$FTCH !!!!!!!!!!!!!!!!!!!!!!!!!!!!!

* Revenue: 438M vs $367M (up 71% YoY)

* Revenue: 438M vs $367M (up 71% YoY)

2/n thread

$FTCH

Announced global partnership with Alibaba and Richemont to accelerate the digitization of luxury industry; strategic partners to invest total $1.15 billion in Farfetch Limited and new Farfetch China joint venture.

$FTCH

Announced global partnership with Alibaba and Richemont to accelerate the digitization of luxury industry; strategic partners to invest total $1.15 billion in Farfetch Limited and new Farfetch China joint venture.

3/n thread

$FTCH Huge. Numbers.

* Adj. EPS $(0.17) Beats $(0.40) Estimate

* Sales $437.70M Beat $367.12M Estimate

$FTCH Huge. Numbers.

* Adj. EPS $(0.17) Beats $(0.40) Estimate

* Sales $437.70M Beat $367.12M Estimate

4/n thread

$FTCH

* Guides to Positive Adjusted EBITDA vs -$0.27 estimates

$FTCH

* Guides to Positive Adjusted EBITDA vs -$0.27 estimates

5/n thread

$FTCH

This is a $70 stock, IMHO.

$FTCH

This is a $70 stock, IMHO.

6/n thread

$FTCH

Slowdown?... 😂

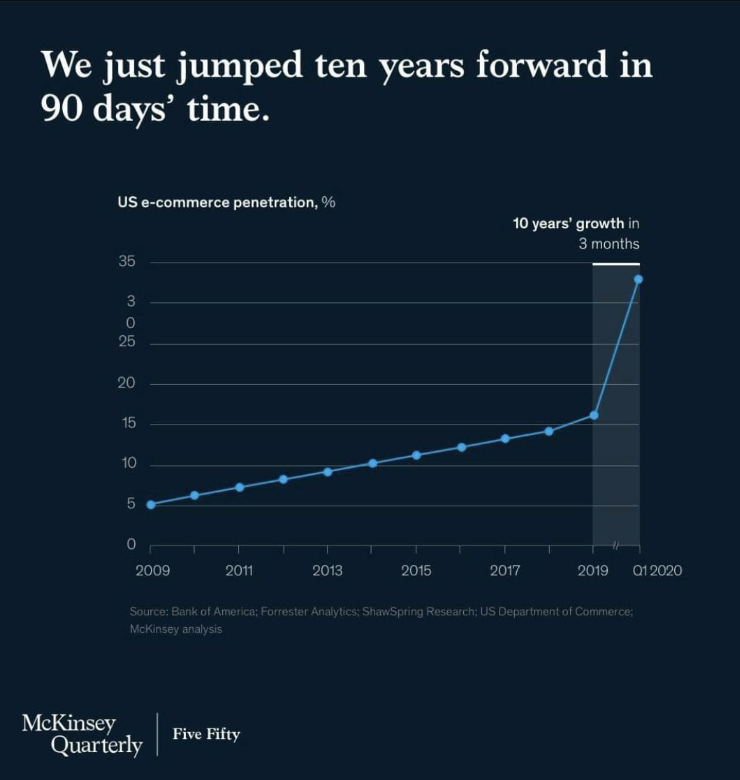

The company accelerated GMV growth to 60% in third quarter 2020 driven by acceleration across all three geographic regions – the Americas, EMEA and APAC, including each of its top 5 countries, which grew faster than during second quarter 2020.

$FTCH

Slowdown?... 😂

The company accelerated GMV growth to 60% in third quarter 2020 driven by acceleration across all three geographic regions – the Americas, EMEA and APAC, including each of its top 5 countries, which grew faster than during second quarter 2020.

• • •

Missing some Tweet in this thread? You can try to

force a refresh