An explanation of funding, and why EVERY Bitcoin trader NEEDS to use it as their main trading tool $BTC #Bitcoin

/THREAD

/THREAD

We've all heard the trading mantra 'Buy low, sell high'

But how many traders can actually implement this seemingly simple strategy to make consistent profits?

Not many. But why?

But how many traders can actually implement this seemingly simple strategy to make consistent profits?

Not many. But why?

1. Because the tools traders use to analyse when prices are 'low' and 'high' are incomplete

AND

2. Because when an edge on the market becomes obvious it seizes to act as an edge

So how does this apply to funding?

AND

2. Because when an edge on the market becomes obvious it seizes to act as an edge

So how does this apply to funding?

Funding is THE greatest tool for timing $BTC tops/bottoms

Funding is a mechanism used on derivatives exchanges where the higher leveraged side of the market pays the lesser leveraged side. It encourages traders to either:

Funding is a mechanism used on derivatives exchanges where the higher leveraged side of the market pays the lesser leveraged side. It encourages traders to either:

- Exit their positions to avoid paying excess funding

- Enter positions to collect funding

As such, funding is fundamentally a tool to equalise leverage used in the market by those going long and short.

- Enter positions to collect funding

As such, funding is fundamentally a tool to equalise leverage used in the market by those going long and short.

Aswell, because Bitmex makes money from fees, funding increases the amount of positions traders enter = more income from fees

When funding is 'negative', people short Bitcoin pay funding to those who are long Bitcoin.

When funding is 'positive' the same happens in the inverse

When funding is 'negative', people short Bitcoin pay funding to those who are long Bitcoin.

When funding is 'positive' the same happens in the inverse

We all know the importance of 'going against the herd'

Well, funding IS the herd. Funding is a representation of the collective positioning of derivatives traders.

We can buy low and sell high by simply doing the opposite of what those on derivatives exchanges do

Want proof?

Well, funding IS the herd. Funding is a representation of the collective positioning of derivatives traders.

We can buy low and sell high by simply doing the opposite of what those on derivatives exchanges do

Want proof?

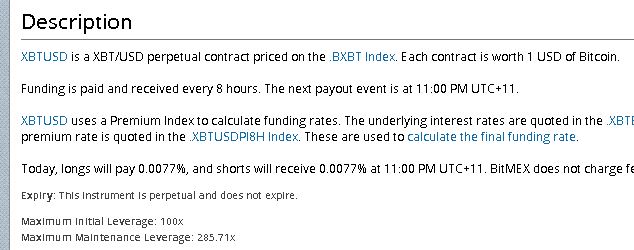

Below is the funding rates of the XBTUSD contract on Bitmex since June 2019.

As you can see, when funding went 'negative' for a period of 1-4 weeks, the bottom was in

When funding went positive for 1-4 weeks, the top was in

With 100% accuracy...

As you can see, when funding went 'negative' for a period of 1-4 weeks, the bottom was in

When funding went positive for 1-4 weeks, the top was in

With 100% accuracy...

With patience and discipline, you could have made a killing

Besides his loom lines and such, this is how @loomdart is able to trade Bitcoin with such accuracy

A sound understanding of funding is the most important aspect of HTF swing trading BTC

Besides his loom lines and such, this is how @loomdart is able to trade Bitcoin with such accuracy

A sound understanding of funding is the most important aspect of HTF swing trading BTC

https://twitter.com/loomdart/status/1308710952511115264?s=20

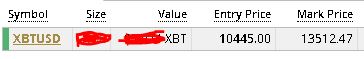

It is funding + a series of other tools which allowed me to enter big @ 10.4k in September

And it will be funding which allows me to sell around the top and buy much lower

(Assuming derivatives markets continue to make up a significant aspect of trading volumes)

And it will be funding which allows me to sell around the top and buy much lower

(Assuming derivatives markets continue to make up a significant aspect of trading volumes)

If you want to learn more about funding and how I used this tool to enter long @ 10.4k, join my trading community here: discord.gg/kyGytKZ

• • •

Missing some Tweet in this thread? You can try to

force a refresh