.@TheJusticeDept NEGLECTS THE @FHFA-C's STATUTORY POWER

"The 3rd amdt(NWS)was a conservator's classic task: renegotiating an obligation".I.e.,a "business action of a conservator standing in the shoes of private corps"

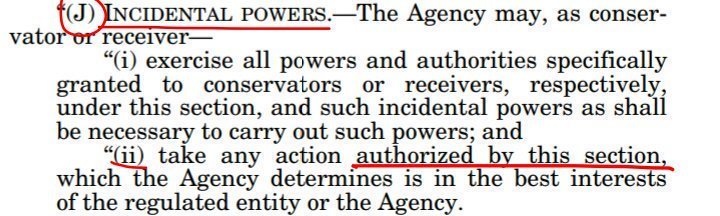

It continues to say LIMITLESS POWERS...#Fanniegate @WhiteHouse

"The 3rd amdt(NWS)was a conservator's classic task: renegotiating an obligation".I.e.,a "business action of a conservator standing in the shoes of private corps"

It continues to say LIMITLESS POWERS...#Fanniegate @WhiteHouse

"sweeping grant of Powers",in its Inc Power:"in the best interests of the FHFA-C",to argue that it's complying w/ its Powers, when that's been debunked by everybody.The phrase includes "AUTHORIZED BY THIS SECTION".Then,any action must comply with the "rehab" Power too.

The DOJ...

The DOJ...

...also omits:

-The obligations it's talking about,are EQUITY affected by HERA's Restriction On Capital Distributions.Then,there's no "renegotiation" but div suspended and REPAYMENT of the SPS under the exception(B),complying also w/ the Power: restore SOLVENCY.

-The 2nd Power...

-The obligations it's talking about,are EQUITY affected by HERA's Restriction On Capital Distributions.Then,there's no "renegotiation" but div suspended and REPAYMENT of the SPS under the exception(B),complying also w/ the Power: restore SOLVENCY.

-The 2nd Power...

...in the FHFA-C's Power(SOUNDNESS=Recap),as Retained Earnings w/ div suspended recapitalizes FnF.

-The Charter's "special borrowing rights from UST",highlighted by prof.Nielsen in his Amicus brief(The low cost UST backstop).FHFA can't negotiate "contracts" w/ UST.

4 BIG MISTAKES

-The Charter's "special borrowing rights from UST",highlighted by prof.Nielsen in his Amicus brief(The low cost UST backstop).FHFA can't negotiate "contracts" w/ UST.

4 BIG MISTAKES

What happended to the Solicitor Gnrl that knew that @FHFA-C has a "rehab" Power? Which is also the name given by the Law professor Vartanian in his Amicus Brief:

The UST/FHFA rather fight a legal case, leaving it to Mafia thugs illiterates in Finance & Law.

https://twitter.com/CarlosVignote/status/1310244702252396544?s=19

The UST/FHFA rather fight a legal case, leaving it to Mafia thugs illiterates in Finance & Law.

@threadreaderapp unroll.

• • •

Missing some Tweet in this thread? You can try to

force a refresh