THREAD:

How Early Are We?

As a starting point, here is the analysis I put forward previously on this topic:

How Early Are We?

As a starting point, here is the analysis I put forward previously on this topic:

https://twitter.com/Croesus_BTC/status/1271165671171227648?s=20

However, as @johnkvallis pointed out to me, there are different levels of #Bitcoin adoption, and each level is at a different point in the adoption curve.

When we clearly segment these levels of Bitcoin adoption, it helps illuminate just how early it still is for Bitcoin.

When we clearly segment these levels of Bitcoin adoption, it helps illuminate just how early it still is for Bitcoin.

For our purposes, let's segment Bitcoin adopters into four buckets:

1. Casual Dabblers (toe dippers)

2. 1% Allocators (ankle deep)

3. Significant Believers (waist high)

4. Bitcoin Maximalists (gone snorkeling)

1. Casual Dabblers (toe dippers)

2. 1% Allocators (ankle deep)

3. Significant Believers (waist high)

4. Bitcoin Maximalists (gone snorkeling)

Before we begin, we need a denominator. We could use global population, but imo this skews results. What we're really assessing is what % of the world with some wealth to store in Bitcoin has done so.

For this, I will say our TAM is 2.2B people.

For this, I will say our TAM is 2.2B people.

https://twitter.com/Croesus_BTC/status/1271165667043971072?s=20

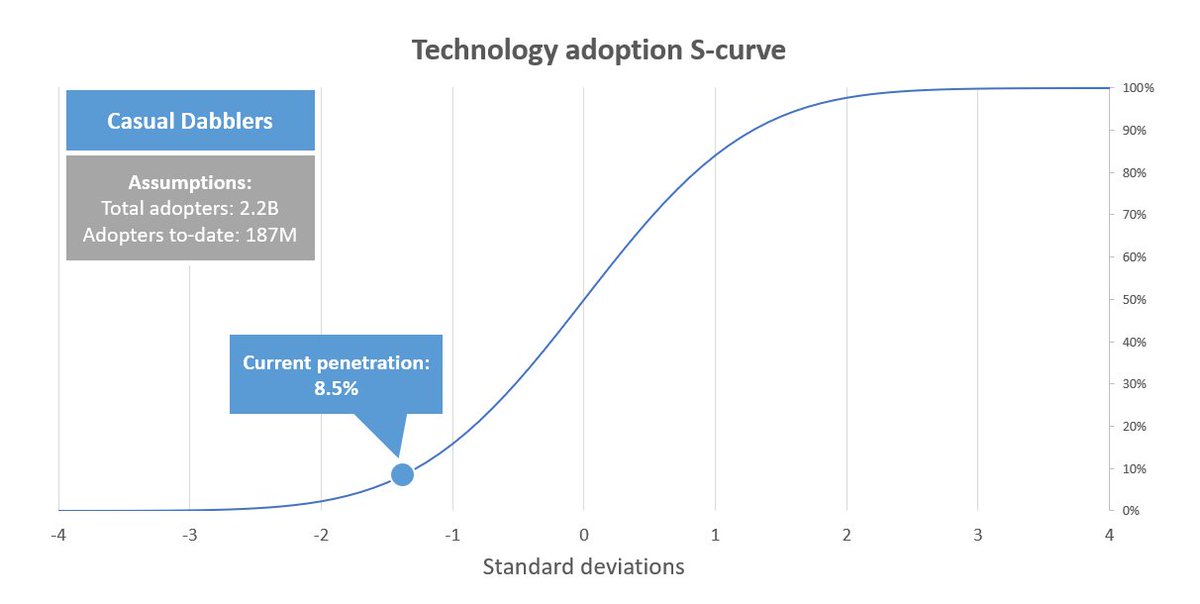

1. Casual dabblers

This includes everyone who has any amount of Bitcoin - your friend with $20 of BTC on a wallet somewhere, or your aunt who can't remember her Coinbase password from 2017.

@woonomic came up with ~187M for this group:

This includes everyone who has any amount of Bitcoin - your friend with $20 of BTC on a wallet somewhere, or your aunt who can't remember her Coinbase password from 2017.

@woonomic came up with ~187M for this group:

https://twitter.com/woonomic/status/1319256970226847745?s=20

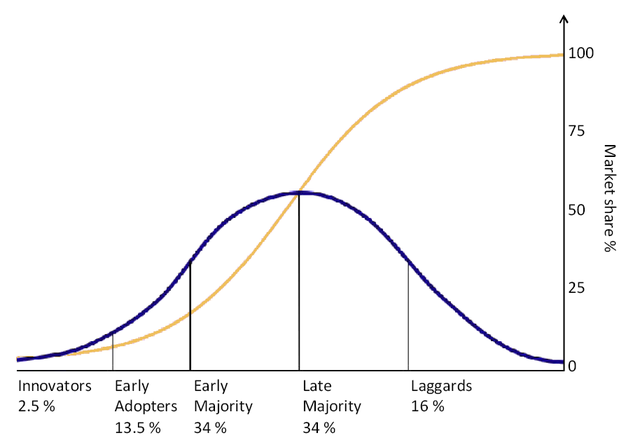

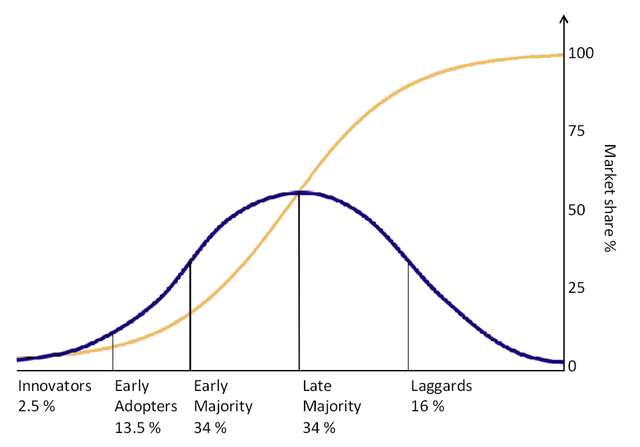

For this level of Bitcoin adoption, that puts us here on the adoption curve:

(also note: from this point, each category is a subset of the previous category - like opening nesting dolls)

(also note: from this point, each category is a subset of the previous category - like opening nesting dolls)

For the remaining subcategories, accurate data is less available. As such, all we can do is ballpark figures via triangulation.

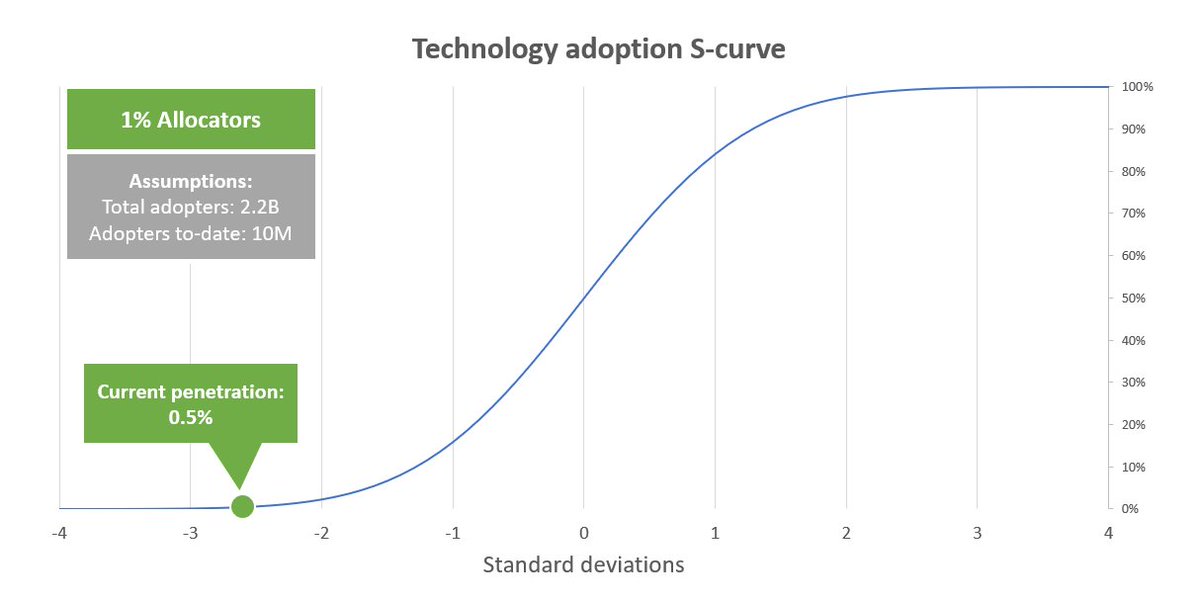

2. 1% Allocators

This is the type of adoption I focused on for my previous analysis, which we can reuse:

2. 1% Allocators

This is the type of adoption I focused on for my previous analysis, which we can reuse:

https://twitter.com/Croesus_BTC/status/1271165668423954432?s=20

This category includes Paul Tudor Jones, your uncle with a meaningful GBTC position, and anyone who has come to view Bitcoin as a diversified portfolio inclusion.

The previous estimate of 10M people in this group means this level of Bitcoin adoption has reached 0.5% penetration

The previous estimate of 10M people in this group means this level of Bitcoin adoption has reached 0.5% penetration

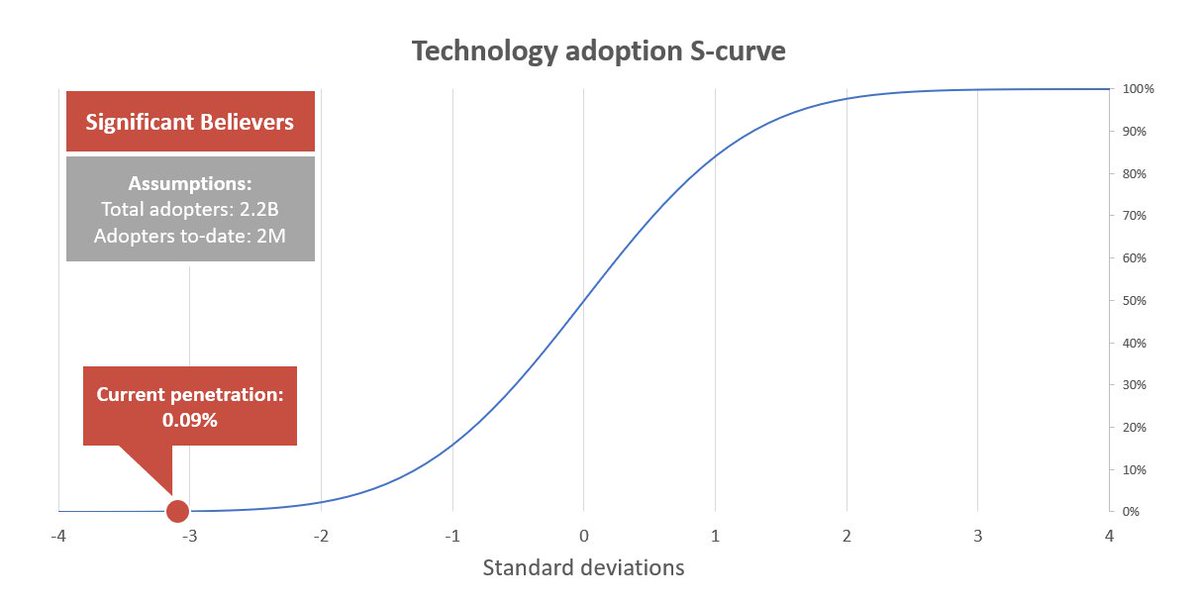

3. Significant Believers

This category includes anyone who has reached a level of understanding of Bitcoin that a 1% or even 5% allocation no longer seems sufficient. Broadly speaking, this group is in the 5-50% allocation range.

Raoul Pal and much of Bitcoin Twitter are here

This category includes anyone who has reached a level of understanding of Bitcoin that a 1% or even 5% allocation no longer seems sufficient. Broadly speaking, this group is in the 5-50% allocation range.

Raoul Pal and much of Bitcoin Twitter are here

This gets much fuzzier, but we can rely on on-chain data. If you have reached this level of understanding of Bitcoin, you probably have clawed your way to at least 1 Bitcoin & have set up your own wallet.

~820k wallets have at least 1 Bitcoin. bitinfocharts.com/top-100-riches…

~820k wallets have at least 1 Bitcoin. bitinfocharts.com/top-100-riches…

Let's say 500k of these are owned by Significant Believers.

Accounting for people below the wholecoiner threshold as well as exchange holders (come on, guys), 2M seems a reasonable, conservative estimate.

Accounting for people below the wholecoiner threshold as well as exchange holders (come on, guys), 2M seems a reasonable, conservative estimate.

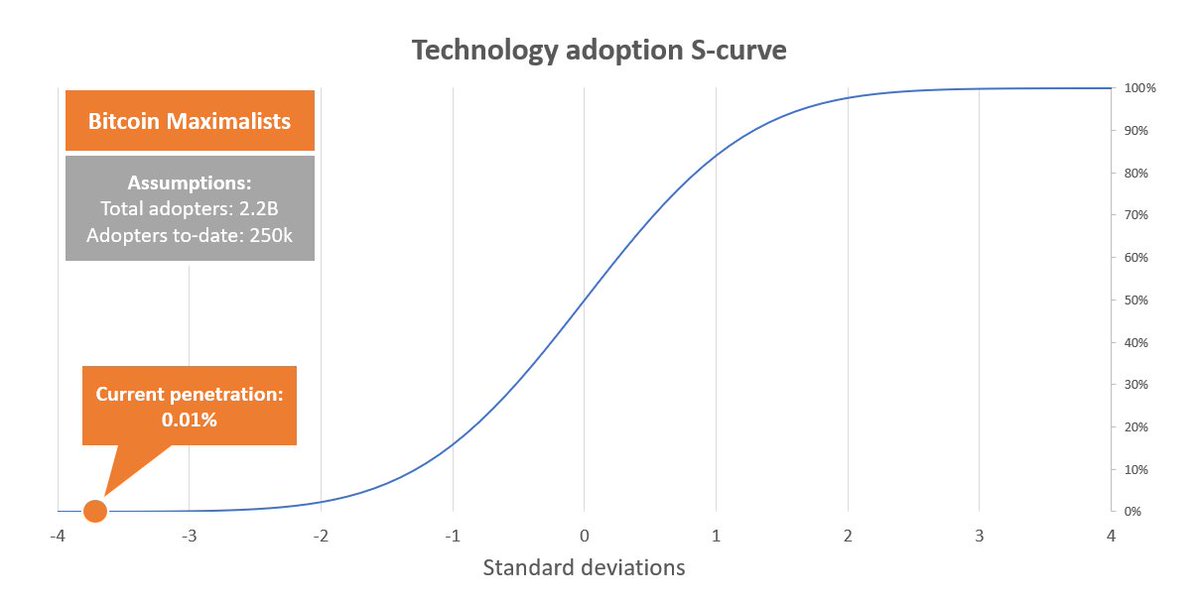

4. Bitcoin Maximalists

For our purposes, let's say this group includes anyone who has dug deep enough into Bitcoin to conclude that more than 50% of their net worth should be stored in Bitcoin.

Gauging the size of this group is nearly impossible, so we'll get creative.

For our purposes, let's say this group includes anyone who has dug deep enough into Bitcoin to conclude that more than 50% of their net worth should be stored in Bitcoin.

Gauging the size of this group is nearly impossible, so we'll get creative.

a. The Bitcoin Standard sales

Let's conservatively estimate that only 20% of maximalists have purchased The Bitcoin Standard, and 50% of people who read it became maximalists. Based on the book's Amazon US rank (6,681), online calculators estimate ~15k copies have been sold.

Let's conservatively estimate that only 20% of maximalists have purchased The Bitcoin Standard, and 50% of people who read it became maximalists. Based on the book's Amazon US rank (6,681), online calculators estimate ~15k copies have been sold.

Let's generously round that ~15k number up to 50k to account for international sales and non-Amazon purchases.

This nets an estimate of 125k maximalists. To be conservative, let's double that and call it 250k.

This nets an estimate of 125k maximalists. To be conservative, let's double that and call it 250k.

b. Qualitative triangulation

Purely subjective, but it seems to me that there are maybe 10k actively engaged Bitcoin maximalists on Twitter, the primary home of maximalist communication. To be very conservative, let's say this represents ~5% of maximalists (200k total).

Purely subjective, but it seems to me that there are maybe 10k actively engaged Bitcoin maximalists on Twitter, the primary home of maximalist communication. To be very conservative, let's say this represents ~5% of maximalists (200k total).

Additionally, as a top-down assessment, it seems reasonable that ~10% of people who have reached 5-50% Bitcoin allocation have made the leap to maximalism.

All in all, ~250k Bitcoin maximalists seems a conservative, if not generous assumption.

That puts us at 0.01% penetration

All in all, ~250k Bitcoin maximalists seems a conservative, if not generous assumption.

That puts us at 0.01% penetration

What this means:

If Bitcoin is on an inevitable trajectory to become the world's preferred money / savings technology and you have already concluded this and acted accordingly... you are in the first 0.01% to do so.

Line up 10,000 people - only 1 Bitcoin maximalist.

If Bitcoin is on an inevitable trajectory to become the world's preferred money / savings technology and you have already concluded this and acted accordingly... you are in the first 0.01% to do so.

Line up 10,000 people - only 1 Bitcoin maximalist.

Put another way, only the Casual Dabbler group has reached "Early Adopter". Every other level of Bitcoin adoption is still in the *first 20%* of the "Innovator" stage.

When your friends and family say they're too late to Bitcoin, you can tell them definitively: "no, you absolutely are not."

Despite how late they may feel, even just a $2k allocation to Bitcoin puts them ahead of 99.5% of Bitcoin's TAM of 2.2B people.

It is so, so early.

Despite how late they may feel, even just a $2k allocation to Bitcoin puts them ahead of 99.5% of Bitcoin's TAM of 2.2B people.

It is so, so early.

Note: I hope it's clear that all of the above is a very loose effort to quantify that which is more or less impossible to accurately quantify. If you take issue with any of my numbers, I'm completely open to alternatives - but only if you cite your sources and show your method.

@HODLAMERICAN615

@coryklippsten

@BVBTC

@CitizenBitcoin

@SwanBitcoin

@LynAldenContact

@100trillionUSD

@princey1976

@johnkvallis

@AnselLindner

@_joerodgers

@edstromandrew

@phil_geiger

@PositiveCrypto

@skwp

@maxkeiser

@sthenc

@coryklippsten

@BVBTC

@CitizenBitcoin

@SwanBitcoin

@LynAldenContact

@100trillionUSD

@princey1976

@johnkvallis

@AnselLindner

@_joerodgers

@edstromandrew

@phil_geiger

@PositiveCrypto

@skwp

@maxkeiser

@sthenc

@TuurDemeester

@real_vijay

@vijay_follower_

@saifedean

@Breedlove22

@parkeralewis

@michael_saylor

@PrestonPysh

@JeffBooth

@woonomic

@APompliano

@nic__carter

@MartyBent

@matt_odell

@stephanlivera

@real_vijay

@vijay_follower_

@saifedean

@Breedlove22

@parkeralewis

@michael_saylor

@PrestonPysh

@JeffBooth

@woonomic

@APompliano

@nic__carter

@MartyBent

@matt_odell

@stephanlivera

@pierre_rochard

@NickSzabo4

@parabolictrav

@adam3us

@novogratz

@michael_saylor

@bitstein

@MarkYusko

@Travis_Kling

@hansthered

@TheCryptoconomy

@JackMallers

@Excellion

@NickSzabo4

@parabolictrav

@adam3us

@novogratz

@michael_saylor

@bitstein

@MarkYusko

@Travis_Kling

@hansthered

@TheCryptoconomy

@JackMallers

@Excellion

• • •

Missing some Tweet in this thread? You can try to

force a refresh