I wrote about the exceptional opportunity in US NatGas about a week ago, and things are moving quickly...

Let’s do an update and go through some exciting developments. In short, the picture for NatGas continues to improve from all angles.

A thread.

Let’s do an update and go through some exciting developments. In short, the picture for NatGas continues to improve from all angles.

A thread.

https://twitter.com/bvddycorleone/status/1319388061520809985

1- Injection into storage last week was only 29 Bcf, an incredible number.

This injection was ~22% lower than consensus estimates for the week (37 Bcf), ~70% lower than the injection in the same week last year (89 Bcf), and ~57% lower than the 5yr average injection (67 Bcf).

This injection was ~22% lower than consensus estimates for the week (37 Bcf), ~70% lower than the injection in the same week last year (89 Bcf), and ~57% lower than the 5yr average injection (67 Bcf).

2- Not only that, but for the week in progress (report for which is out next Thursday), we’re anticipating a net withdrawal from storage.

That means we’re kicking off withdrawal season two weeks early this year. 🤠

hellenicshippingnews.com/us-working-nat…

That means we’re kicking off withdrawal season two weeks early this year. 🤠

hellenicshippingnews.com/us-working-nat…

3- LNG feedgas demand has also rebounded very nicely since the CV19 slump, now comping positive YoY.

Take a look at these excellent charts from @CelsiusEnergyFM:

Take a look at these excellent charts from @CelsiusEnergyFM:

https://twitter.com/celsiusenergyfm/status/1322141589242814469

5- In addition, with oil at $35 and looking like it may grind lower, we’re fast approaching shut-in economics again.

Now look. Winter’21 supply/demand is already looking quite promising for bulls. So if we turn off byproduct gas going into it...?

...Hoo boy.

Now look. Winter’21 supply/demand is already looking quite promising for bulls. So if we turn off byproduct gas going into it...?

...Hoo boy.

6- Also, given the reports from $XOM and $CVX this week, in which massive job cuts were announced along with significant impairment charges on shale assets, it doesn’t sound like the O&G industry is jumping for joy or gearing up to spend money on drilling new wells anytime soon.

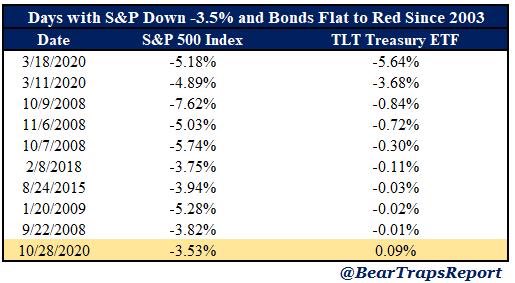

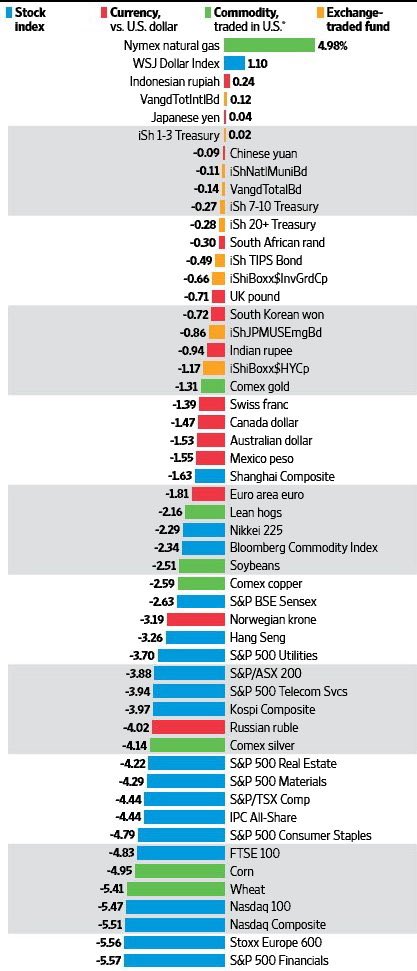

7- With all that, it should be no surprise that NatGas outperformed virtually every other asset this week (see charts).

Most notably, $NG outperformed $NDX by over 1000bps, and $AR outperformed by ~500bps.

If this marks the reversal, the party’s really just getting started...

Most notably, $NG outperformed $NDX by over 1000bps, and $AR outperformed by ~500bps.

If this marks the reversal, the party’s really just getting started...

8- And I can’t overstate just how over-extended the relative valuation of tech compared to energy is at this point in time.

It’s unprecedented, and it’s getting harder to ignore the signals that a reversal may already be underway.

Chart via @HFI_Research:

It’s unprecedented, and it’s getting harder to ignore the signals that a reversal may already be underway.

Chart via @HFI_Research:

https://twitter.com/hfi_research/status/1322248709799780352

9- Finally, as @contrarian8888 likes to remind us:

At the peak of Dot Com in Mar’00, tech was outperforming energy by 100%. By yr end, energy was outperforming tech by 100% (so a 200% swing in under a yr).

When things unwind this time, it could be just as violent, if not more..

At the peak of Dot Com in Mar’00, tech was outperforming energy by 100%. By yr end, energy was outperforming tech by 100% (so a 200% swing in under a yr).

When things unwind this time, it could be just as violent, if not more..

https://twitter.com/contrarian8888/status/1322878158773825538

10- Buckle up friends. All I can say is, this winter’s gonna be real fun...

HT @CelsiusEnergyFM @Grainjones @HFI_Research @contrarian8888 @hkuppy @pineconemacro @EthanHBellamy @WarrenPies @ericnuttall @trader_ferg @jam_croissant @coloradotravis.

Always appreciate thoughts/comments/criticisms.

Always appreciate thoughts/comments/criticisms.

• • •

Missing some Tweet in this thread? You can try to

force a refresh