When I started "investing" in 2004 I had no idea what I was doing

I couldn't tell you ANYTHING about a balance sheet, income statement, management...nothing!

To prove just how bad I was, I looked up the first stocks I bought in 2004-2007

Here's how it went...

👇👇👇👇👇

I couldn't tell you ANYTHING about a balance sheet, income statement, management...nothing!

To prove just how bad I was, I looked up the first stocks I bought in 2004-2007

Here's how it went...

👇👇👇👇👇

Stock #1 - $STEM

I heard stem cells were going to be big, so I bought this penny stock

The ONLY thing I knew was the ticker - That's it!

I sold it for a 20% gain in a few months

My feelings: Investing is easy!

I heard stem cells were going to be big, so I bought this penny stock

The ONLY thing I knew was the ticker - That's it!

I sold it for a 20% gain in a few months

My feelings: Investing is easy!

Stock #2 - $DIGI

Another penny stock -- I couldn't tell you ANYTHING about this company either

Bought for $1.40 -- sold 1 month later a 5% loss

My feelings: Investing is still easy!

(currently about $0.10 share, down 90%)

Another penny stock -- I couldn't tell you ANYTHING about this company either

Bought for $1.40 -- sold 1 month later a 5% loss

My feelings: Investing is still easy!

(currently about $0.10 share, down 90%)

Stock #3 - $ALT

Penny stocks -- I can't telll you anything about this company.

Bought $1.01 - Sold 1 month later at cost

My feelings: Investing might not be easy

($ALT is unlisted today)

Penny stocks -- I can't telll you anything about this company.

Bought $1.01 - Sold 1 month later at cost

My feelings: Investing might not be easy

($ALT is unlisted today)

Stock #4 - $UAIR (United Airlines)

Penny stock + company I know! I can't lose!

Bought for $1.13

Sold for $0.75 -- 3 DAYS LATER!!!!

My first "big loss"

My feelings: Investing is getting harder

Penny stock + company I know! I can't lose!

Bought for $1.13

Sold for $0.75 -- 3 DAYS LATER!!!!

My first "big loss"

My feelings: Investing is getting harder

Stock #5 - $VODG

Penny stock - bought for $0.18 (So cheap, how could I lose????)

Sold for $0.20, 1-month later

My feelings: Investing is easy again!

Penny stock - bought for $0.18 (So cheap, how could I lose????)

Sold for $0.20, 1-month later

My feelings: Investing is easy again!

Stock #6 - $DDD

This ticker was a penny stock, clinical-stage biotech at the time, NOT 3D Systems

Bought at $3.15

Sold 3-months later at $4.50

My feelings: Investing is SO EASY - who are these suckers that buy 'high priced' stocks like $KO?????

This ticker was a penny stock, clinical-stage biotech at the time, NOT 3D Systems

Bought at $3.15

Sold 3-months later at $4.50

My feelings: Investing is SO EASY - who are these suckers that buy 'high priced' stocks like $KO?????

Stock #7 - $DDD again

Back to old reliable!

Bought at $4.83 (higher than my 1st sale price)

Bought again at $3.50 (what a bargain!)

Sold for $1.30 (biggest loss to date!)

(Eventually becomes unlisted)

My feelings: Investing sucks sometimes!

Back to old reliable!

Bought at $4.83 (higher than my 1st sale price)

Bought again at $3.50 (what a bargain!)

Sold for $1.30 (biggest loss to date!)

(Eventually becomes unlisted)

My feelings: Investing sucks sometimes!

My feelings: No more penny stocks for me - too risky!

I screen on Yahoo Finance for stocks based solely on trailing dividend yield. Nothing else! Bring on the HUGE dividends!

Stock #8 - $CIF

12% dividend -- how can I lose?

Bought $3.21

Sold $3.11

My feelings: Dividends!

I screen on Yahoo Finance for stocks based solely on trailing dividend yield. Nothing else! Bring on the HUGE dividends!

Stock #8 - $CIF

12% dividend -- how can I lose?

Bought $3.21

Sold $3.11

My feelings: Dividends!

Stock #9 - $IMH

22% dividend yield! I REALLY can't lose now!

Bought $17.05 (expensive!)

Sold $17.60 3-months later (luck)

(Current price $1.40)

My feelings: Dividends!!

22% dividend yield! I REALLY can't lose now!

Bought $17.05 (expensive!)

Sold $17.60 3-months later (luck)

(Current price $1.40)

My feelings: Dividends!!

Stock #10 - $PURE

Back to clinical-stage biopharma penny stock that's going to the moon!

Bought $1.90, $2.30, $2.40, $2.10

Sold $4.65 & $3.13 (success!)

My feelings: I'm getting better at 'investing'!

Back to clinical-stage biopharma penny stock that's going to the moon!

Bought $1.90, $2.30, $2.40, $2.10

Sold $4.65 & $3.13 (success!)

My feelings: I'm getting better at 'investing'!

Stock #11 - $CLM

What's it do? No clue!

20% dividend!

Bought at $9.15

Sold 1-month later at $8.20

My feelings: What aren't these dividend stocks working?

What's it do? No clue!

20% dividend!

Bought at $9.15

Sold 1-month later at $8.20

My feelings: What aren't these dividend stocks working?

The good news: I consumed EVERY piece of financial content that I can get my hands on at this time

Rich Dad Poor Dad

The Millionaire Next Door

The Motley Fool Investment Guide

etc, etc, etc

I discover Fool.com and start reading as many free articles as I could

Rich Dad Poor Dad

The Millionaire Next Door

The Motley Fool Investment Guide

etc, etc, etc

I discover Fool.com and start reading as many free articles as I could

Rick Munnariz becomes my favorite Fool.com writer (he's @Market)

He taught me that buying "good" companies is the way to go

I buy $EBAY, $GE, $BAC, $GOOG

I buy ETFs like $QQQ, $EEM

He taught me that buying "good" companies is the way to go

I buy $EBAY, $GE, $BAC, $GOOG

I buy ETFs like $QQQ, $EEM

Peter Schiff & Robert Kiyosaki convince me that inflation is going to make the dollar worthless

So I buy $GLD, $SLV, $SLW and foreign stocks

I still like dividends, so I buy $BP, $MO, $CVX, $PAYX

So I buy $GLD, $SLV, $SLW and foreign stocks

I still like dividends, so I buy $BP, $MO, $CVX, $PAYX

In 2008, I FINALLY become a paying member of Fool.com

I read EVERY back issue -- I CANNOT BELIEVE the quality of the research

I start posting on the boards

I see that companies like $NFLX, $AMZN, $ATVI have CRUSHED the market and are favorites of David & Tom

I read EVERY back issue -- I CANNOT BELIEVE the quality of the research

I start posting on the boards

I see that companies like $NFLX, $AMZN, $ATVI have CRUSHED the market and are favorites of David & Tom

I continue to read, read, read, read, read

I follow Fools like Tom Engle (TMF1000), Jim Gillies (TMFCanuck), and Jim Mueller (TMFTortise)

I can't believe how smart these other investors are -- how thorough they are with their research

I follow Fools like Tom Engle (TMF1000), Jim Gillies (TMFCanuck), and Jim Mueller (TMFTortise)

I can't believe how smart these other investors are -- how thorough they are with their research

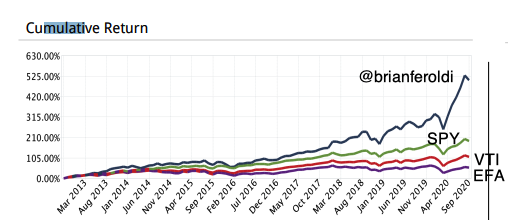

I start to buy more GOOD companies like $NFLX, $AMZN, $GOOG

I start to develop a LONG TERM mindset

I start to read @morganhousel and learn about market history and psychology.

I abandon my desire to own gold/silver/oil

I start to develop a LONG TERM mindset

I start to read @morganhousel and learn about market history and psychology.

I abandon my desire to own gold/silver/oil

It's OK to suck in the beginning

I sure did!

Get some skin in the game, make mistakes, and learn from them

Connect with other investors, and develop a system

Most of all, develop a LONG-TERM MINDSET

INVEST, don't trade

Let's all make money and get better, together!

I sure did!

Get some skin in the game, make mistakes, and learn from them

Connect with other investors, and develop a system

Most of all, develop a LONG-TERM MINDSET

INVEST, don't trade

Let's all make money and get better, together!

Side note:

buying $BAC and $GE in 2007 might not have been the best idea

buying $BAC and $GE in 2007 might not have been the best idea

• • •

Missing some Tweet in this thread? You can try to

force a refresh