What I have noticed about wildly successful entrepreneurs is that they may not be the best people to teach principles of entrepreneurial success.

I love listening to Dangote interviews/talks. But learn just as much from University professors at Harvard who don't own businesses

I love listening to Dangote interviews/talks. But learn just as much from University professors at Harvard who don't own businesses

https://twitter.com/The_Omoluabi/status/1322089434418978818

There are three main reasons for this.

1. Many rich & success entrepreneurs arent self aware. In fact there is evidence to suggest that as your level of power increases, self awareness decreases.

So they don't actually know what made them successful.

1. Many rich & success entrepreneurs arent self aware. In fact there is evidence to suggest that as your level of power increases, self awareness decreases.

So they don't actually know what made them successful.

There is a big role that luck plays in individual stories. A well connected parent. A relationship with an influential politician etc.

However, researchers can look at all the data from lots of wealthy people and distil it to the trends in a way that most individuals cannot.

However, researchers can look at all the data from lots of wealthy people and distil it to the trends in a way that most individuals cannot.

Secondly the issue of candor. As my favourite Stanford Professor points out in his book "Power", wealthy people often edit their stories significantly to paint themselves in the best possible light.

This is another reason why you may not get the correct advice from someone who has "done it".

Thirdly, most billionaires just have other priorities. And usually imparting business knowledge to young people isn't usually one of them.

I just don't see Mike Adenuga/Bill Gates/Jeff Bezos giving many detailed business school style lectures or writing books about business

I just don't see Mike Adenuga/Bill Gates/Jeff Bezos giving many detailed business school style lectures or writing books about business

Very few billionaires write books and when they do they are often fluffy with limited availability,compared to researchers.

It's not everyone that can teach, that can do. And it's definately not everyone that can do, that's able to teach.

It's not everyone that can teach, that can do. And it's definately not everyone that can do, that's able to teach.

Some like Mrs Ibukun Awosika has developed a way,a structure and a format to impart business knowledge to young women in a way that Dangote may never be able to.

The ability to teach is a gift in itself. The generosity that enables one to share is rare.

The ability to teach is a gift in itself. The generosity that enables one to share is rare.

Meeting someone like Mrs Awosika with the combination of the ability to teach, generosity to share candidly & honestly AND the experience to back it up....almost impossible to find.

Fourthly,some billionaires are naturally gifted in ways that most people aren't. So their advice simply won't work for most people.

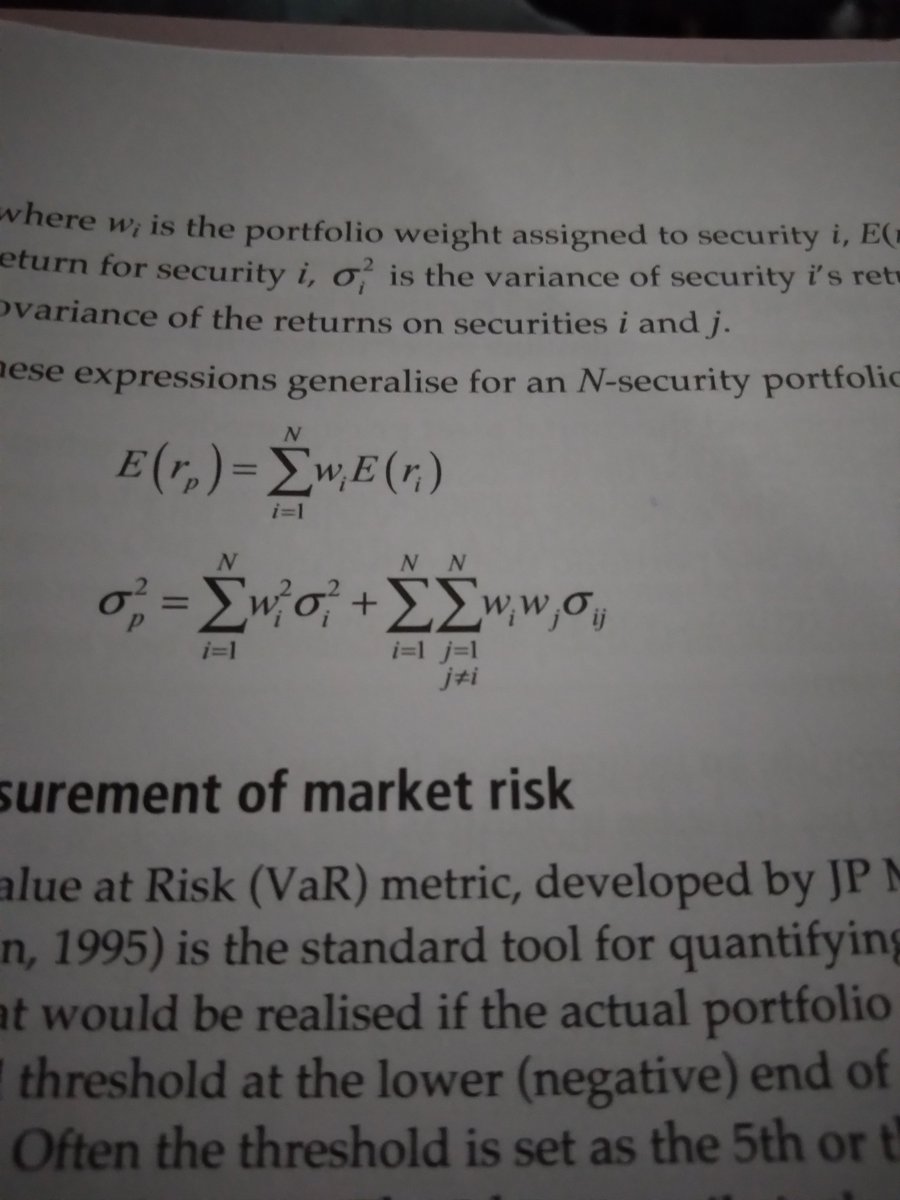

Warren Buffet has said he doesnt use traditional financial decision rules when buying stocks.

Warren Buffet has said he doesnt use traditional financial decision rules when buying stocks.

It's as if he has a way of randomly calculating some sort of decision rule protocol in his head.

But most people could not invest without going through the process of using decision rules.

But most people could not invest without going through the process of using decision rules.

In Jim Ovias book his advice is to "go with your gut". Only he forgets to mention that he a genius. He is astutely emotionally intelligent & is able to make decisions balancing up all variables in seconds.

I may need to spend hours pouring over the data, using aids like a decision making tree and turning to advisers before I come to a decision that he would be able to make in seconds.

I will end this thread, somewhat ironically with a quote from a Professor who explained this concept in a way that perhaps few of the super successful people could,for the reasons outlined about.

A letter written abt Buffett by Ahmad Rahnema, Prof of Finance at IESE.

Buffet and Charlie Monger claim to have never used textbook decision rules for investing. Yet they have built the most successful investment vehicle in the world.

So why did I put myself through this👇

Buffet and Charlie Monger claim to have never used textbook decision rules for investing. Yet they have built the most successful investment vehicle in the world.

So why did I put myself through this👇

Prof calls Warren Buffet a "natural player" in his letter. A highly gifted anomaly. He hasn't even been able to teach his kids what exactly it is he does that makes him so successful.

I am sure he doesnt entirely understand himself.

I am sure he doesnt entirely understand himself.

• • •

Missing some Tweet in this thread? You can try to

force a refresh