1/ The New York Times released their latest installment in their terrific Trump taxes series today. I've got some thoughts on this one as well, which I'll be outlining here over the next hour or so. nytimes.com/interactive/20…

2/ The story really includes two stories. First, there's one about cash flowing out of the Trump International Hotel in Las Vegas. Second, there's another about a train project that Trump's partner in the hotel has talked to about the president. We'll start with the cash.

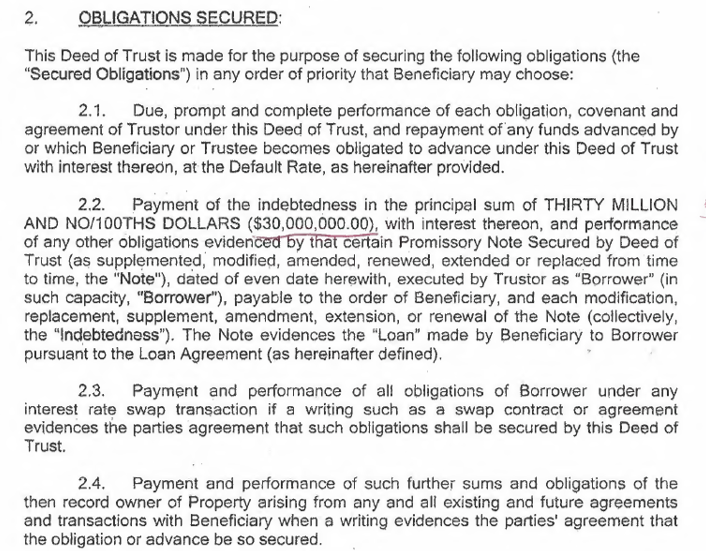

3/ On 9/15/2016, weeks before the election, Trump signed a document to secure a $30M loan against the Trump International Hotel in Las Vegas, which he owns in a 50-50 partnership with fellow billionaire Phil Ruffin. You can see the amount and the signature on these documents.

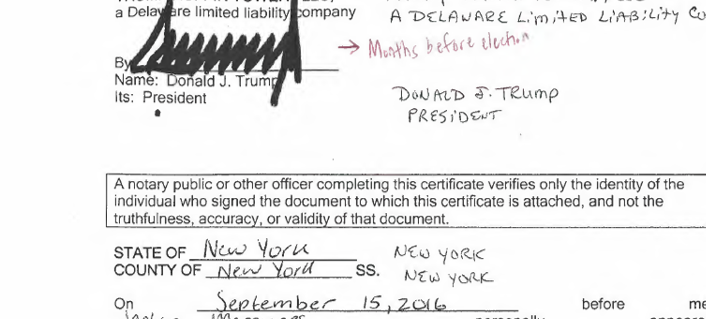

4/ Not long after, Donald Trump makes a sudden donation of $10 million to his presidential campaign, as you can here: docquery.fec.gov/cgi-bin/fecimg…

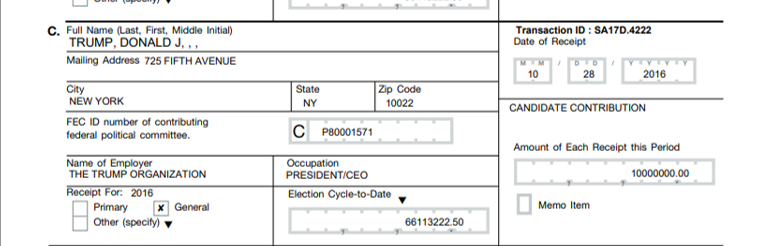

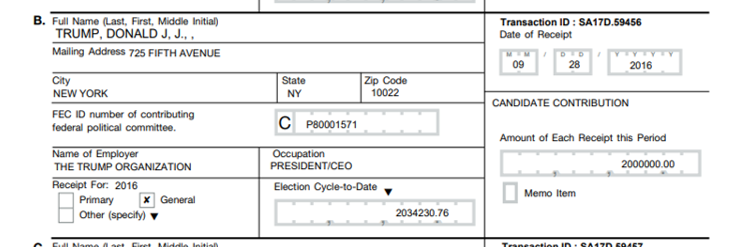

5/ There was also a $2 million donation that Trump made to his campaign around the same time, which you can see here: docquery.fec.gov/cgi-bin/fecimg…

6/ The fact that Trump got this loan late in 2016, then turned around and made quick contributions to his campaign, is not new. @ChaseWithorn and I wrote about it in this October 2019 story, for example. forbes.com/sites/danalexa…

7/ But the NYT adds details about how that money may have flowed through Trump's companies -- and what the legal implications could be. Ultimately, the NYT says Trump got a $21M+ windfall from the hotel.

This part is important/new: Trump & Ruffin treated it as a writeoff.

This part is important/new: Trump & Ruffin treated it as a writeoff.

8/ The Times explains a tax professor's analysis: "Unless the payments were for actual business expenses, he said, claiming a tax deduction for them would be illegal." nytimes.com/interactive/20…

9/ And that's not the only potential problem with the payments. Again, the NYT explains: "If they were not legitimate and were also used to fund Mr. Trump's presidential run, they could be considered illegal campaign contributions."

10/ Onto the 2nd part of the story, which centers around a proposal for a train connecting California to Las Vegas. As the NYT story graciously notes, Ruffin talked to me about this project in 2017 -- and admitted he had spoken with Trump about it, too. forbes.com/sites/danalexa…

11/ That's important because the project depends, in part, on the support of the Trump administration. Here's how Ruffin described it to me: "All of the plans and the environmental stuff, everything is all set,” he said. “All that has to happen is Trump has to approve it.”

12/ The NYT provides a great update on what has happened with the train proposal since then: "A panel composed largely of Trump appointees gave the train company permission to sell $1 billion in tax-free bonds to private investors. ... Trains could begin running as soon as 2024."

13/ It's worth noting that a spokesperson for the Dept. of Transportation told the NYT Ruffin's conversation w/ Trump didn't affect the administration's review policy.

We are now exactly where @LarryNoble_DC predicted we would be when we spoke about this nearly 4 years ago.

We are now exactly where @LarryNoble_DC predicted we would be when we spoke about this nearly 4 years ago.

14/ In other words, the problem with Trump holding onto his business interests when he entered government wasn’t just that he could make decisions to steer money to places that would benefit him. It was also that, even if he didn't, it would look like he had.

15/ This isn't the only potential conflicts of interest in Trump's empire. There are hundreds of others. If you're interested in those, I hope you'll consider my new book, "White House, Inc.: How Donald Trump Turned the Presidency into a Business." penguinrandomhouse.com/books/623950/w…

• • •

Missing some Tweet in this thread? You can try to

force a refresh