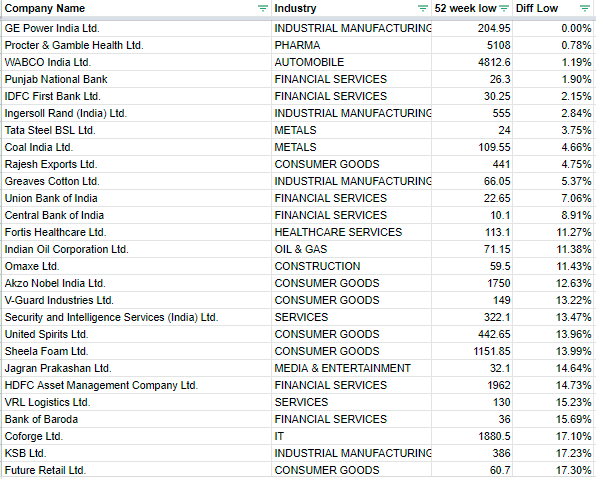

Nifty 500 Stocks

Low P/E and High P/E stocks (not adjusted for exceptional/ corporate events)

#BSE #NSE #FII #DII

Low P/E and High P/E stocks (not adjusted for exceptional/ corporate events)

#BSE #NSE #FII #DII

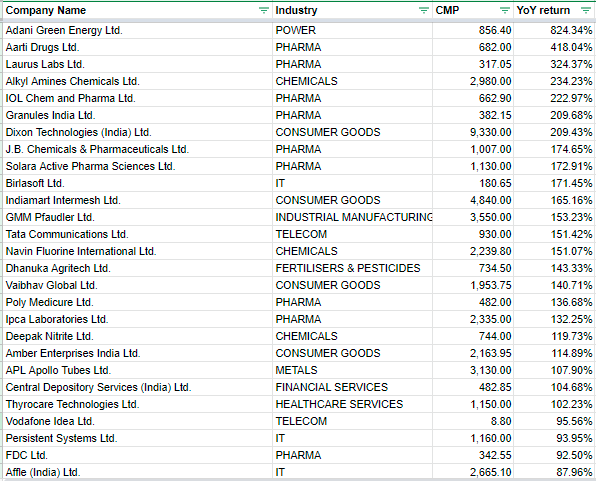

Nifty 500 Stocks

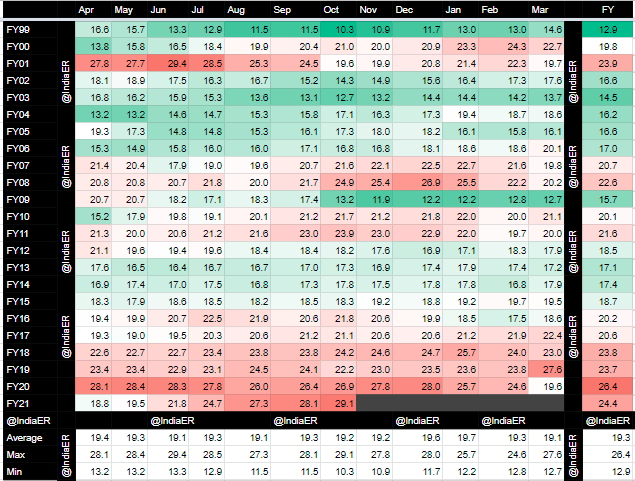

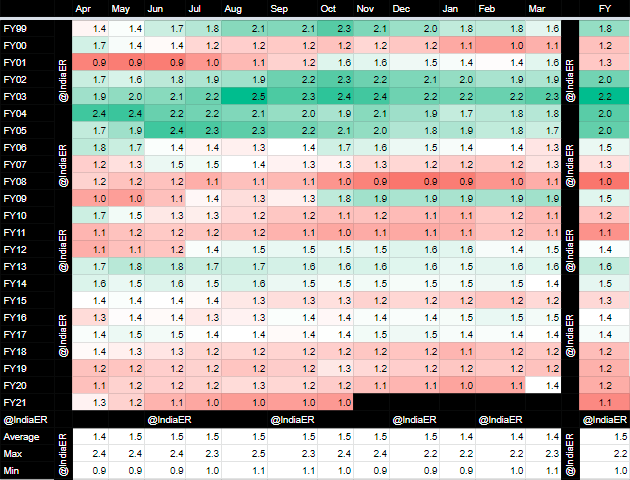

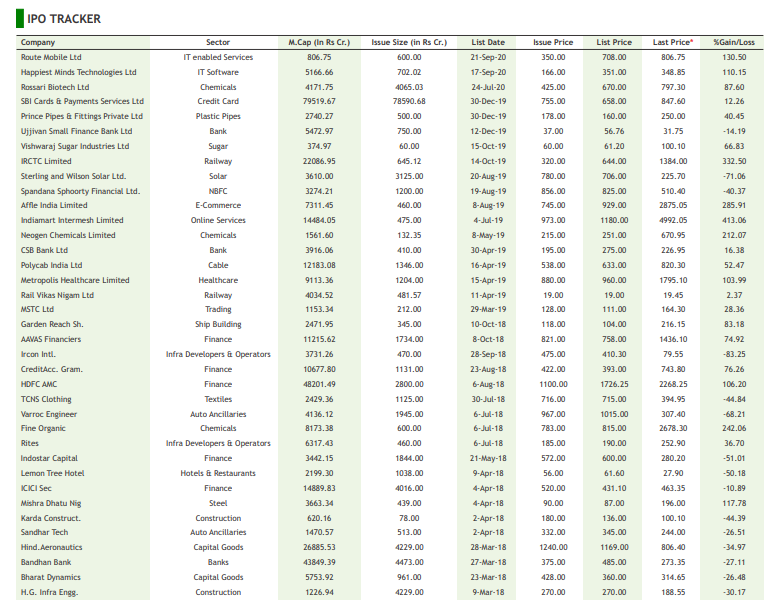

Best and worst year-on-year price returns

(not adjusted for exceptional/ corporate events)

#BSE #NSE #FII #DII

Best and worst year-on-year price returns

(not adjusted for exceptional/ corporate events)

#BSE #NSE #FII #DII

• • •

Missing some Tweet in this thread? You can try to

force a refresh