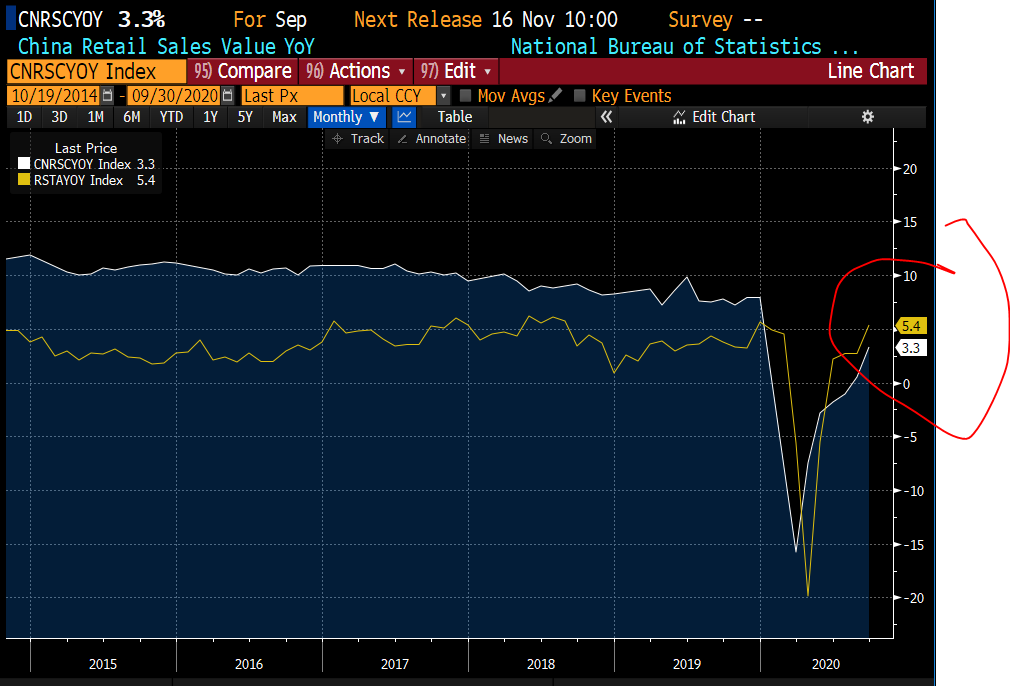

In one hour, we get China GDP for Q3 & expectations of a bounce from Q2. The question is whether its demand side of growth will be as good & so eyes on September retail sales (exps 1.6%YoY from 0.5%YoY in August).

US retail sales +5.4%YoY for September & V-shaped in recovery.

US retail sales +5.4%YoY for September & V-shaped in recovery.

Odds for Trump rising again & here are the latest polls. With US data strong (US retail sales beat), less pressure on stimulus although let's not forget that was the past & so still key. Pelosi sets a Tuesday deadline. Let's see!

China GDP lower than expected at 4.9%YoY but retail sales for September bounced to 3.3%YoY from 1.6%.

Where are we? We are here (or shall I say we were here in September):

China retail sales improving to +3.3%YoY

US retail sales also bouncing to +5.4%YoY!

Not bad.

China retail sales improving to +3.3%YoY

US retail sales also bouncing to +5.4%YoY!

Not bad.

Don't fret China's worse than expected GDP of +4.9%YoY:

a) Still a good number & frankly GDP is lagging (we're in October & having data that has July, August & September is pretty much old news)

b) Retail sales bouncing is good news.

The US & China showing recovering of demand!

a) Still a good number & frankly GDP is lagging (we're in October & having data that has July, August & September is pretty much old news)

b) Retail sales bouncing is good news.

The US & China showing recovering of demand!

Details of retail sales: the good news is that consumer goods are improving & even eating out is less negative. Auto was strong too at +11.2%YoY

• • •

Missing some Tweet in this thread? You can try to

force a refresh