This week was... interesting. The election turbulence that some were predicting finally materialized.

The most notable day of the week, IMO, was Wednesday: stocks sold off by more than 3.5%, while Treasuries offered no protection.

Risk Parity continues to teeter.

A thread.

The most notable day of the week, IMO, was Wednesday: stocks sold off by more than 3.5%, while Treasuries offered no protection.

Risk Parity continues to teeter.

A thread.

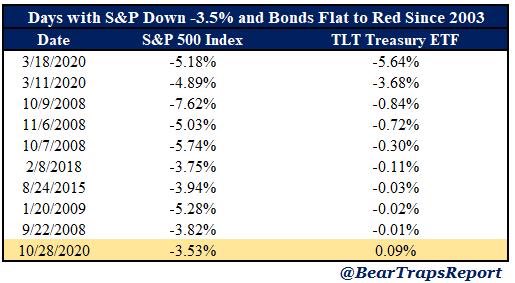

1- Wednesday was one of only 10 days since 2008 where stocks sold off 3.5% or more while Treasuries offered little to no relief.

Table via @Convertbond:

Table via @Convertbond:

2- Days like Wednesday pose a systemic threat to the financial world. And the frequency of such days appears to be on the rise:

2020 has already posted 3 days (Wednesday being the third) of heavy blows to the Risk Parity framework.

Risk Parity funds are NOT having fun.

2020 has already posted 3 days (Wednesday being the third) of heavy blows to the Risk Parity framework.

Risk Parity funds are NOT having fun.

3- Trillions of dollars in highly levered assets are linked to R-P.

The largest example is the neutron bomb that is Bridgewater’s “All Weather Fund”.

If stocks & bonds continue to drop simultaneously, the implosion of R-P funds would reverberate through the financial system.

The largest example is the neutron bomb that is Bridgewater’s “All Weather Fund”.

If stocks & bonds continue to drop simultaneously, the implosion of R-P funds would reverberate through the financial system.

4- And it doesn’t end with the funds. The traditional 60/40 is based on R-P and is pervasive in the investing world. Everyone and their mother is invested in some form of 60/40.

What happens if bonds no longer offer protection when stocks drop, and instead also drop themselves?

What happens if bonds no longer offer protection when stocks drop, and instead also drop themselves?

5- Well, it would have immense consequences on the psychology of investors, since capital destruction would be an order of magnitude greater on equity downturns.

If bonds begin to persistently fall alongside stocks, then downturns would sting investor portfolios a lot more...

If bonds begin to persistently fall alongside stocks, then downturns would sting investor portfolios a lot more...

6- Just picture the average 60/40 investor. If stocks fall 20%, his total portfolio might only fall, say, half of that thanks to the bonds.

Now, the average investor might be able to accept a 10% hit to his portfolio without doing something stupid, but 20%? Or more? Not so sure.

Now, the average investor might be able to accept a 10% hit to his portfolio without doing something stupid, but 20%? Or more? Not so sure.

7- As @pineconemacro told me,

“Bonds not only help limit drawdowns and help amplify long term compounding...they also limit dumb humans from selling bottoms.”

So a breakdown in R-P would accentuate behavioural issues that could lead to deeper equity drawdowns as they occur.

“Bonds not only help limit drawdowns and help amplify long term compounding...they also limit dumb humans from selling bottoms.”

So a breakdown in R-P would accentuate behavioural issues that could lead to deeper equity drawdowns as they occur.

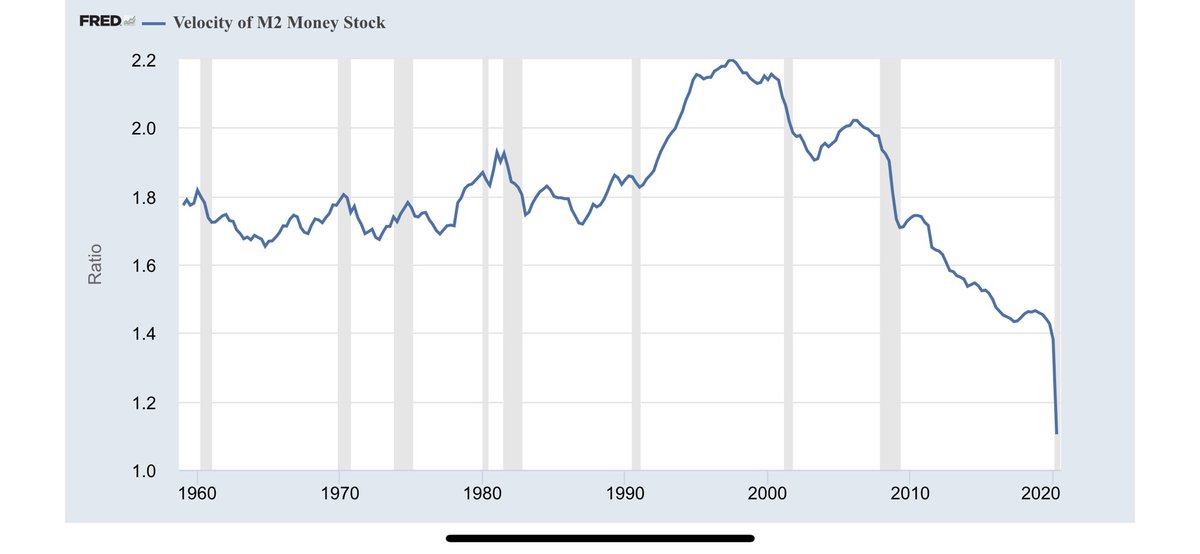

8- The catalyst for a breakdown in R-P is rising rates.

Rates will eventually break out and stabilize at a higher level. This is a question of IF not WHEN.

And, if the shift to greater fiscal will spur inflation, higher rates could come a lot sooner than many think...

Rates will eventually break out and stabilize at a higher level. This is a question of IF not WHEN.

And, if the shift to greater fiscal will spur inflation, higher rates could come a lot sooner than many think...

HT @Convertbond @pineconemacro @hkuppy @profplum99 @WayneHimelsein @bondstrategist @DiMartinoBooth @jam_croissant @capitalistexp @PeterSchiff @TheBubbleBubble.

As usual, I appreciate any thoughts or criticisms or feedback.

As usual, I appreciate any thoughts or criticisms or feedback.

• • •

Missing some Tweet in this thread? You can try to

force a refresh