NEW: The Trump campaign is gearing up for a legal blitz to challenge the 2020 election results.

Some lawyers at firms representing the campaign worry about violating the rule of law and eroding democracy. with @jbsgreenberg @RachelAbramsNY

nytimes.com/2020/11/09/bus…

Some lawyers at firms representing the campaign worry about violating the rule of law and eroding democracy. with @jbsgreenberg @RachelAbramsNY

nytimes.com/2020/11/09/bus…

One of the firms, Jones Day, is among the country's biggest.

Partners there have been grumbling about the close relationship with the Trump admin, where many partners have taken senior roles (incl Don McGahn).

Jones Day has earned $20M working for Trump and GOP in recent years.

Partners there have been grumbling about the close relationship with the Trump admin, where many partners have taken senior roles (incl Don McGahn).

Jones Day has earned $20M working for Trump and GOP in recent years.

In the hour since this article was published, the Trump campaign has filed a new federal lawsuit in Pennsylvania alleging voter fraud.

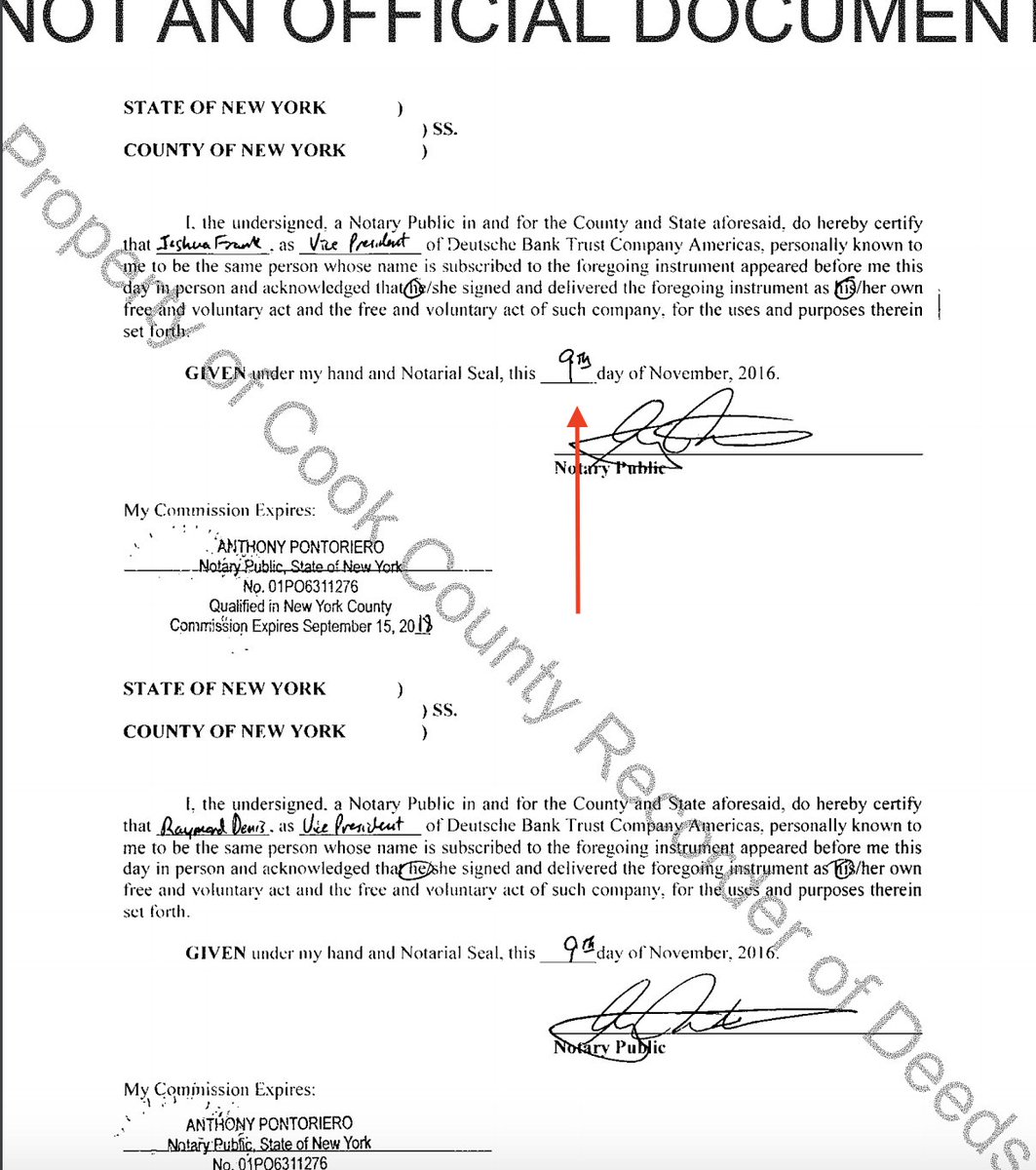

It was filed by Porter Wright, one of the firms where some lawyers are voicing ethical concerns about working for Trump. cdn.donaldjtrump.com/public-files/p…

It was filed by Porter Wright, one of the firms where some lawyers are voicing ethical concerns about working for Trump. cdn.donaldjtrump.com/public-files/p…

Also, silly me, I forgot to include the handles for the two law firms featured in this story for their work helping the Trump campaign challenge the election results. They are: @JonesDay and @PorterWright

• • •

Missing some Tweet in this thread? You can try to

force a refresh