The new @BerkeleyLab compilation of utility-scale #solar data and trends is out! A briefing slide deck, data file, maps, and data visualizations can all be found at utilityscalesolar.lbl.gov.

Here are some highlights → THREAD

Here are some highlights → THREAD

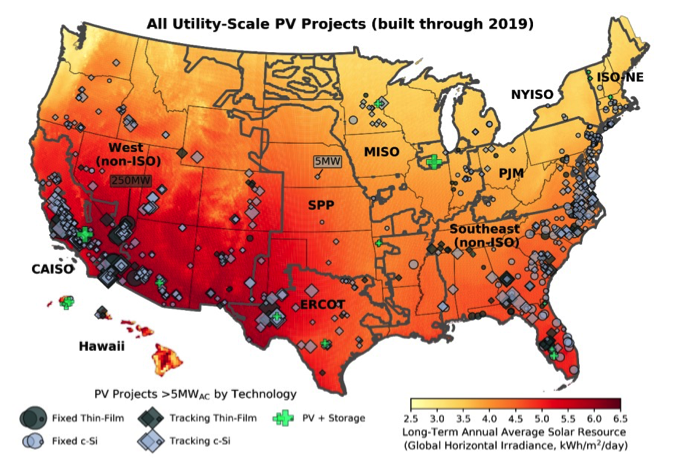

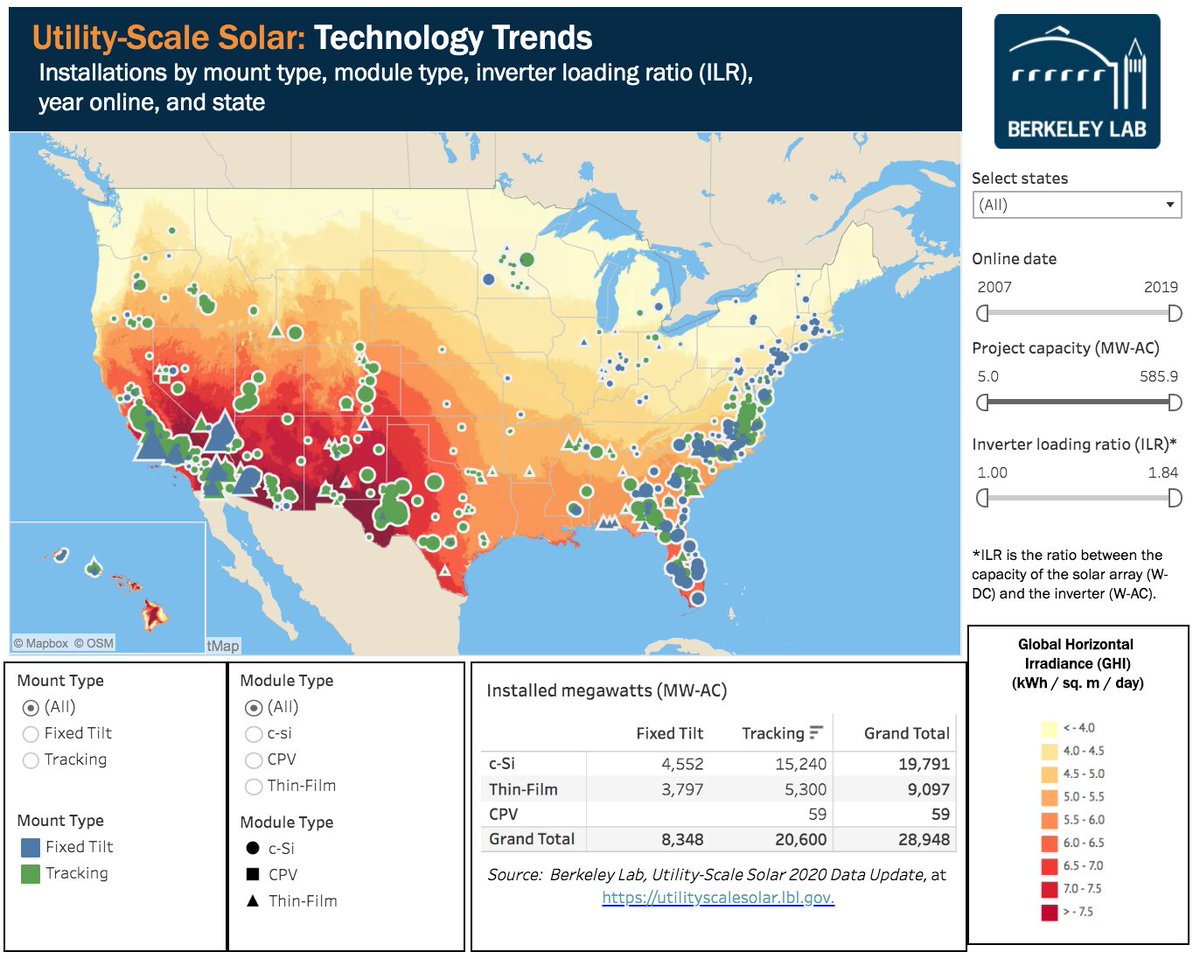

More than 4.5 GW of utility-scale (>5 MW) solar came online in 2019, bringing cumulative capacity to 29 GW. Projects are spread across all 10 regions that we track, though more heavily concentrated in the sunniest regions. Maps and data available at utilityscalesolar.lbl.gov. 2/x

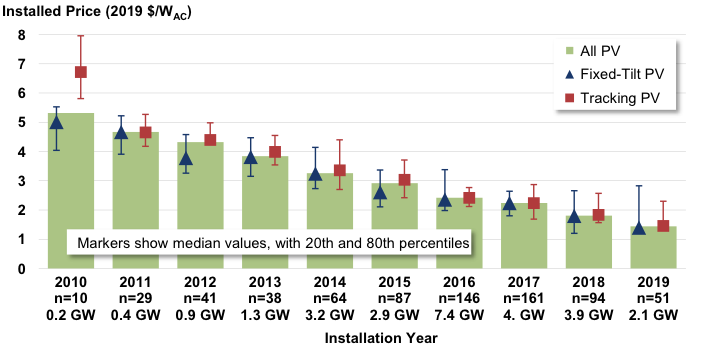

The median installed cost of new projects in 2019 fell to $1.4/W-AC, down 20% from 2018 and more than 70% from 2010. 77% of projects and 88% of capacity added in 2019 used single-axis tracking. More details in the new @BerkeleyLab data resource at utilityscalesolar.lbl.gov. 3/x

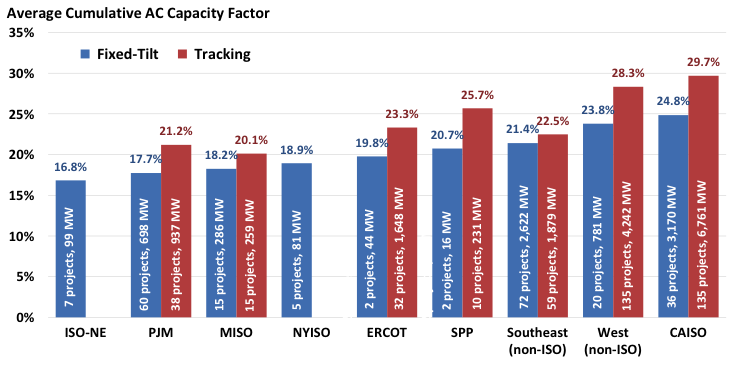

Average capacity factors range from 17% in the least-sunny regions to 30% in the sunniest. Single-axis tracking adds roughly 5% to capacity factor in the regions with the strongest solar resource. Details (with interactive data visualizations) are at utilityscalesolar.lbl.gov. 4/x

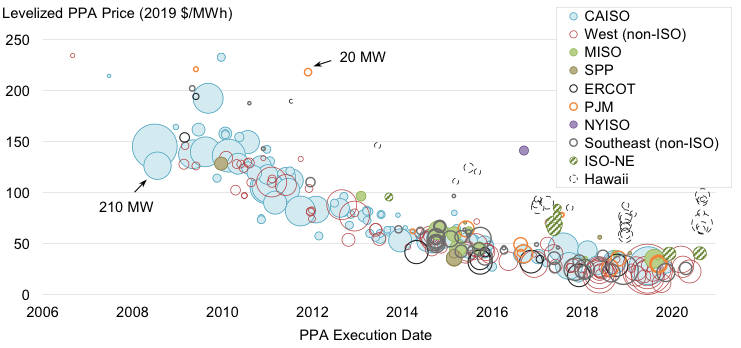

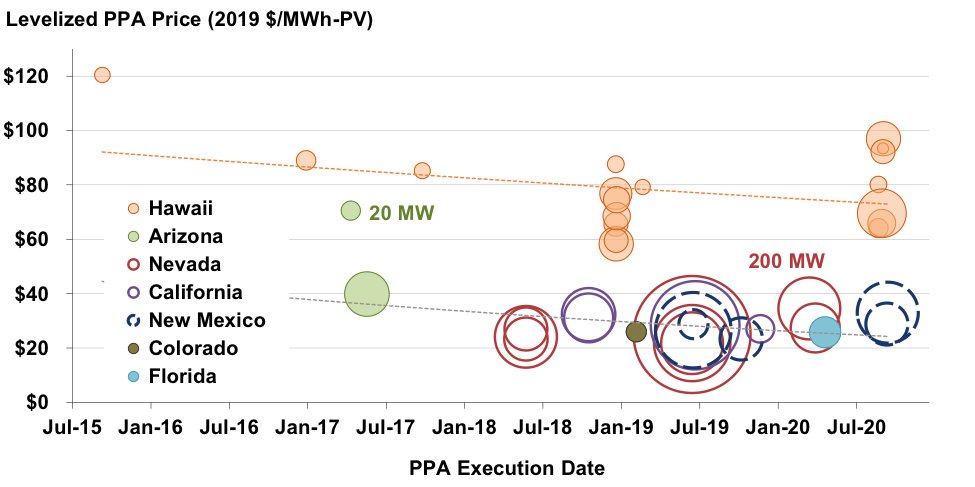

Nationwide average levelized power purchase agreement (PPA) prices fell to $24/MWh in 2019, down 17% from 2018 and more than 80% since 2010. Get all the deets at utilityscalesolar.lbl.gov. 5/x

39 projects (totaling 4.2 GW) in our PPA price sample have batteries, with 2.3 GW / 9.5 GWh of storage. 18 of these PV hybrid projects are in Hawaii. Several recent mainland hybrids have been priced in the mid-$20/MWh range. 6/x

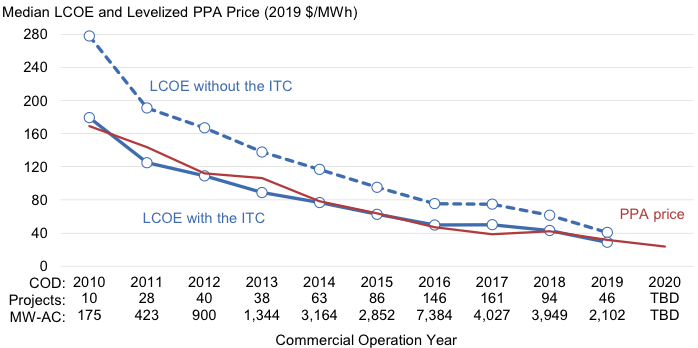

Not including the 30% tax credit (ITC), the median levelized cost of energy (LCOE) from utility-scale PV is down 85% since 2010, to $40/MWh in 2019. When the 30% ITC is included, the LCOE closely tracks PPA prices over time, suggesting an efficient, cost-based PPA market. 7/x

In higher-penetration markets like @California_ISO, the ‘market value’ of #solar has been declining, but falling PPA prices have largely kept pace, thereby preserving solar’s net value. See all the latest data and trends at utilityscalesolar.lbl.gov. 8/x

Interconnection queues suggest that utility-scale solar will continue to grow rapidly. Across all 7 ISOs + 30 utilities surveyed, there were ~370 GW of #solar in the queues at the end of 2019. Nearly a third is paired with battery #storage. More at utilityscalesolar.lbl.gov. 9/x

Interested in the latest utility-scale solar trends from the United States? We have a briefing slide deck and data file, and a plethora of data visualizations. Play around with the data yourself at emp.lbl.gov/data /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh