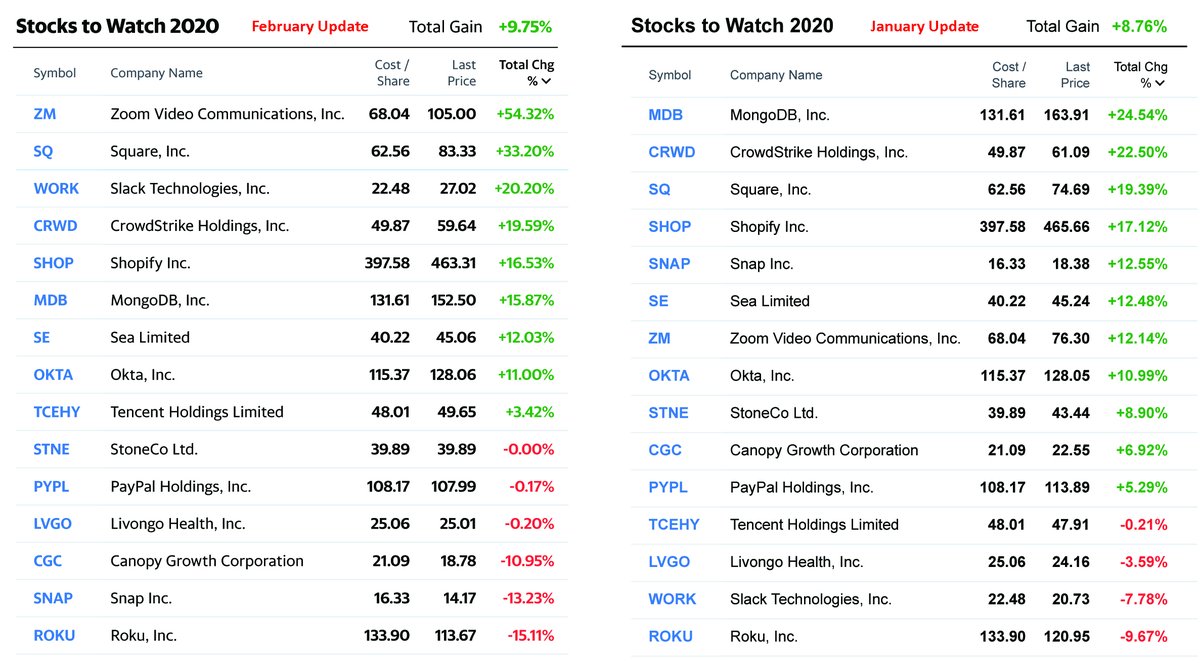

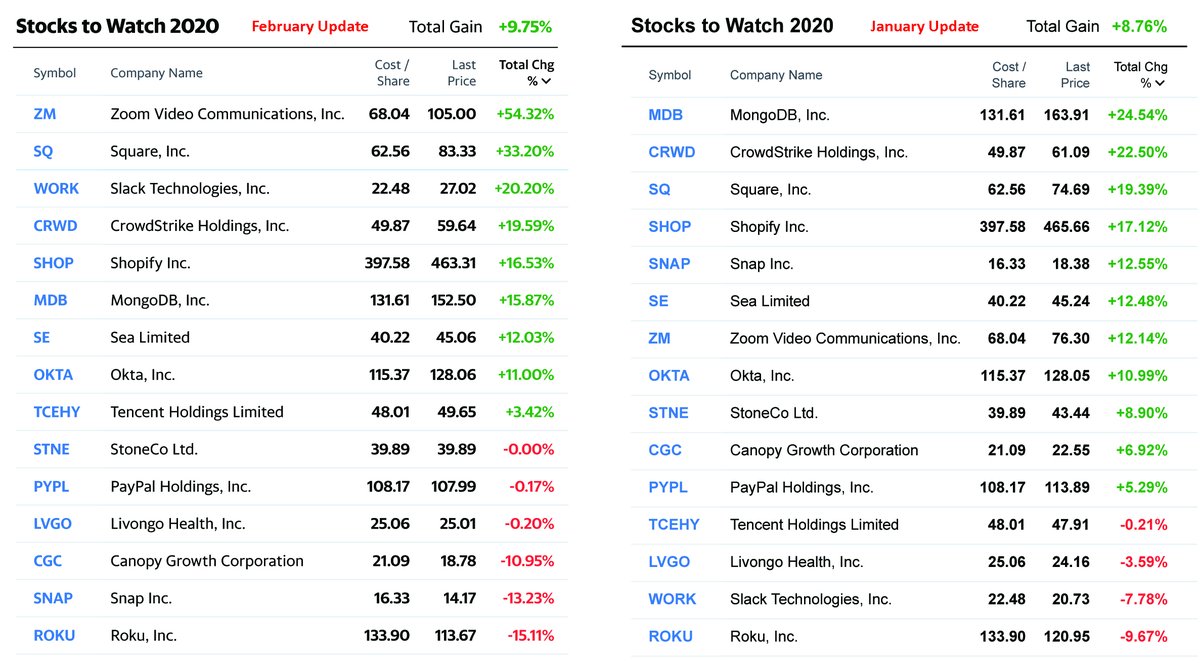

Overall, +9.75%

8 double digit gainers

3 stocks with 20%+ gains

1 even stock

5 negative returns

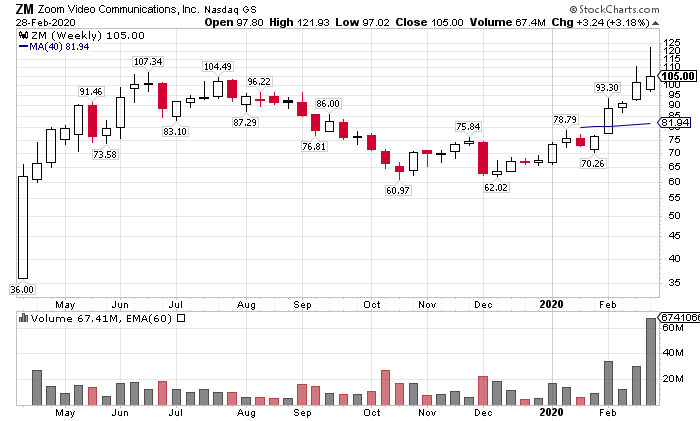

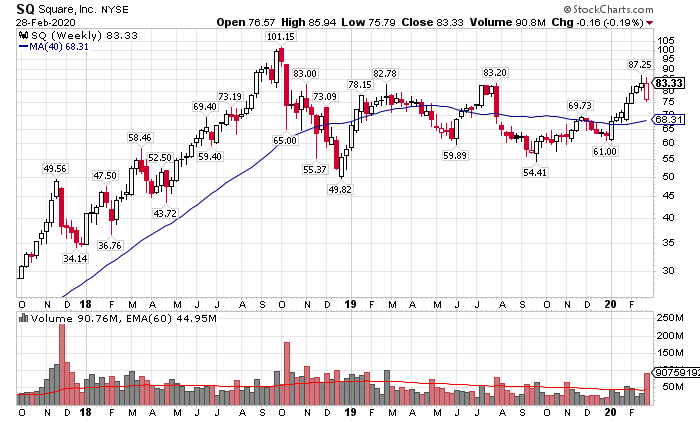

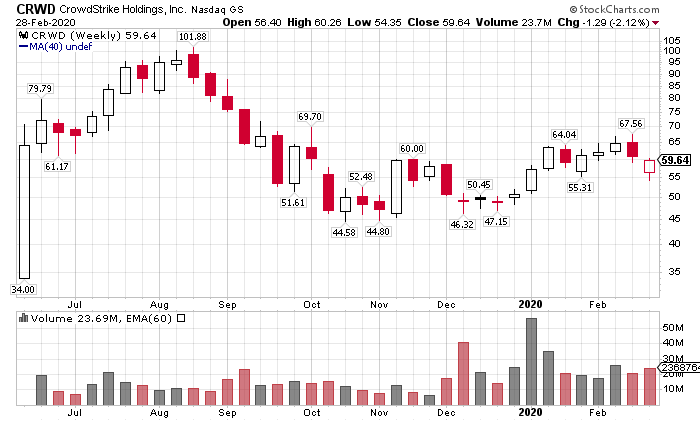

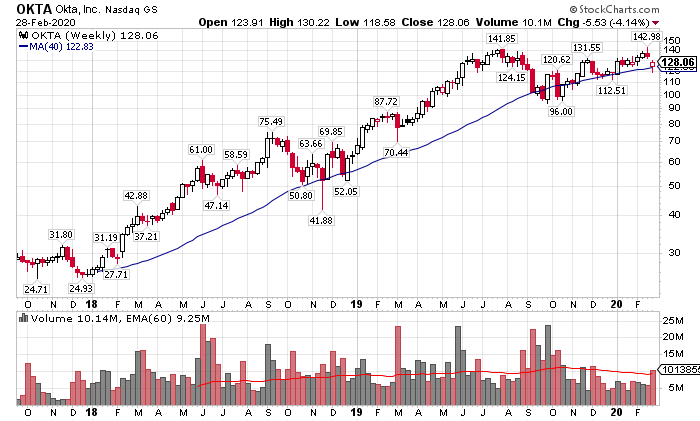

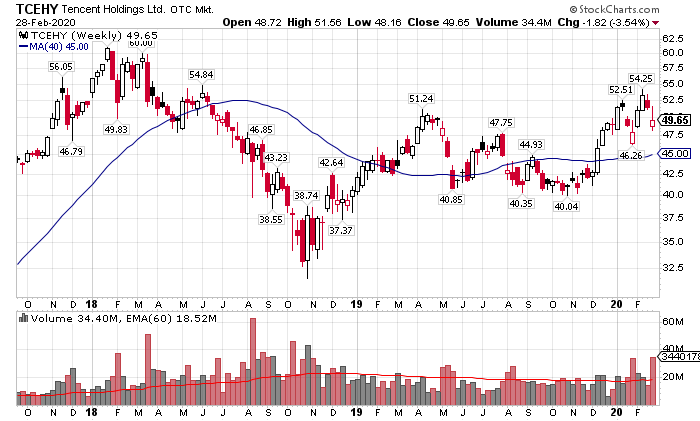

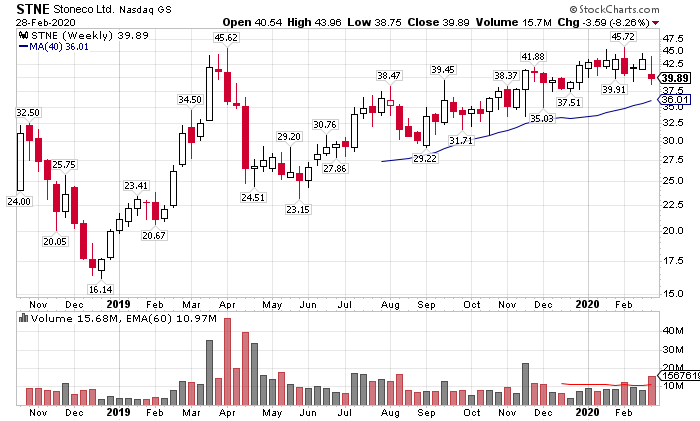

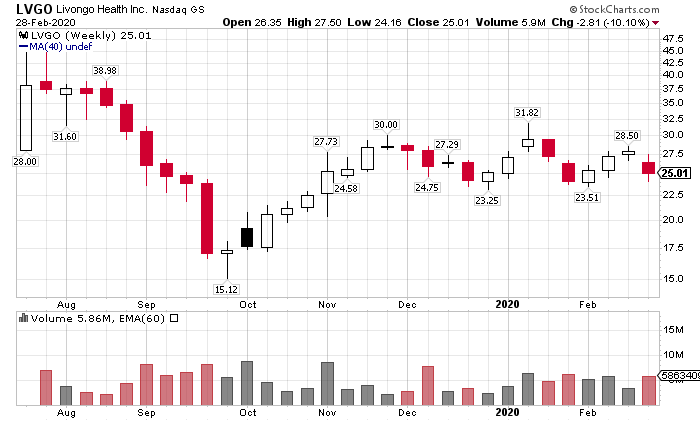

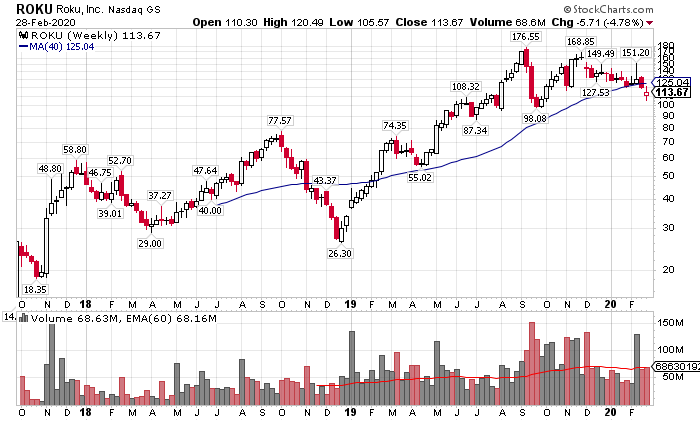

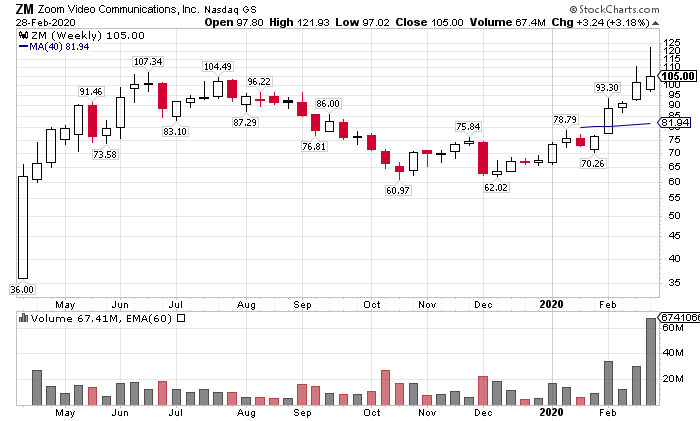

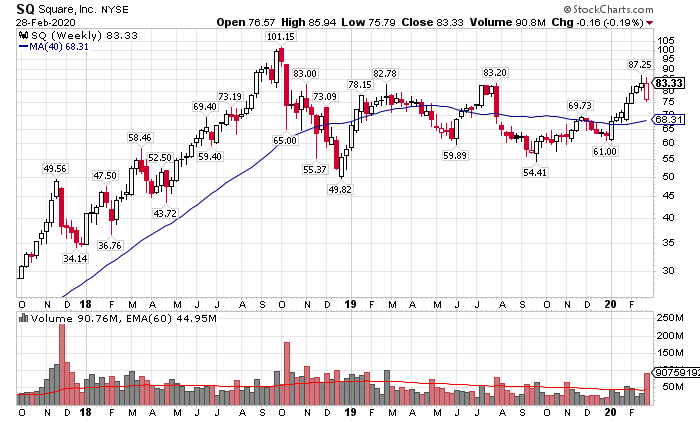

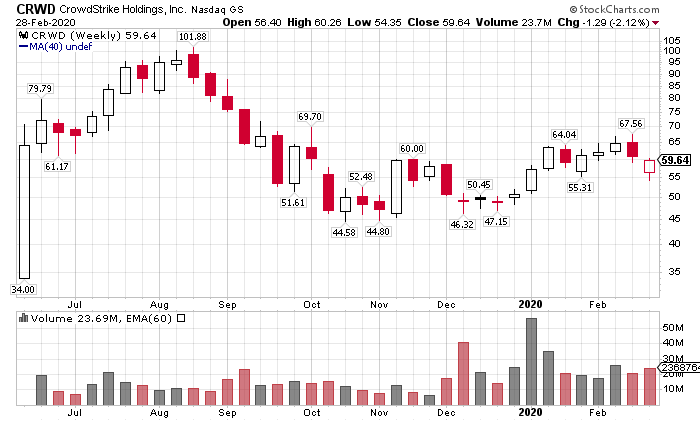

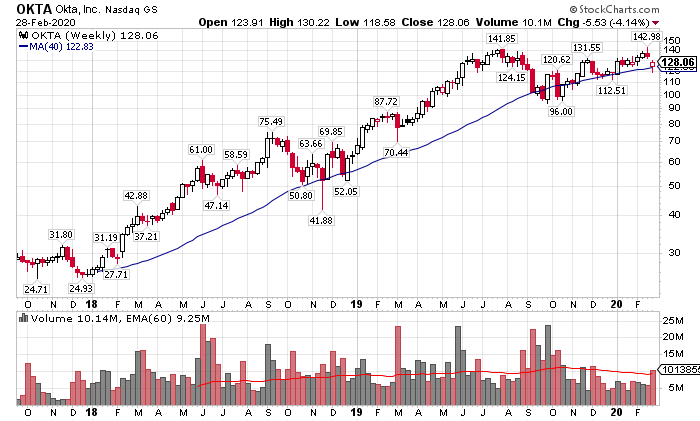

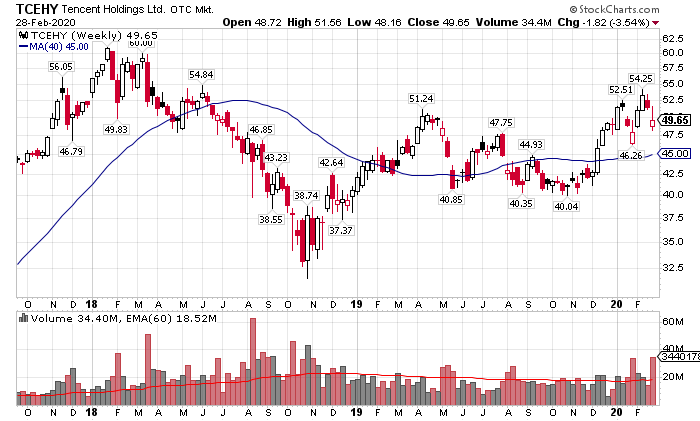

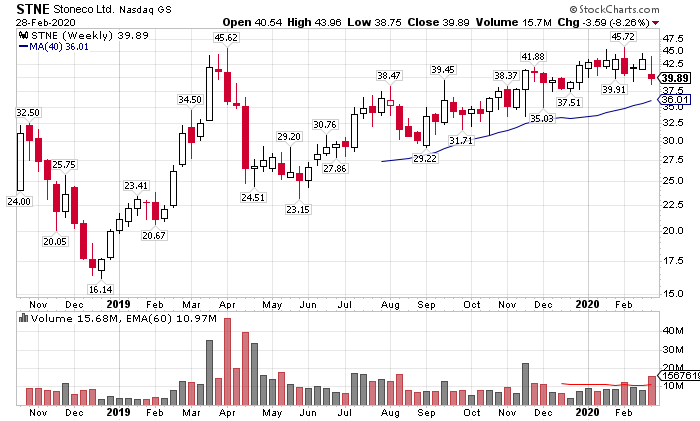

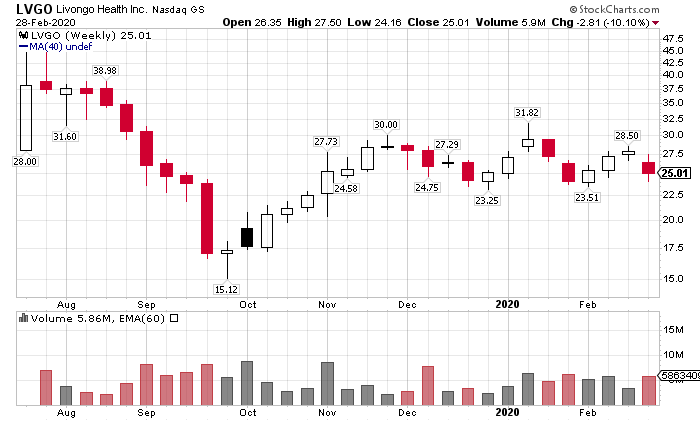

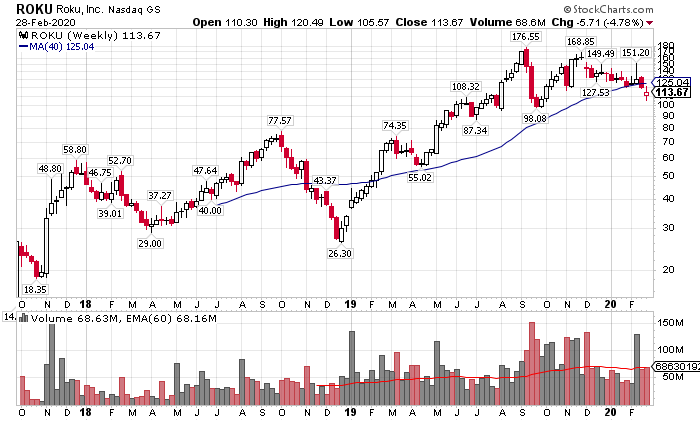

$ZM $SQ $WORK $CRWD $SHOP $MDB $SE $OKTA $TCEHY $STNE $PYPL $LVGO $CGC $SNAP $ROKU

chrisperruna.com/2020/01/05/sto…

Keep Current with Chris Perruna

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!