THREAD | 10 Steps to Profitable Trading

The secret to winning big in the market is not to be right all the time but to lose the least amount of money possible when you are wrong.

As long as you win larger than you lose, you will be a profitable trader at the end of each year.

The secret to winning big in the market is not to be right all the time but to lose the least amount of money possible when you are wrong.

As long as you win larger than you lose, you will be a profitable trader at the end of each year.

1) Manage Risk:

Learn to trade a manageable portion of your portfolio (only you can determine this number or percentage, it differs for every person).

Always establish a risk/reward ratio before making a trade or investment. Without the ratio, how do you know your risk?

Learn to trade a manageable portion of your portfolio (only you can determine this number or percentage, it differs for every person).

Always establish a risk/reward ratio before making a trade or investment. Without the ratio, how do you know your risk?

2) Understand Position Sizing:

All traders must learn to know “how much” to trade on each position. Do not overtrade or you will run the risk of ruin. NEVER run the risk of ruin!

Position sizing is rule number one of managing risk.

All traders must learn to know “how much” to trade on each position. Do not overtrade or you will run the risk of ruin. NEVER run the risk of ruin!

Position sizing is rule number one of managing risk.

3) Cut Losses:

Do not allow losses to run wild when the story changes. You must learn to cut losses & understand that losses are a part of the game. Every one makes mistakes and loses.

Check you ego of winning at the door. We are here to make money, not go undefeated.

Do not allow losses to run wild when the story changes. You must learn to cut losses & understand that losses are a part of the game. Every one makes mistakes and loses.

Check you ego of winning at the door. We are here to make money, not go undefeated.

4) Learn when to Sell:

You must learn when to sell. Selling is more important than buying as it ties directly to risk management. Use stops if you haven’t yet developed the discipline to get out when the story changes.

Sell when the story changes but don't overtrade.

You must learn when to sell. Selling is more important than buying as it ties directly to risk management. Use stops if you haven’t yet developed the discipline to get out when the story changes.

Sell when the story changes but don't overtrade.

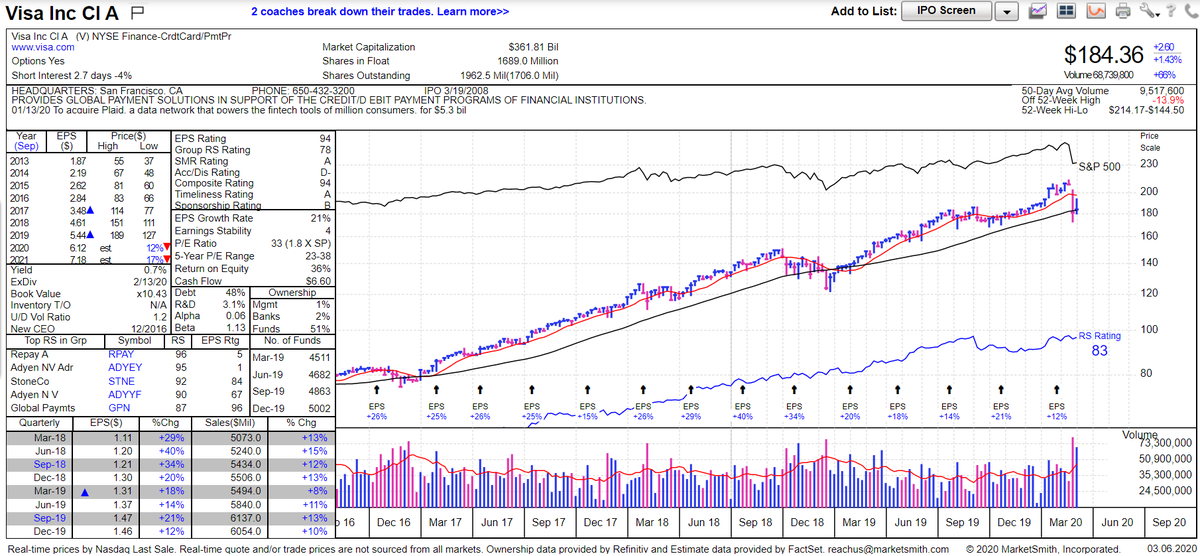

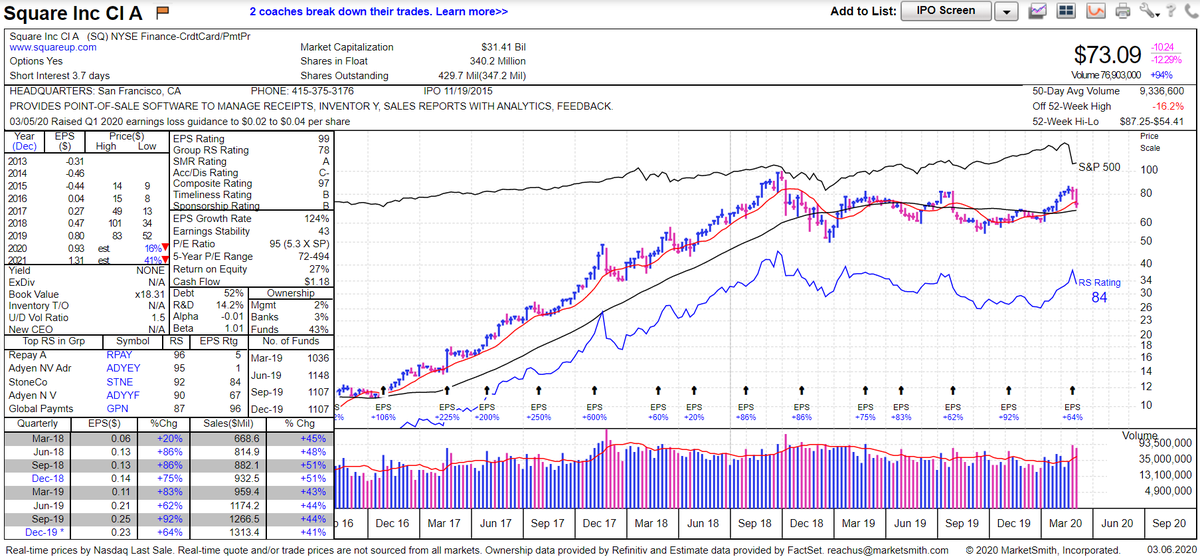

5) Average up in Price:

I will never hesitate to add shares in a stock that is moving higher but I often avoid averaging down.

You want to add shares in stocks that are leading and rarely give you the chance to grab (winners).

Trends last a lot longer than most expect.

I will never hesitate to add shares in a stock that is moving higher but I often avoid averaging down.

You want to add shares in stocks that are leading and rarely give you the chance to grab (winners).

Trends last a lot longer than most expect.

6) Have Patience:

It takes years (often a lifetime) to master trading as an profitable skill; even then, you are never done learning or adapting.

It takes years (often a lifetime) to master trading as an profitable skill; even then, you are never done learning or adapting.

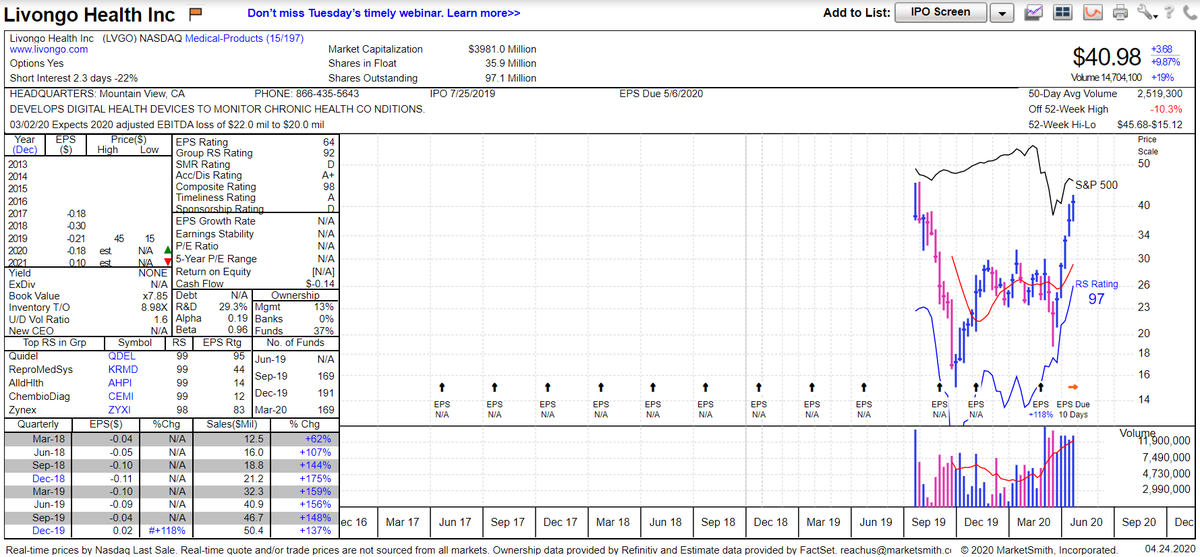

7) Buy 52-week Highs, not 52-Week Lows:

Don’t be afraid to buy stocks making new highs. The garbage sits at the bottom of the market along with poor earnings, weakness and further downward pressure.

Buy strength and the momentum moving higher.

Don’t be afraid to buy stocks making new highs. The garbage sits at the bottom of the market along with poor earnings, weakness and further downward pressure.

Buy strength and the momentum moving higher.

8) Ignore the Talking Heads:

Do not listen to the noise, gossip & rumors flying around on TV, fintwit, stock blogs & newspapers. It a surefire route to bad information and clueless advice.

*Skin in the Game*

Do your own research; you’ll come out much further ahead.

Do not listen to the noise, gossip & rumors flying around on TV, fintwit, stock blogs & newspapers. It a surefire route to bad information and clueless advice.

*Skin in the Game*

Do your own research; you’ll come out much further ahead.

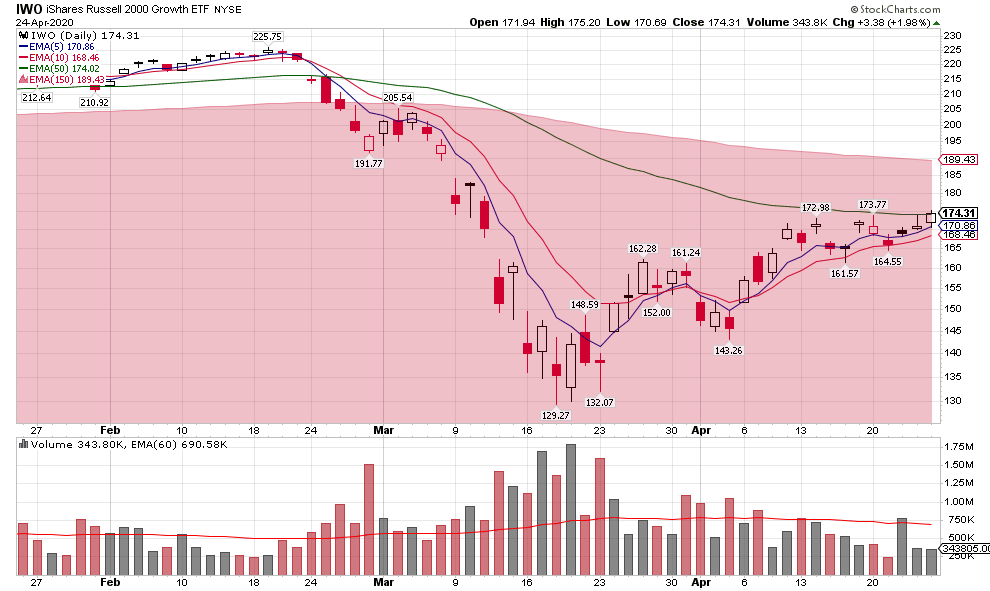

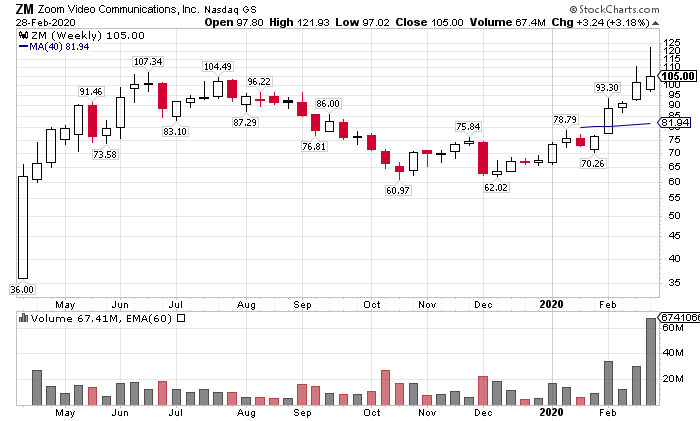

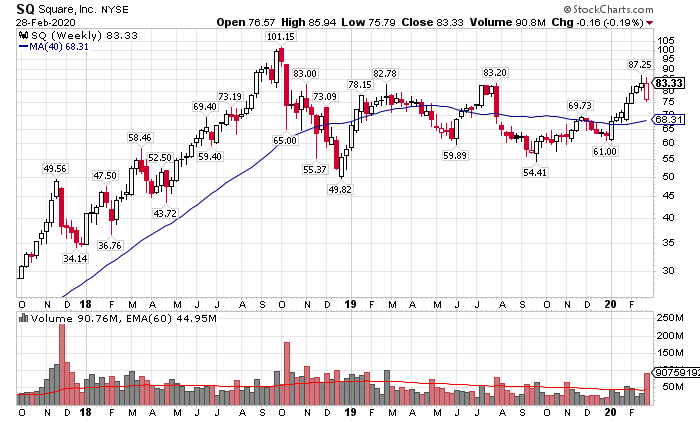

9) Understand Technical Analysis:

Fundamental analysis tells me what to focus on (sales, earnings, etc.) while technical analysis provides a visual tool of what everyone has done and may do going forward (bases, support, resistance, etc.).

It's a guide, not a predictor.

Fundamental analysis tells me what to focus on (sales, earnings, etc.) while technical analysis provides a visual tool of what everyone has done and may do going forward (bases, support, resistance, etc.).

It's a guide, not a predictor.

10) Control Emotions:

You must control your emotions or the game is over!

Understand you and trade accordingly.

It's the stomach, not the brain that controls your overall outcome.

Lastly, ignore naysayers and trolls & stick to your plan!

You must control your emotions or the game is over!

Understand you and trade accordingly.

It's the stomach, not the brain that controls your overall outcome.

Lastly, ignore naysayers and trolls & stick to your plan!

• • •

Missing some Tweet in this thread? You can try to

force a refresh