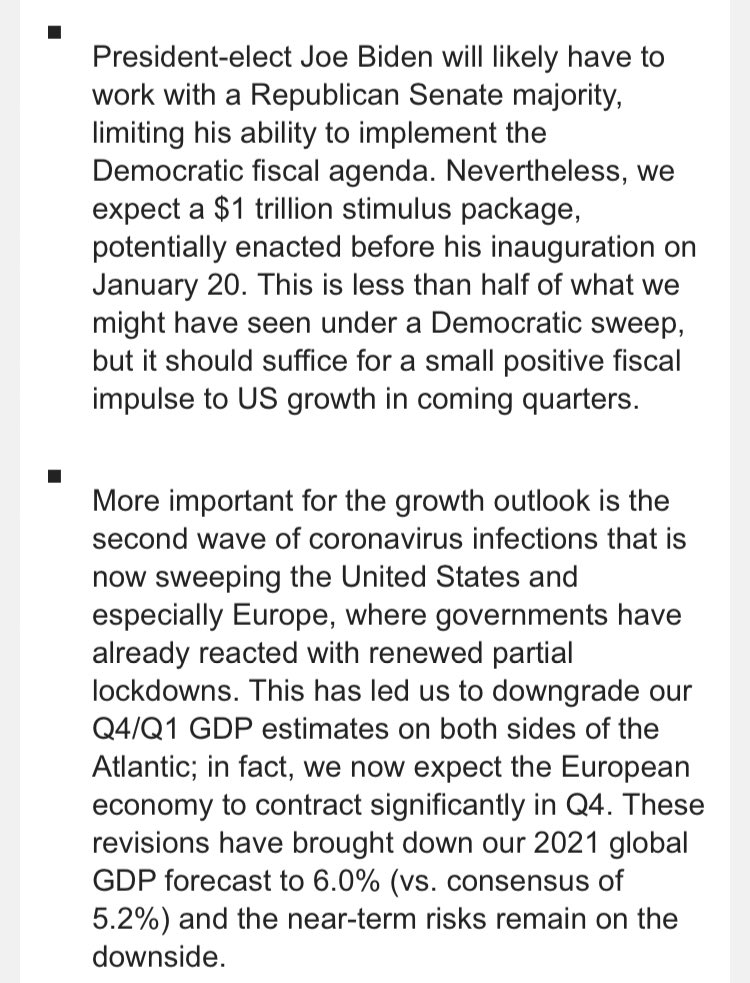

Since I know that what everyone *really* wants right now is the take of financial analysts, I’m going to share some of the first notes to hit my inbox. First up is Goldman Sachs, which thinks Biden will still get a $1tn stimulus package despite GOP-controlled Senate.

SEB also thinks a $1tn stimulus package is coming, but expects the biggest change to be on the international arena.

Regarding the point that the US economy still needs a fiscal jolt, here is a good chart from Apollo’s Torsten Sløk, showing how the jobs recovering is still incomplete and slowing.

Here is Invesco’s “Five forces that could propel markets during a Biden presidency”. blog.invesco.us.com/five-forces-th…

• • •

Missing some Tweet in this thread? You can try to

force a refresh