1/ Thoughts on @jnovogratz episode at @InvestLikeBest

As I'm originally from Bangladesh, this one really touched me, and would share my own experiences of growing up in Bangladesh while simultaneously sharing notes from the episode.

As I'm originally from Bangladesh, this one really touched me, and would share my own experiences of growing up in Bangladesh while simultaneously sharing notes from the episode.

2/ First, let's start with this beautiful "Blue Sweater" story.

Yes, today we are much more connected. One thing I have seen Americans consistently underestimate is how closely America is followed by the majority of the world.

Yes, today we are much more connected. One thing I have seen Americans consistently underestimate is how closely America is followed by the majority of the world.

3/ I have Bangladeshi friends who never came to the US (and may never will) and yet their knowledge/interest on 2020 election would be among top 10 percentile in the US.

Of course, Hollywood has incredible influence as well. One thing that surprises me how America failed...

Of course, Hollywood has incredible influence as well. One thing that surprises me how America failed...

4/...to create a much more global appeal for any of the major sports (Football, Baseball, or even Basketball) that are popular in the US.

I am curious if anyone has a good answer why this was the case. I would imagine sports appeal would be easier to export.

I am curious if anyone has a good answer why this was the case. I would imagine sports appeal would be easier to export.

5/ Okay, I have digressed a bit. Back to the episode.

For Jacqueline, character has become the most important criterion for investment. A bet on character always makes sense, and especially so when you are dealing with harrowing lack of basic components in the system.

For Jacqueline, character has become the most important criterion for investment. A bet on character always makes sense, and especially so when you are dealing with harrowing lack of basic components in the system.

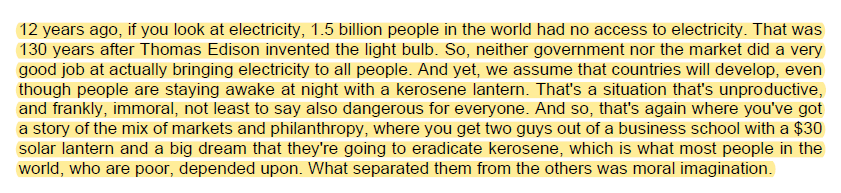

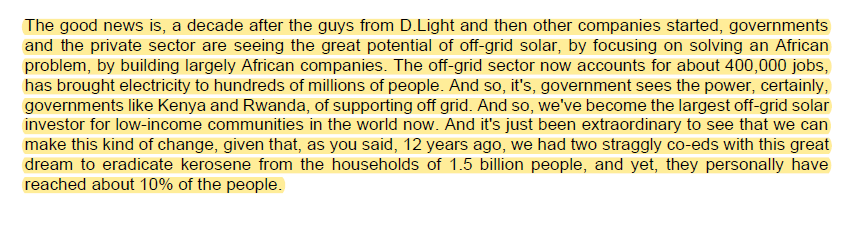

6/ 130 years after Edison invented the light bulb, a billion people remain unelectrified today.

I wasn't shocked. The village I was born 30 years ago in Bangladesh only got electrified less than 10 years ago.

I wasn't shocked. The village I was born 30 years ago in Bangladesh only got electrified less than 10 years ago.

7/ "The purpose doesn't find people that are sitting and pondering what their purpose is, we find our purpose by living into our purpose."

8/ The reasons for lagging behind on the development curve are multifaceted.

But once change comes to the scene, the development curve catches up by leaps and bounds.

But once change comes to the scene, the development curve catches up by leaps and bounds.

9/ Even when our family moved to the nearby city and had access to electricity, load shedding was such a daily phenomenon!!

I kinda miss those kerosene lanterns, haha. If you don't know how it looks, here you go

I kinda miss those kerosene lanterns, haha. If you don't know how it looks, here you go

10/ An amazing story of two entrepreneurs from Ethiopia, where capita chicken consumption was <1 lb, and how they helped reduce child malnutrition by 11% in the whole country.

11/ Only 1 in 3 people in the world have access to a toilet.

This one shocked me, but perhaps it shouldn't have.

Even today, if I went back to my village in Bangladesh, yes, I would have access to a toilet, but I don't think I would want to use it.

This one shocked me, but perhaps it shouldn't have.

Even today, if I went back to my village in Bangladesh, yes, I would have access to a toilet, but I don't think I would want to use it.

12/ If 1 in 3 have access to a toilet in the world, I wonder how many of them have access to a "decent" toilet.

Access to decent sanitation is obviously taken for granted in the west. But incredible to think just how privileged minority we are in the whole world.

Access to decent sanitation is obviously taken for granted in the west. But incredible to think just how privileged minority we are in the whole world.

End/ Episode link: investorfieldguide.com/jacqueline-nov…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh