As someone who is #irresponsiblylong both Bitcoin and DeFi, I cannot understand the constant tensions and bickering between the communities

In yesterday's daily, I explore why I believe Bitcoin and DeFi are symbiotic rather than competitive

Thread 👇

In yesterday's daily, I explore why I believe Bitcoin and DeFi are symbiotic rather than competitive

Thread 👇

1/11 Bitcoin can be seen as "Digital Gold", with its like for like characteristics as a store of value being superior in every way

However, it's also much more than this as it's natively digital nature enables programmability, utility and financial innovation at software speed

However, it's also much more than this as it's natively digital nature enables programmability, utility and financial innovation at software speed

2/ Bitcoin is not only a financial asset that is no one else’s liability, it can also be used as part of a broader financial system without becoming someone else’s liability

Rather than trust a counterparty, users need only trust cryptoeconomic incentives and human greed

Rather than trust a counterparty, users need only trust cryptoeconomic incentives and human greed

3/ This is where DeFi comes in

DeFi is our first legit attempt at building the decentralised infrastructure that can give Bitcoin its utility without rendering it someone else's liability

DeFi is our first legit attempt at building the decentralised infrastructure that can give Bitcoin its utility without rendering it someone else's liability

4/ While the current iteration sits mostly on Ethereum and uses bridge tech with significant centralisation vectors among many other flaws, focusing on this is missing the forest for the trees

This is early stage tech and will continue to progress quickly

This is early stage tech and will continue to progress quickly

5 We see DeFi as building the open, borderless, trustless financial infrastructure of the future

However, this financial infrastructure is useless without liquidity and liquidity ultimately comes from assets people want

However, this financial infrastructure is useless without liquidity and liquidity ultimately comes from assets people want

6/ While $USDT is currently the most liquid asset in DeFi, it inherits the dollar's monetary policy and we are bearish on its long-term prospects

We see BTC as the leading contender to become the base trading pair and reserve asset of the financial system of the future

We see BTC as the leading contender to become the base trading pair and reserve asset of the financial system of the future

7/ While short-term BTC strength may pull liquidity from DeFi, long-term it attracts more capital to the space, increasing liquidity and demand for Bitcoin utility provided by DeFi

Similarly, the growth of DeFi is good for BTC because it increases its utility and network effect

Similarly, the growth of DeFi is good for BTC because it increases its utility and network effect

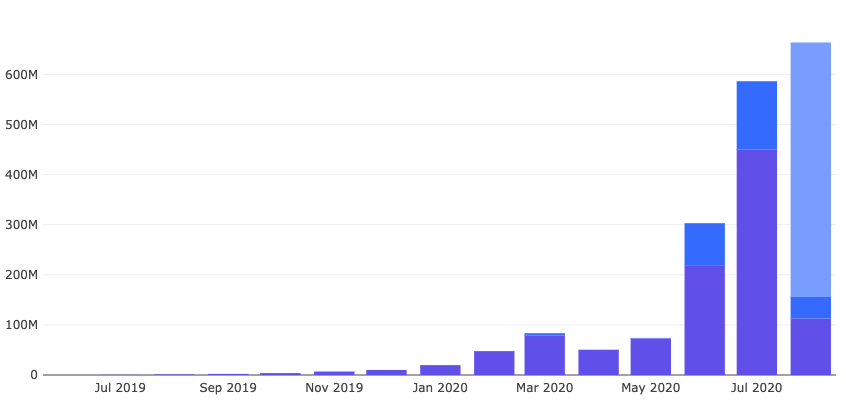

8/ There is already over $1B of Bitcoin on Ethereum being used to earn yield on AMMs, deposited as collateral and borrowed

As the ecosystem and technology develop, we expect Bitcoin’s utility to rise exponentially, increasing its liquidity and network effect

As the ecosystem and technology develop, we expect Bitcoin’s utility to rise exponentially, increasing its liquidity and network effect

9/ While Bitcoin and DeFi tend to clash philosophically, with the former prioritising immutability (autonocratic) and the latter upgradeability (anthropocratic), it's worth remembering that different goals require different approaches

10/ An autonocratic approach might be the right way to build digital gold as robustness, predictability and security should be prioritised over everything else

However, it is not the right approach to innovation or iterating on early stage technology (i.e. DeFi)

However, it is not the right approach to innovation or iterating on early stage technology (i.e. DeFi)

11/ Ultimately, the vision of the world of self-sovereign individuals that both the BTC and DeFi communities believe in requires both BTC and DeFi to succeed

Rather than bicker, let's embrace the different methodologies and #buidl towards this vision together

Rather than bicker, let's embrace the different methodologies and #buidl towards this vision together

Subscribe to Delphi Digital and read the full article on our website here:

delphidigital.io/reports/bitcoi…

delphidigital.io/reports/bitcoi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh