in 2019 and Feb 2020. So seems like an odd realization.

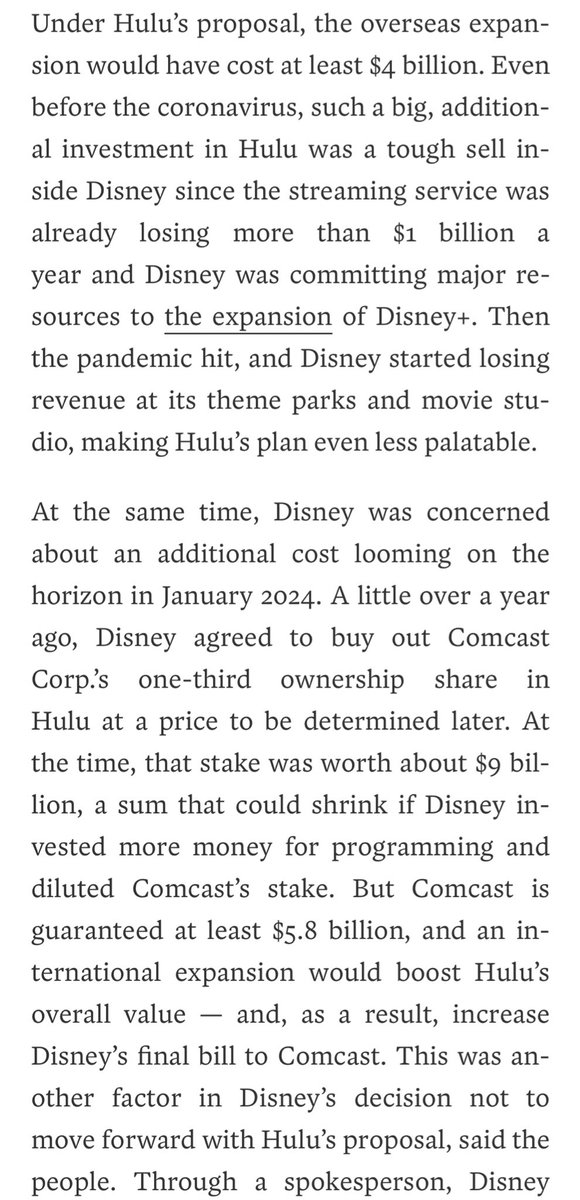

Another explanation is IMO crazy but seems may have played a role.

Another explanation is IMO crazy but seems may have played a role.

The idea that you would sacrifice value creation in Hulu because Comcast would participate in perhaps a couple billion of additional proceeds is bonkers.

Hulu remains one of the longest running strategic enigmas I've seen

If you weren't going to take Hulu International, why buy out Comcast? D+ clearly could stand on its own in the US. And if you didn't need Hulu I go back to why did they buy Fox? For NatGeo and the Simpsons? Clearly some hindsight here b/c no one knew D+ would be so successful but

this was a thread from when the Fox deal was first rumored

https://twitter.com/modestproposal1/status/941303373130805248

and a few months later

https://twitter.com/modestproposal1/status/960902136623239168

• • •

Missing some Tweet in this thread? You can try to

force a refresh