1) THREAD | Stock Market Patience:

It’s what we all struggle with when it comes to investing.

Twitter is a haven for activity, lots of traders w/ action that is easy to get caught up in.

We all do at times.

Patience is what we are mentally trying to learn, fighting to grasp!

It’s what we all struggle with when it comes to investing.

Twitter is a haven for activity, lots of traders w/ action that is easy to get caught up in.

We all do at times.

Patience is what we are mentally trying to learn, fighting to grasp!

2) Conviction in our analysis & stock purchases is critical to success.

Position sizing will allow you to sit patiently through the inevitable pullbacks.

EVERY great stock pulls-back with a sizable drawdown on multiple occasions. Learn to deal with it. Don't get shaken out.

Position sizing will allow you to sit patiently through the inevitable pullbacks.

EVERY great stock pulls-back with a sizable drawdown on multiple occasions. Learn to deal with it. Don't get shaken out.

3) It seems as if everyone heads for the doorway at the first sign of trouble. No one has the conviction or patience to stay put on fintwit.

Activity, followers, activity, being right, trolls, not being wrong, selling subs, etc…

Forget that garbage! It's noise.

Activity, followers, activity, being right, trolls, not being wrong, selling subs, etc…

Forget that garbage! It's noise.

4) At the end of the day, it’s all about making money and not being right or wrong.

But beyond that, for me, it’s about growing wealth.

Having one good year is fun but having a great decade is a lot better.

Pair a couple decades together and you'll be wealthy.

But beyond that, for me, it’s about growing wealth.

Having one good year is fun but having a great decade is a lot better.

Pair a couple decades together and you'll be wealthy.

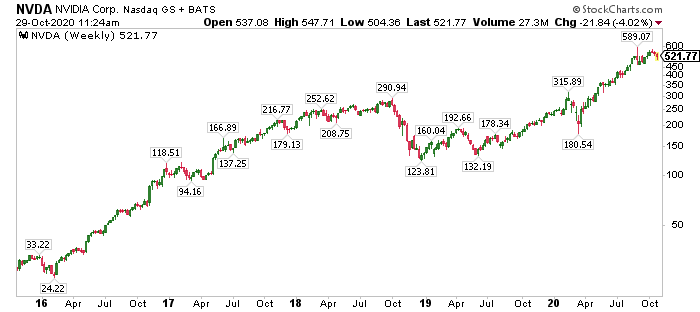

5) Take a look at the $NVDA chart.

It dropped from $290 to $123 in 2019, back to $315, then $180... then to $589

Who really held through all that? Not fintwit.

And this volatile action came after a run from $24 in 2016 w/ many pullbacks along the way.

One of many examples.

It dropped from $290 to $123 in 2019, back to $315, then $180... then to $589

Who really held through all that? Not fintwit.

And this volatile action came after a run from $24 in 2016 w/ many pullbacks along the way.

One of many examples.

6) If you want to grow wealth, you must understand that the money is made in the sitting, not the trading.

If you want to scalp profits & pay taxes, trade often.

I fight this battle often, sometimes I win, sometimes I lose.

I make mistakes all the time but I try to get better.

If you want to scalp profits & pay taxes, trade often.

I fight this battle often, sometimes I win, sometimes I lose.

I make mistakes all the time but I try to get better.

7) Action is tough to get away from.

Everyone wants to buy the next best stock. Many do this by selling a great stock they already own that may be correcting, for a variety of healthy reasons.

Have patience, have conviction, study & learn to get better.

IGNORE THE NOISE!

Everyone wants to buy the next best stock. Many do this by selling a great stock they already own that may be correcting, for a variety of healthy reasons.

Have patience, have conviction, study & learn to get better.

IGNORE THE NOISE!

• • •

Missing some Tweet in this thread? You can try to

force a refresh