Bitcoin is resilient around $13k, Ethereum hit $420, and DeFi TVL is at an ATH at $12 billion.

As DeFi continues to grow, decentralized exchanges will remain pivotal.

Here’s a thread on the outlook of the AMM market (Uniswap, Balancer, Sushiswap, LinkSwap, DODO).

As DeFi continues to grow, decentralized exchanges will remain pivotal.

Here’s a thread on the outlook of the AMM market (Uniswap, Balancer, Sushiswap, LinkSwap, DODO).

Before we get into it, a brief explainer of automated market makers.

AMMs are a type of decentralized exchange where users pool liquidity, then trade with the coins in the pool. AMMs price liquidity with a formula (often x * y = k), algorithmically matching purchases and sales.

AMMs are a type of decentralized exchange where users pool liquidity, then trade with the coins in the pool. AMMs price liquidity with a formula (often x * y = k), algorithmically matching purchases and sales.

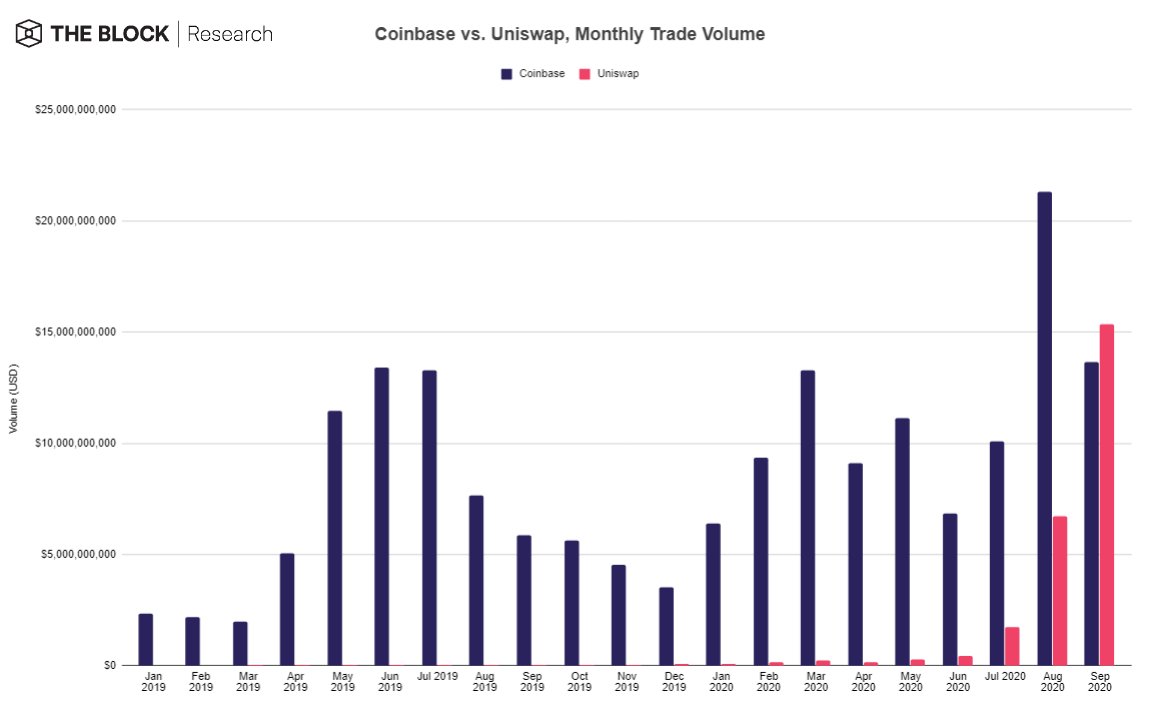

AMMs are starting to overtake centralized exchanges.

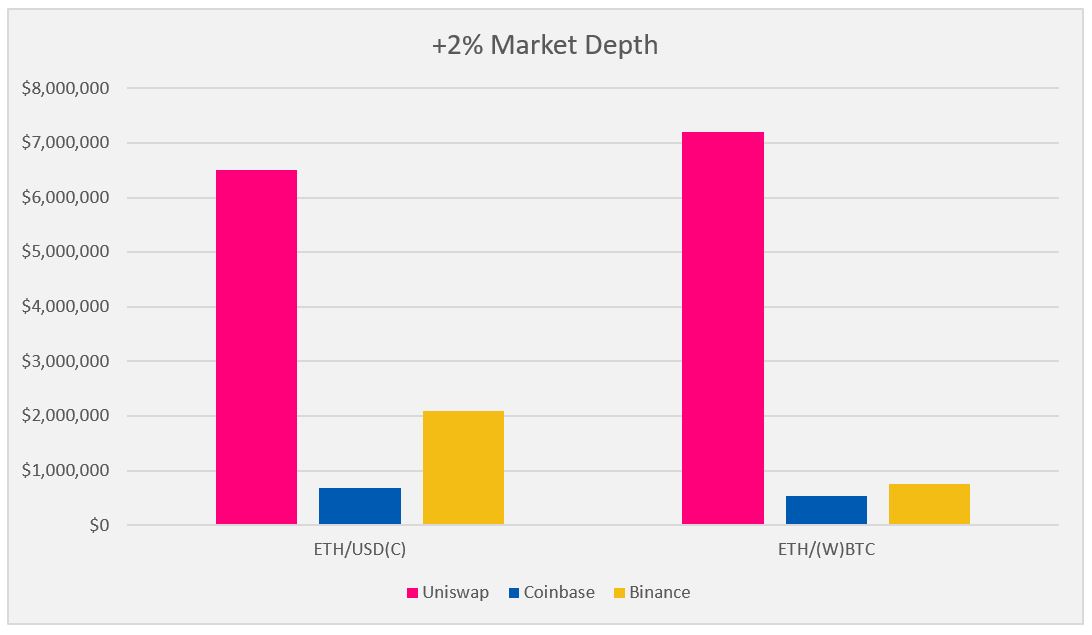

Uniswap alone did more volume than Coinbase in September. AMM liquidity pools can sometimes be deeper than centralized exchanges, sans trading fees (see image #1).

AMM also enable-chain arbitrage, a massive market.

Uniswap alone did more volume than Coinbase in September. AMM liquidity pools can sometimes be deeper than centralized exchanges, sans trading fees (see image #1).

AMM also enable-chain arbitrage, a massive market.

First off, @UniswapProtocol.

Uniswap remains the largest AMM by far, with a total of $3 billion in liquidity and around $150-300m in daily volume.

This is for good reason: thanks to UNI LP rewards, the best UX, and network effects, Uniswap easily takes the cake.

Uniswap remains the largest AMM by far, with a total of $3 billion in liquidity and around $150-300m in daily volume.

This is for good reason: thanks to UNI LP rewards, the best UX, and network effects, Uniswap easily takes the cake.

There’s also Uniswap v3 on the horizon. Many are hoping that brings scaling (Optimistic Ethereum?) and capital efficiency improvements that many have been waiting for.

Good thread from @iwearahoodie on more:

Good thread from @iwearahoodie on more:

https://twitter.com/iwearahoodie/status/1308550829054459904

With v3 on the horizon and network effects (integrated in DeFi consumer-facing apps like Dharma, a large number of trading pairs, exchange for IDOs, etc.), I don't see Uniswap's dominance slipping soon.

Right on up, @SushiSwap.

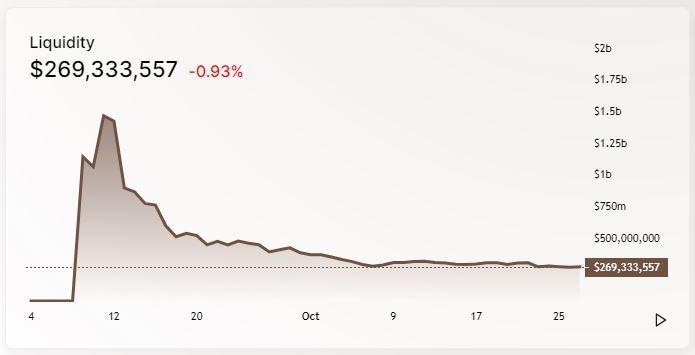

SushiSwap was all the rage a few months ago, but the decline of $SUSHI (and LP rewards by extension) has resulted in a drop in SushiSwap's trading volume and liquidity.

With few competitive advantages right now, its volume may continue its decline.

SushiSwap was all the rage a few months ago, but the decline of $SUSHI (and LP rewards by extension) has resulted in a drop in SushiSwap's trading volume and liquidity.

With few competitive advantages right now, its volume may continue its decline.

I'm not counting it out just yet.

Sushiswap still has the benefit of distributing 1/6 of the 0.3% trading fee to SUSHI holders.

With Uniswap governance stalling right now, this fee distribution may be a solid source of revenue for holders.

Sushiswap still has the benefit of distributing 1/6 of the 0.3% trading fee to SUSHI holders.

With Uniswap governance stalling right now, this fee distribution may be a solid source of revenue for holders.

Balancer is up next.

@BalancerLabs is a unique AMM in that it's multi-sided and doesn't use the constant product formula model. This means Balancer pools can kinda act as on-chain index funds.

Balancer also has a variable pool fee, which gives users to ability to experiment.

@BalancerLabs is a unique AMM in that it's multi-sided and doesn't use the constant product formula model. This means Balancer pools can kinda act as on-chain index funds.

Balancer also has a variable pool fee, which gives users to ability to experiment.

We've seen Balancer play a key role in the roll-out of certain tokens.

YFI, for instance, was partially launched through a 98/2 DAI/YFI pool. Same thing with SAFE/COVER.

Further experimentation with different pool tokens and weights should result in unique use cases.

YFI, for instance, was partially launched through a 98/2 DAI/YFI pool. Same thing with SAFE/COVER.

Further experimentation with different pool tokens and weights should result in unique use cases.

On to a newcomer: LinkSwap (@YFLinkio).

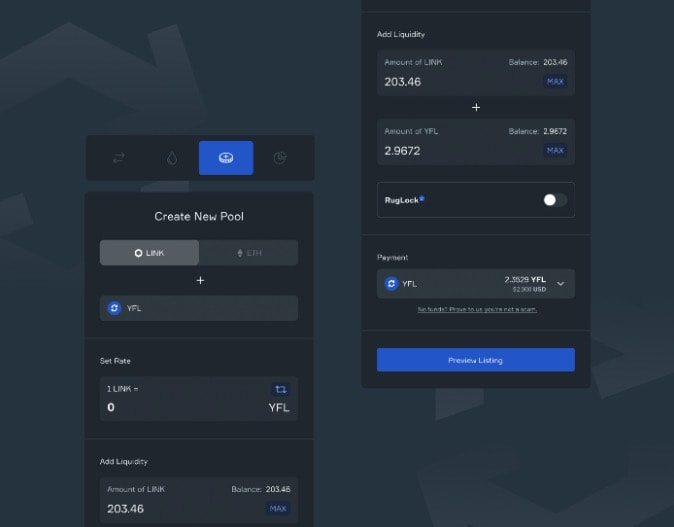

LinkSwap is an upcoming AMM that is offering Continuous Liquidity Pools (CLPs).

It has some interesting features like RugLock and SlipStop, aimed at preventing rug pulls and front-running bots from hurting users.

LinkSwap is an upcoming AMM that is offering Continuous Liquidity Pools (CLPs).

It has some interesting features like RugLock and SlipStop, aimed at preventing rug pulls and front-running bots from hurting users.

CLPs are a pretty cool AMM type that charges a slippage-based fee. The higher amount of pool liquidity a trader demands, the more premium they pay. This prevents or at least mitigates some manipulation.

h/t - Andrew Kang touched more on CLPs here:

h/t - Andrew Kang touched more on CLPs here:

https://twitter.com/Rewkang/status/1299851593962070017

LinkSwap is tied to the $YFL governance token, which has a staking mechanism that rewards users with 1/6 of the platform's trading fees.

It also disburses 90% of platform listing fees (for projects activating RugLock/SlipLock) to holders.

It also disburses 90% of platform listing fees (for projects activating RugLock/SlipLock) to holders.

Finally, @BreederDodo.

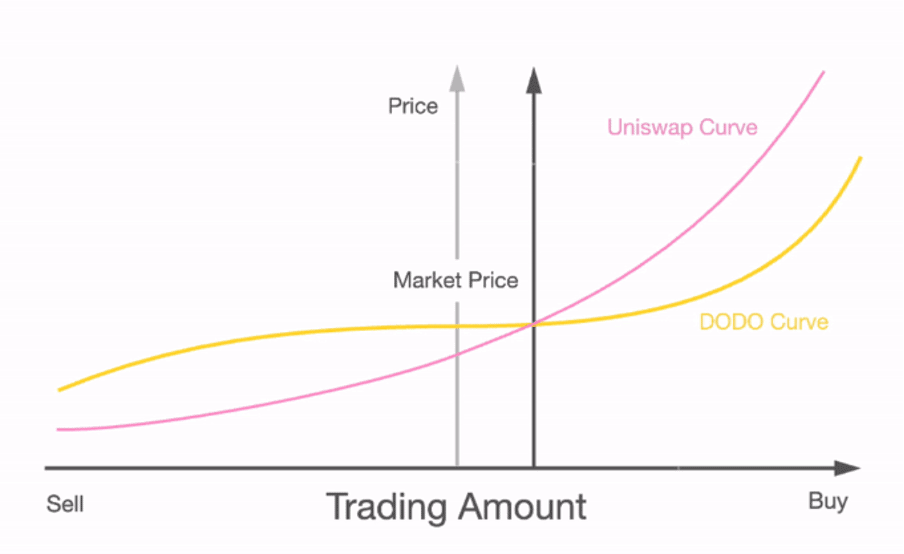

DODO is interesting as well as it integrates a Proactive Market Maker (PMM) algorithm. It's a dynamic formula that attempts to improve capital efficiency and liquidity.

Works similar to Curve, where the liquidity around the market price is rather flat.

DODO is interesting as well as it integrates a Proactive Market Maker (PMM) algorithm. It's a dynamic formula that attempts to improve capital efficiency and liquidity.

Works similar to Curve, where the liquidity around the market price is rather flat.

I'm sure I missed a few Ethereum-based AMMs.

But the five I mentioned—Uniswap, Balancer, SushiSwap, LinkSwap, and DODO—were the first that came to mind.

Feel free to share any other cool AMMs you know of. May do another thread later.

But the five I mentioned—Uniswap, Balancer, SushiSwap, LinkSwap, and DODO—were the first that came to mind.

Feel free to share any other cool AMMs you know of. May do another thread later.

As an aside, I guess this is kind of my celebratory thread for hitting 1k followers on this account. Thanks for the support.

Seven days ago, my follower count was 500!

Made this second account to share some of my thoughts on more esoteric subjects without spamming my main feed.

Seven days ago, my follower count was 500!

Made this second account to share some of my thoughts on more esoteric subjects without spamming my main feed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh