1/ Lenders will expect Trump’s businesses to pay back an est. $900M from 2021 to 2024. If the president is reelected, that debt would come due during his 2nd term in office.

We know this because we have the documents. Let’s go through them one-by-one. forbes.com/sites/danalexa…

We know this because we have the documents. Let’s go through them one-by-one. forbes.com/sites/danalexa…

2/ We’ll start in a San Francisco office tower, where Trump holds a 30% interest alongside publicly traded Vornado, which discloses the debt. As of June, it was $543M, but I’m estimating that’s down to $541M now, and Trump’s share is therefore $162M. It’s due September 2021.

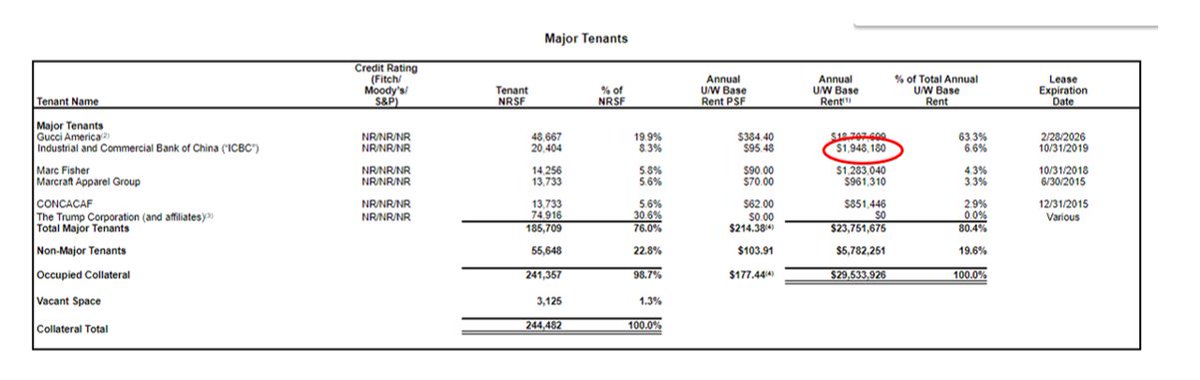

3/ Next up: Trump Tower, where the president has an $100 million loan maturing 9/6/22, as you can see in this debt prospectus. It’s an interest-only loan, so Trump has not paid down the principal at all. Debt coming due in 2nd term so far: $262M.

4/ Two months after that loan matures, there another one coming due against 1290 Ave of the Americas, a Manhattan office building in which Trump also holds a 30% stake alongside Vornado. It’s $950M, so Trump’s portion of that is $285M. Debt coming due in 2nd term now up to $547M.

5/ Let’s head down to Florida. In 2023, the president’s loans against the Trump National Doral golf resort will come due, according to his financial disclosure report. You can see two mortgages here totaling $125M. Debt coming due in 2nd term now at $672M.

6/ By 2024, Trump will have to pay back his loan against the D.C. hotel. Deutsche Bank gave him a $170M mortgage to build out the place, which now appears to be underwater—or close to it. This one could get messy. Debt coming due in 2nd term now up to $842M.

7/ The same year, Trump will have to resolve a different Deutsche Bank loan, this time an estimated $45M against his tower in Chicago. The hotel there also doesn’t seem to be thriving, which could make that one tricky as well. Debt coming due in 2nd term: Now at an est. $887M.

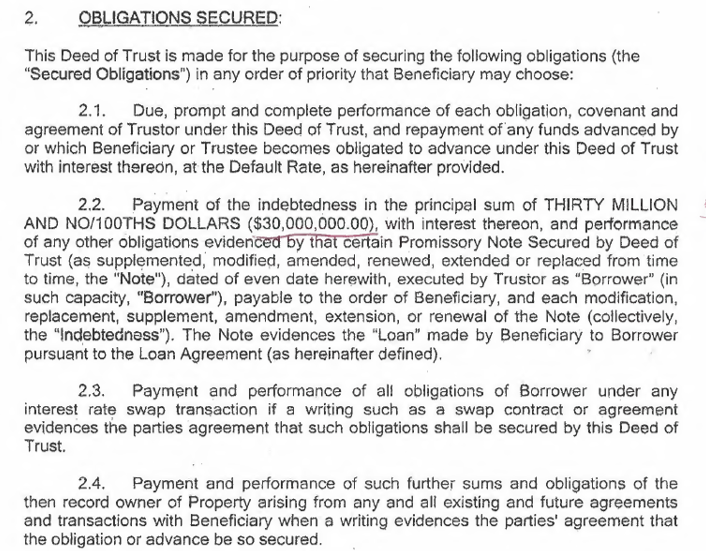

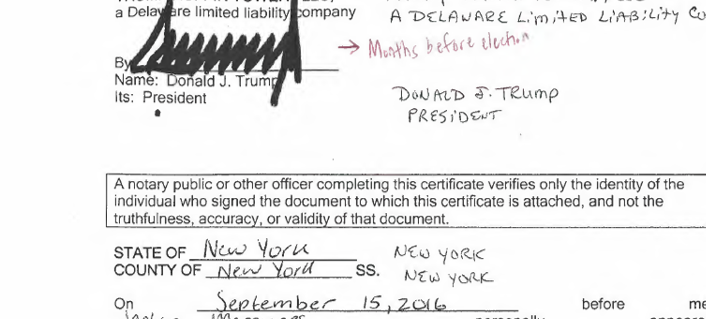

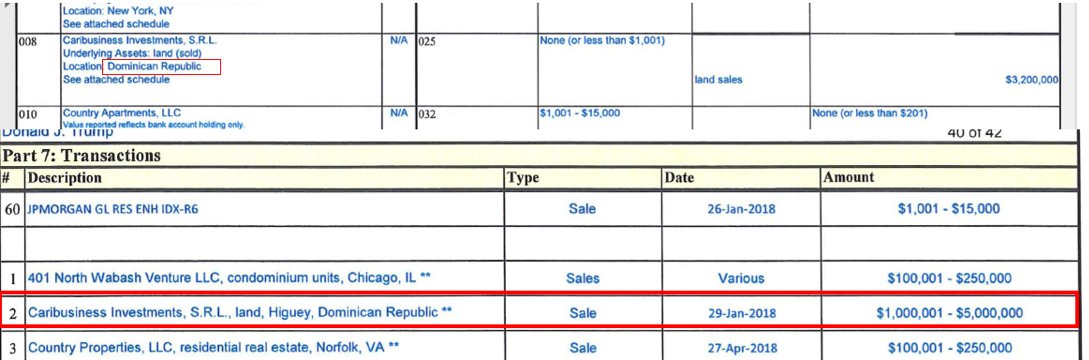

8/ A loan against Trump Plaza, one of the president’s properties in Manhattan, comes due on July 6, 2024, according to this document. That loan has $13M of principal left on it. So the tally of debt coming due in Trump’s 2nd term if he gets reelected concludes at $900M.

• • •

Missing some Tweet in this thread? You can try to

force a refresh