Cobra Effect 101

With the rise of government and central bank intervention in the economy and markets, the term "cobra effect" has experienced a revival.

But what is a "cobra effect" and how does it work?

Here's Cobra Effect 101!

👇👇👇

With the rise of government and central bank intervention in the economy and markets, the term "cobra effect" has experienced a revival.

But what is a "cobra effect" and how does it work?

Here's Cobra Effect 101!

👇👇👇

1/ The term "cobra effect" is used to describe a situation where the solution to a given problem makes the problem worse.

It is commonly used when talking about the unintended negative consequences of government policies.

Well-intentioned solutions may make matters worse.

It is commonly used when talking about the unintended negative consequences of government policies.

Well-intentioned solutions may make matters worse.

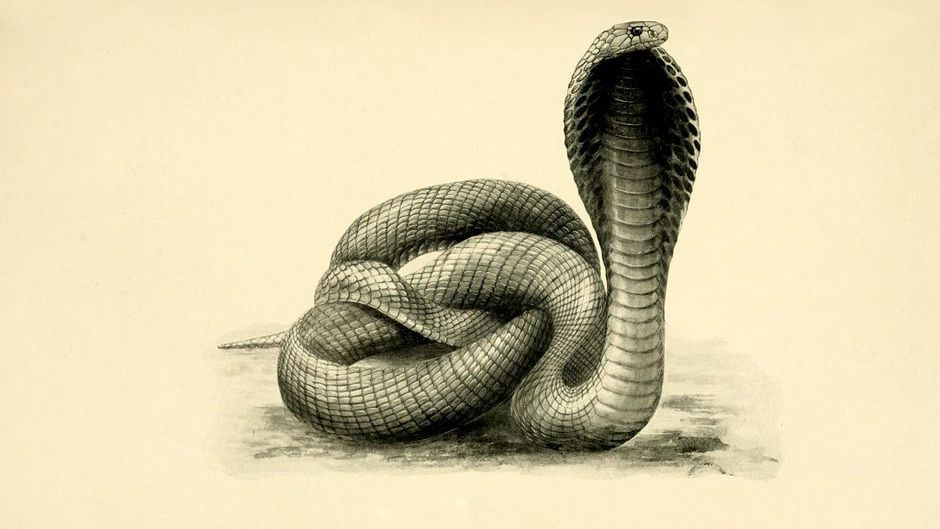

2/ The term originates from an ill-fated British policy implemented in India during its colonial rule.

Concerned about the number of cobras in Delhi, they announced a policy that offered a reward for dead cobras.

It started well - many dead cobras were turned in for the reward.

Concerned about the number of cobras in Delhi, they announced a policy that offered a reward for dead cobras.

It started well - many dead cobras were turned in for the reward.

3/ But soon, certain enterprising Indians concocted a plan. They began breeding cobras, killing them, and turning them in for the bounty.

Annoyed by the abuse of the policy, the British scrapped it.

Stuck with a bunch of (now worthless) cobras, the breeders released them.

Annoyed by the abuse of the policy, the British scrapped it.

Stuck with a bunch of (now worthless) cobras, the breeders released them.

4/ So a policy intended to curb the population of cobras in Delhi ultimately led to an increase in the population.

The Cobra Effect was born.

The term is becoming quite prevalent in the modern era.

Let's look at a few examples where we might be seeing it in action...

The Cobra Effect was born.

The term is becoming quite prevalent in the modern era.

Let's look at a few examples where we might be seeing it in action...

5/ Bailouts?

When the government bails out a corporation, it presumably does so with good intentions (to save jobs, etc.).

But the bailouts may have unintended consequences if other executives perceive themselves to be "playing with house money" with a government backstop.

When the government bails out a corporation, it presumably does so with good intentions (to save jobs, etc.).

But the bailouts may have unintended consequences if other executives perceive themselves to be "playing with house money" with a government backstop.

6/ Executives are compensated on the basis of shareholder returns. Increased risk amplifies returns. Why not take on additional risk if Uncle Sam has your back?

The seemingly well-intentioned government action may lead to more risk-taking and an increase in business collapses.

The seemingly well-intentioned government action may lead to more risk-taking and an increase in business collapses.

7/ Monetary & Fiscal Policy?

Aggressive, stimulative monetary and fiscal policy is undertaken in an effort to stimulate a struggling economy.

But the typical government actions - lowering interest rates, QE, and direct stimulus - may have painful unintended consequences.

Aggressive, stimulative monetary and fiscal policy is undertaken in an effort to stimulate a struggling economy.

But the typical government actions - lowering interest rates, QE, and direct stimulus - may have painful unintended consequences.

8/ Low risk-free rates and the "Fed put" may lead to rampant speculative bubbles and painful bursts.

The Cantillon Effect may appear, as the flow path of new money through the economy disproportionately benefits the wealthy, furthering inequality.

The Cantillon Effect may appear, as the flow path of new money through the economy disproportionately benefits the wealthy, furthering inequality.

https://twitter.com/SahilBloom/status/1309145743756865536

9/ @axios's @DionRabouin reported that some Fed officials are now pushing for "'tougher financial regulation' as concerns grow that monetary policy is 'encouraging behavior detrimental to economic recovery and creating pressure for additional bailouts.'" axios.com/the-fed-is-sta…

10/ So there are several ongoing policy actions that may have cobra effects.

As an informed citizen, it is worth being educated on the subject and keeping an eye on the space.

I'd love for you to join the conversation! What examples of potential cobra effects do you see today?

As an informed citizen, it is worth being educated on the subject and keeping an eye on the space.

I'd love for you to join the conversation! What examples of potential cobra effects do you see today?

11/ That was Cobra Effect 101! I hope you found it useful.

Special thanks to my friend @kencotto for the suggestion to cover this great topic.

And for more educational threads on business, money, finance, and economics, check out my meta-thread below.

Special thanks to my friend @kencotto for the suggestion to cover this great topic.

And for more educational threads on business, money, finance, and economics, check out my meta-thread below.

https://twitter.com/SahilBloom/status/1284583099775324161

• • •

Missing some Tweet in this thread? You can try to

force a refresh