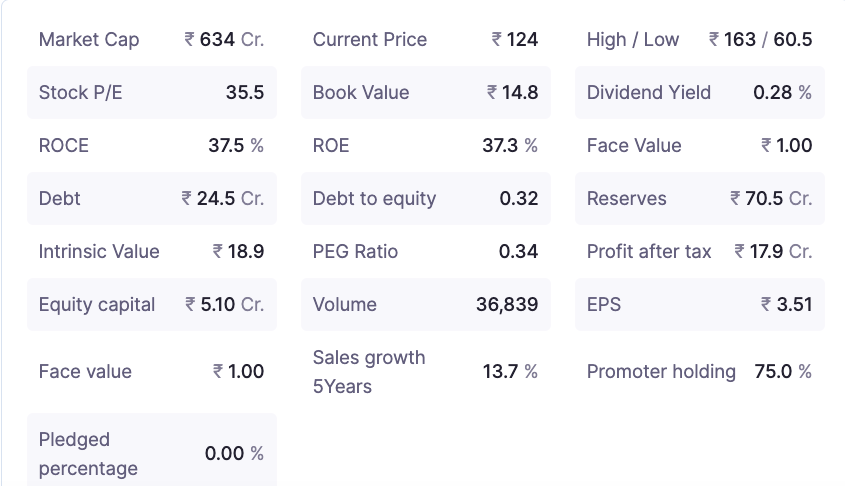

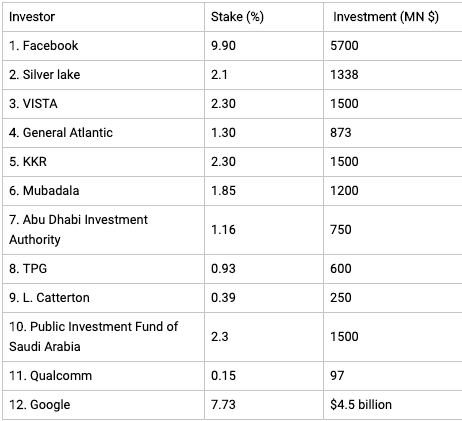

Detail analysis on 'mere' 635 Crore market cap stock 👉

"Black Rose Industries Ltd"

CMP: Rs 125

(definitely not a recommendation to buy)

Thread 👇

"Black Rose Industries Ltd"

CMP: Rs 125

(definitely not a recommendation to buy)

Thread 👇

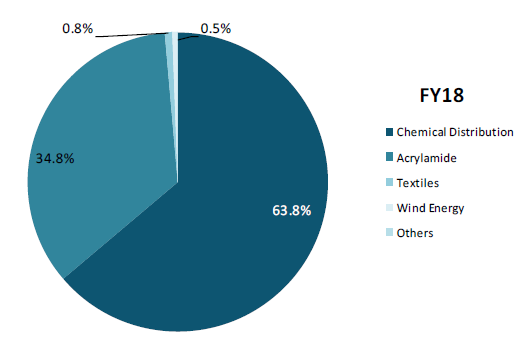

2. Asia Fab Limited now known as Black Rose Industries was incorporated in 1990 with the following businesses:

A. Chemicals

~ Chemical Distribution - Speciality Chemical & Performance Chemical

~ Chemical Manufacturing

B. Textile &

C. Renewable Energy

A. Chemicals

~ Chemical Distribution - Speciality Chemical & Performance Chemical

~ Chemical Manufacturing

B. Textile &

C. Renewable Energy

3. Management

Exe Director: Anup Jatia (Chemical Engg. & Economics)

Responsible for overall ops, manages relationships with principals and clients. Brought up in Japan & is fluent in the language...

Japan connection we will discuss in detail later.

blackrosechemicals.com/team

Exe Director: Anup Jatia (Chemical Engg. & Economics)

Responsible for overall ops, manages relationships with principals and clients. Brought up in Japan & is fluent in the language...

Japan connection we will discuss in detail later.

blackrosechemicals.com/team

4. Thread Focus on Chemical Business

The company produce & supply acrylamide solution under the brand name BRILMIDE ®

Recently they have entered in the niche space of manufacturing of Polyacrylamide (commercialized in Jan 2020) & expanded its manufacturing in Acrylamide Soln

The company produce & supply acrylamide solution under the brand name BRILMIDE ®

Recently they have entered in the niche space of manufacturing of Polyacrylamide (commercialized in Jan 2020) & expanded its manufacturing in Acrylamide Soln

5. Their business progression was:

Chemical Distribution

🔽

Acrylamide Soln Manufacturing

🔽

Polyacrylamide Soln Manufacturing

They have Foreign Technology License Agreement with Mitsui Chemicals of Japan for manufacture of acrylamide monomer in India.

Chemical Distribution

🔽

Acrylamide Soln Manufacturing

🔽

Polyacrylamide Soln Manufacturing

They have Foreign Technology License Agreement with Mitsui Chemicals of Japan for manufacture of acrylamide monomer in India.

6. Acrylamide division operates India’s first & only acrylamide manufacturing plant.

y Acrylamide?

Domestic Demand:

7K MT (100% Solid Basis)

14K MT (50% Soln)

Mitsui Tech is highly efficient & provides high purity acrylamide, an environmentally friendly zero discharge process.

y Acrylamide?

Domestic Demand:

7K MT (100% Solid Basis)

14K MT (50% Soln)

Mitsui Tech is highly efficient & provides high purity acrylamide, an environmentally friendly zero discharge process.

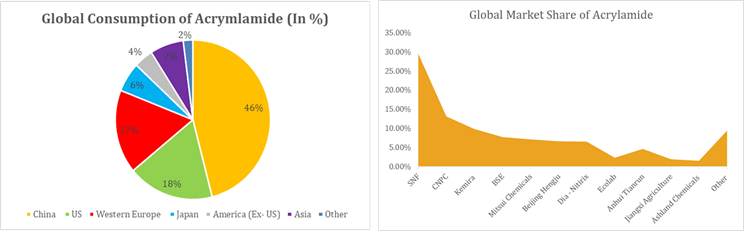

7. Global Consumption of Acrylamide:

Source: chemarc.com

Recent expansion of capacity from 10,000MT to 14,000MT in order to meet both domestic and export market demand.

From below distribution chart we get to know China, US & Western Europe r major consumers.

Source: chemarc.com

Recent expansion of capacity from 10,000MT to 14,000MT in order to meet both domestic and export market demand.

From below distribution chart we get to know China, US & Western Europe r major consumers.

8. Forgot to mention what are the application of "Acrylamide"

Acrylamide is used in:

1. Waste Water Treatment

2. Shale gas extraction

3. Shale Strengthening

4. Waterproofing Chemicals

5. Coating & Paint Emulsions

6. Sugar Manufacturing

7. Cosmetics &

8. EOR

Acrylamide is used in:

1. Waste Water Treatment

2. Shale gas extraction

3. Shale Strengthening

4. Waterproofing Chemicals

5. Coating & Paint Emulsions

6. Sugar Manufacturing

7. Cosmetics &

8. EOR

9. PolyAcrylamide is used in:

1. EOR - Enhanced Oil Recovery

2. Textiles

3. Paper

4. Textiles

5. Ceramic Tiles

6. Base Metal Linings

Market Size (Global): $4.5 B @ 6% growth rate.

Didi not find market size for Acrylamide.. ..

1. EOR - Enhanced Oil Recovery

2. Textiles

3. Paper

4. Textiles

5. Ceramic Tiles

6. Base Metal Linings

Market Size (Global): $4.5 B @ 6% growth rate.

Didi not find market size for Acrylamide.. ..

10. Distribution Business:

Black Rose distributes more than 40 specialty chemicals of which Resorcinol (consume Tyre Industry) is the major contributor.

Black Rose distributes more than 40 specialty chemicals of which Resorcinol (consume Tyre Industry) is the major contributor.

11. Potential, Competition & Risk:

Potential: The demand in India is expected to grow at 20%.

At this rate the demand can be expected at around 42,000-tons on 50% basis and 21,000-tons on 100% basis.

Current CAPEX should yield in 2021..

Potential: The demand in India is expected to grow at 20%.

At this rate the demand can be expected at around 42,000-tons on 50% basis and 21,000-tons on 100% basis.

Current CAPEX should yield in 2021..

12. Competition & Risk: SNF Flopam entry in India or Domestic players entry in future may affect margins..

snf-india.com in India has bought up with the expansion plans of more than 5X of BRIL 😢

snf-india.com in India has bought up with the expansion plans of more than 5X of BRIL 😢

14. Products:

1. Speciality Chemicals

2. Performance Chemicals

3. Water & Wastewater Treatment

4. Exports

5. Dental

6. Acrylamide

7. Ceramic Binder

1. Speciality Chemicals

2. Performance Chemicals

3. Water & Wastewater Treatment

4. Exports

5. Dental

6. Acrylamide

7. Ceramic Binder

16. a stock with v low Market Cap does attract 'Retailers'. I see hardly any holdings by FIIs & DIIs, others holding is 19.6% not sure if they are retail investors 🙂.

Latest Capex should enhance revenue from 2021 & stock should climb-up.

Do your *through* research before u buy

Latest Capex should enhance revenue from 2021 & stock should climb-up.

Do your *through* research before u buy

17. Source of Info:

thetycoonmindset.com/finance/black-…

forum.valuepickr.com/t/black-rose-i…

screener.in/company/514183…

blackrosechemicals.com/home

brildent.in

chemarc.com

moneycontrol.com/india/stockpri…

Happy Investing

End

thetycoonmindset.com/finance/black-…

forum.valuepickr.com/t/black-rose-i…

screener.in/company/514183…

blackrosechemicals.com/home

brildent.in

chemarc.com

moneycontrol.com/india/stockpri…

Happy Investing

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh