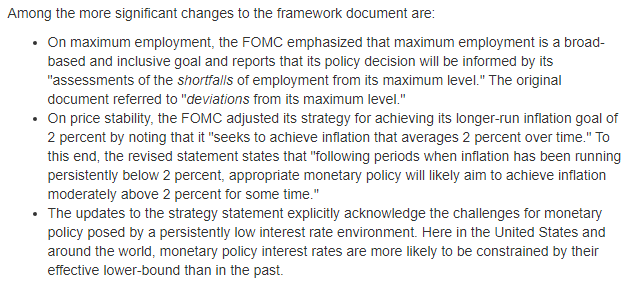

GDP rose by +7.4% in Q3 (pretty much exactly as expected), after falling by -9.0% in Q2 and -1.3% in Q1. All told, the economy is -3.5% smaller than it was at the end of 2019.

For context, the economy is roughly as far below its peak as in the darkest days of the last recession

For context, the economy is roughly as far below its peak as in the darkest days of the last recession

When the economy rises by +7.4%, some will report this as being at an "annualized rate" of 33.1%.

Lemme be crystal clear: This does not mean that the economy is now one-third bigger. (Lemme explain...)

Lemme be crystal clear: This does not mean that the economy is now one-third bigger. (Lemme explain...)

Reporting *quarterly* GDP growth at an *annualized* rate answers the question: If the economy also grew at this rate for the next 3 quarters, how much larger would the economy be?

But there's no chance that will happen, so the annualized rate answers a question no-one is asking.

But there's no chance that will happen, so the annualized rate answers a question no-one is asking.

There will be lots of political chatter about today's GDP number. It's true, Q3 is a record rate of growth. But note Q2 was a record contraction, the likes of which we've never seen before.

Big jump down, big bounce back. What really matters is that we're not all the way back.

Big jump down, big bounce back. What really matters is that we're not all the way back.

So where are we?

The economy is -3.5% smaller than it was in late 2019. Is that a big hole? Well, that's roughly as large as the hole the economy fell into during the financial crisis, and at the time we thought that a damn big hole.

The economy is -3.5% smaller than it was in late 2019. Is that a big hole? Well, that's roughly as large as the hole the economy fell into during the financial crisis, and at the time we thought that a damn big hole.

Was this an unexpectedly large rebound?

Not really. Go back to the start of the year, and look at the forecasts from then, and most forecasters were expecting the economy to basically stop in Q2, and then largely rebound in Q3.

Not really. Go back to the start of the year, and look at the forecasts from then, and most forecasters were expecting the economy to basically stop in Q2, and then largely rebound in Q3.

How informative are today's GDP data?

Not very. The growth from Q3 to Q2 reflects the depth of the Q2 hole as much as it reflects the size of the Q3 recovery.

We already knew Q2 was horrible, and we all know Q3 was better. Tons of indicators have told us this.

Not very. The growth from Q3 to Q2 reflects the depth of the Q2 hole as much as it reflects the size of the Q3 recovery.

We already knew Q2 was horrible, and we all know Q3 was better. Tons of indicators have told us this.

Watch the market (non-)response to today's GDP numbers, and you'll see what I mean. For all the political chatter, markets haven't responded at all. That's because there's not really much relevant news about the state of the economy in these numbers.

Lemme clarify what I mean here: Today's GDP numbers tell us about the average of July, August and September, relative to the average of April, May and June.

But we already had data through to October on tons of other informative indicators.

But we already had data through to October on tons of other informative indicators.

If you want an up-to-date assessment of the state of the economy, economists rarely look to GDP. That's because the numbers are released with a long lag -- the mid-point of Q3 was back in mid-August -- and quarterly averages aren't much help in detecting month-to-month movements.

I think what most of us care about is whether the economy has continued to recover after the mechanical bounceback in Q3.

To judge that, you'll need to look at more recent and high-frequency numbers, like those here: tracktherecovery.org

To judge that, you'll need to look at more recent and high-frequency numbers, like those here: tracktherecovery.org

If you wanna focus on the latest numbers, the Labor Department just released initial unemployment claims data for *last week*.

More Americans applied for unemployment benefits last week than in any week in the Great Recession (or any prior recession).

More Americans applied for unemployment benefits last week than in any week in the Great Recession (or any prior recession).

https://twitter.com/calculatedrisk/status/1321797219410825216

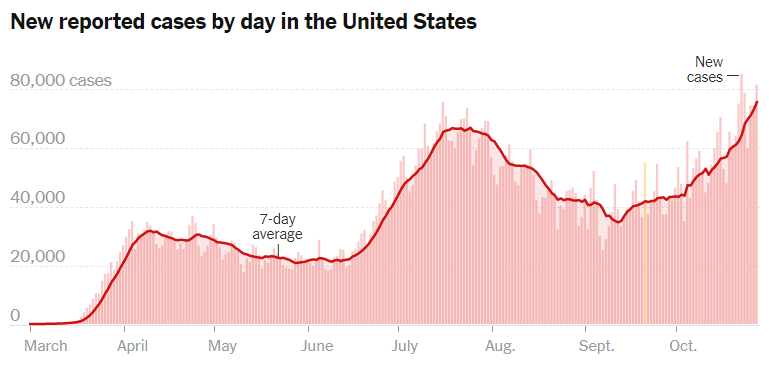

And if you really want to see where the economy is going, the indicator that Wall Street economists are tracking most closely is the progress of the virus.

It's impossible to have a healthy economy without a healthy population. The economy won't re-open if people don't feel safe

It's impossible to have a healthy economy without a healthy population. The economy won't re-open if people don't feel safe

If you have a cranky uncle who insists that you focus on annualized rates, point out that the number of new covid cases in Q3 rose to be +87% higher than in Q2, which is an annualized rate of +1,123%.

Ugh, I broke my own thread. Rest of the GDP thread continues below...

https://twitter.com/JustinWolfers/status/1321795829972295680

My students are doing their midterm today (good luck, folks!). Thinking of grading them at an annualized rate. The big numbers (I scored 360%!) might change the headlines, but they won't change the reality.

A true story and a GDP analogy: The most rapid improvement in my lung capacity did not occur during my most intense marathon training, but rather a year later when I was recovering from pneumonia. Even so, I still felt like crap, and wish I had done more to avoid getting sick.

• • •

Missing some Tweet in this thread? You can try to

force a refresh