“The Fed could have done more and probably should have done more” - Chair Powell

Time for a #FedThread on Diversity @federalreserve

- Yellen on why diversity matters

- Bostic’s suggestions

- The first Black Director

- My new database

- Charts 🎉

- More resources

[1/34]

Time for a #FedThread on Diversity @federalreserve

- Yellen on why diversity matters

- Bostic’s suggestions

- The first Black Director

- My new database

- Charts 🎉

- More resources

[1/34]

So so much could be said about why diversity matters.

But for starters let’s turn to 4 points Janet Yellen, first woman Fed Chair (maybe first woman Treas. Sec.) made at a @BrookingsInst conference:

1) “Basic fairness” - first for a reason, and honestly should be enough

[2/34]

But for starters let’s turn to 4 points Janet Yellen, first woman Fed Chair (maybe first woman Treas. Sec.) made at a @BrookingsInst conference:

1) “Basic fairness” - first for a reason, and honestly should be enough

[2/34]

2) “Lack of diversity harms the field because it wastes talent”

3) “Diversity insures that research done within economics appropriately reflects society’s priorities”

[3/34]

3) “Diversity insures that research done within economics appropriately reflects society’s priorities”

[3/34]

4) “Diverse groups outperform in solving complex problems and ethnic diversity appears to promote deliberation and disrupt conformity”

More great stuff in Yellen’s speech here, as well as the conference she was introducing: brookings.edu/research/forme…

[4/34]

More great stuff in Yellen’s speech here, as well as the conference she was introducing: brookings.edu/research/forme…

[4/34]

Just like there’s so much that could be said about WHY diversity matters, there’s tons of suggestions for HOW the @federalreserve could improve.

Here are 3 suggestions from @RaphaelBostic, first (and only to-date) Black Fed Reserve Bank President (@AtlantaFed):

[5/34]

Here are 3 suggestions from @RaphaelBostic, first (and only to-date) Black Fed Reserve Bank President (@AtlantaFed):

[5/34]

1) Work on “a more muscular outreach program” to see how communities are actually doing

2) Use the “convening power” of the Fed to steer attention to topics like racial inequality

[6/34]

2) Use the “convening power” of the Fed to steer attention to topics like racial inequality

[6/34]

3) Hold to the new policy framework, minorities are often last to benefit from tightening labor markets

For more on @RaphaelBostic check out this great article from @rachsieg: washingtonpost.com/business/2020/…

Here’s the speech where these came from: frbatlanta.org/news/speeches/…

[7/34]

For more on @RaphaelBostic check out this great article from @rachsieg: washingtonpost.com/business/2020/…

Here’s the speech where these came from: frbatlanta.org/news/speeches/…

[7/34]

The structure of our central bank here in the US is a messy one. It combines aspects of a political agency, a technocrat-run economic engine, and even traditional forprofit corporations.

[8/34]

[8/34]

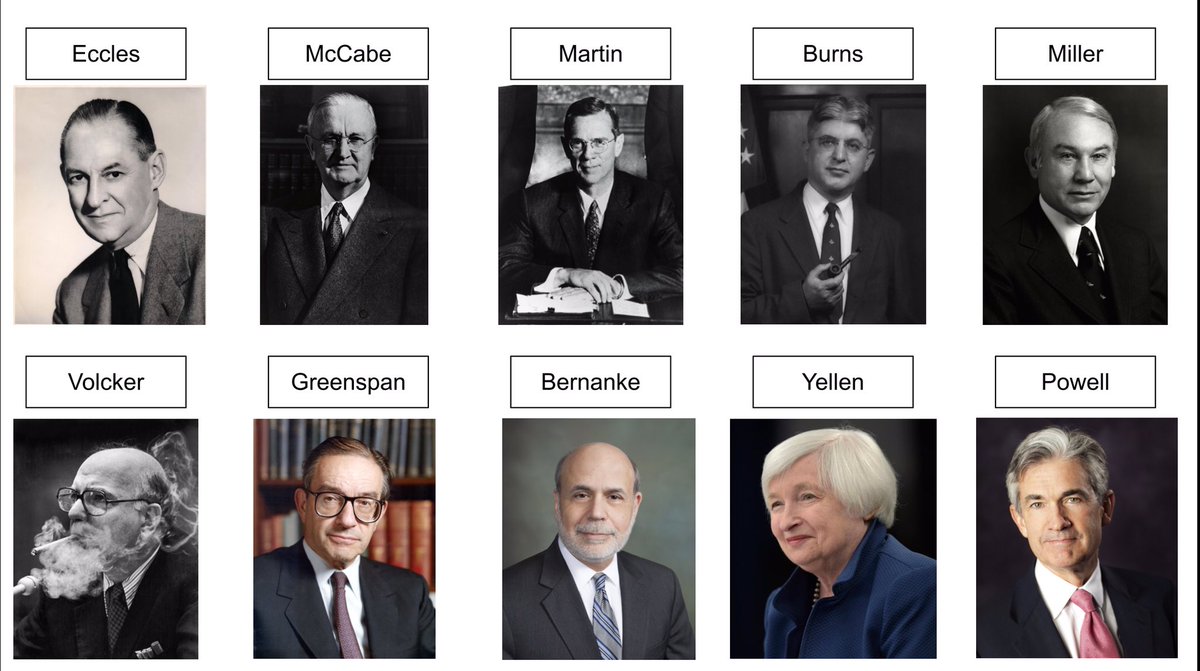

Power at the Fed is both:

Concentrated - most prominently in the hands of the person sitting in the Chair’s seat

Dispersed - sometimes literally like the Reserve Bank Presidents who physically live outside of DC.

[9/34]

Concentrated - most prominently in the hands of the person sitting in the Chair’s seat

Dispersed - sometimes literally like the Reserve Bank Presidents who physically live outside of DC.

[9/34]

A group at the Fed whose power is rarely appropriately described is that of the Reserve Bank Boards of Directors.

Each of the twelve Reserve Banks have 9 directors (pics for those interested in details)

[10/34]

Each of the twelve Reserve Banks have 9 directors (pics for those interested in details)

[10/34]

The Reserve Bank Directors have a lot less power than the Directors of a traditional corporation. Most importantly, they don’t get to tell the Reserve Bank President how to vote on monetary policy decisions or how to write the rules about regulating banks.

[11/34]

[11/34]

However, they do have the hugely influential job of selecting the Reserve Bank Presidents.

In the 106-year history of the Fed, there have been 1,955 people elected/appointed to 2,607 positions (same person can be elected/appointed to different positions on the Board).

[12/34]

In the 106-year history of the Fed, there have been 1,955 people elected/appointed to 2,607 positions (same person can be elected/appointed to different positions on the Board).

[12/34]

I spent literally hundreds of hours scouring annual reports, newspapers, census records and genealogical websites building a biographical database of each of the Directors (thanks for your help, mom!)

I have a white/not-white race-indicator for 97.4% of directors.

[13/34]

I have a white/not-white race-indicator for 97.4% of directors.

[13/34]

The backbone of the database is the Fed annual reports. They list all directors for each of the districts. A few directors started and ended their time between annual reports, so they aren’t in my database. One such director not in the database was first Black director.

[14/34]

[14/34]

In late 1970 the first Black director was appointed to the @NewYorkFed

His name was Whitney M. Young, Jr

He helped organize the March on Washington, advised three US Presidents, and served as Executive Director of the National Urban League.

cau.edu/school-of-soci…

[15/34]

His name was Whitney M. Young, Jr

He helped organize the March on Washington, advised three US Presidents, and served as Executive Director of the National Urban League.

cau.edu/school-of-soci…

[15/34]

However, he tragically drowned a few months later while swimming near Lagos, Nigeria on a trip meant to increase understanding between Africans and Americans.

Even though he’s not in the official numbers, I wanted to highlight his story.

nytimes.com/1971/03/13/arc…

[16/34]

Even though he’s not in the official numbers, I wanted to highlight his story.

nytimes.com/1971/03/13/arc…

[16/34]

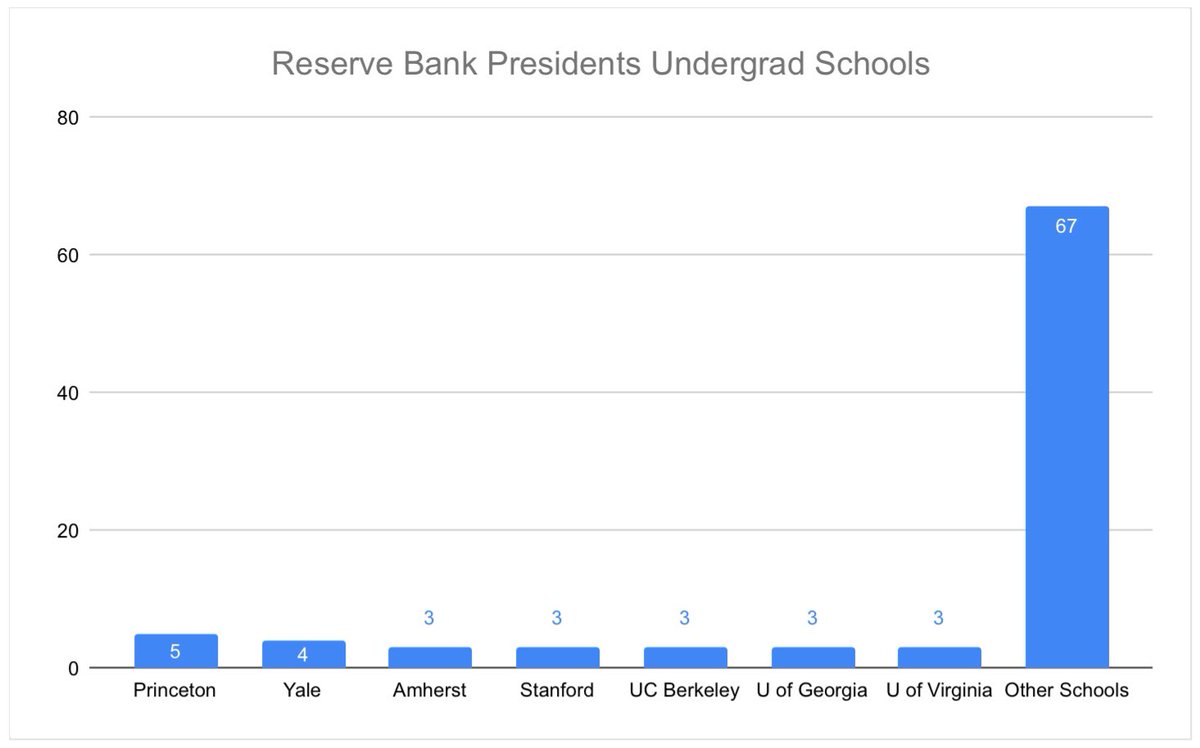

Now let’s look at the data.

Here’s the portion of White and Nonwhite directors elected/appointed to new positions at all of the Reserve Banks for the entire history of the Fed.

[17/34]

Here’s the portion of White and Nonwhite directors elected/appointed to new positions at all of the Reserve Banks for the entire history of the Fed.

[17/34]

Here’s the number of NonWhite Directors over time for the:

@BostonFed, @NewYorkFed, @PhiladelphiaFed, @ClevelandFed

[18/34]

@BostonFed, @NewYorkFed, @PhiladelphiaFed, @ClevelandFed

[18/34]

Here’s the number of NonWhite Directors over time for the:

@RichmondFed, @AtlantaFed, @ChicagoFed, and @StLouisFed

[19/34]

@RichmondFed, @AtlantaFed, @ChicagoFed, and @StLouisFed

[19/34]

Here’s the number of NonWhite Directors over time for the:

@MinneapolisFed, @KansasCityFed, @DallasFed, and @SFFed

[20/34]

@MinneapolisFed, @KansasCityFed, @DallasFed, and @SFFed

[20/34]

The combined tenure of all NonWhite Directors varies greatly between the districts with @SFFed having the most with a total of 61 years and @MinneapolisFed with just 15 years.

[21/34]

[21/34]

The first NonWhite Directors in the database were in 1972 (one each in the @PhiladelphiaFed and @SFFed) and the last district to have their first NonWhite Director was @MinneapolisFed in 2003.

[22/34]

[22/34]

Remember that the 9 Directors are divided into three groups of three:

A) bankers elected by bankers

B) nonbankers elected by bankers

C) nonbankers appointed by Fed in Washington

Takeaway #1: very few NonWhite bankers

Takeaway #2: big jump in NonWhite Directors post-GFC

[23/34]

A) bankers elected by bankers

B) nonbankers elected by bankers

C) nonbankers appointed by Fed in Washington

Takeaway #1: very few NonWhite bankers

Takeaway #2: big jump in NonWhite Directors post-GFC

[23/34]

In the next few weeks I’ll be diving into how the make-up of the Reserve Bank Board of Directors changed after the GFC. In addition to race, I’ll look at gender, age, sector they represent, and whether or not they’re from the Reserve City.

[24/34]

[24/34]

For those interested in diving into this area further I wanted to end this thread recommendations:

First up, if you haven’t read @Claudia_Sahm blogpost, it’s the reason Chair Powell responded with the quote in my first tweet. It’s a must read: macromomblog.com/2020/07/29/eco…

[25/34]

First up, if you haven’t read @Claudia_Sahm blogpost, it’s the reason Chair Powell responded with the quote in my first tweet. It’s a must read: macromomblog.com/2020/07/29/eco…

[25/34]

On the issue of diversity at the Reserve Bank Boards of Directors I recommend GAO report from ‘11 by Orice Williams Brown. It was required by Dodd-Frank. Even though their data only is ‘06-10, it’s full of excellent and insightful details. gao.gov/assets/590/585…

[26/34]

[26/34]

In this compelling 2016 oped @Aarondklein makes a strong case for more diversity at the Fed brookings.edu/opinions/the-f…

The folks @Fed_Up_Campaign published an important report last years on diversity populardemocracy.org/sites/default/…

[27/34]

The folks @Fed_Up_Campaign published an important report last years on diversity populardemocracy.org/sites/default/…

[27/34]

If you’re looking to make a difference, I highly recommend donating to the @SadieCollective (@itsafronomics & @TheFantaTraore). They’re doing phenomenal groundwork supporting Black women in (and getting into) economics. sadiecollective.org

[28/34]

[28/34]

You should be following the full team over @employamerica:

@sam_a_bell @IrvingSwisher @ArnabDatta321 @ENPancotti @tragicbios

[29/34]

@sam_a_bell @IrvingSwisher @ArnabDatta321 @ENPancotti @tragicbios

[29/34]

.@MehrsaBaradaran’s book The Color of Money is essential reading. If you’ve got this far in the thread and haven’t already read the book, stop and get it right now.

audible.com/pd/The-Color-o…

[30/34]

audible.com/pd/The-Color-o…

[30/34]

The Fed is hosting 7 virtual events called, “Racism and the Economy: exploring racial justice”.

Here’s the announcement and a link to the first event with @MinneapolisFed @neelkashkari, @BostonFed, and @AtlantaFed @RaphaelBostic

bostonfed.org/news-and-event…

[32/34]

Here’s the announcement and a link to the first event with @MinneapolisFed @neelkashkari, @BostonFed, and @AtlantaFed @RaphaelBostic

bostonfed.org/news-and-event…

[32/34]

Biden’s economic plan included two measures to increase the focus on Diversity at the Fed: joebiden.com/racial-economi…

The @Transition46 Fed team is solid @MehrsaBaradaran @amandalfischer @LevMenand @drlisadcook @AndyGreenSF @DennisKelleher @DamonSilvers @ProfAggarwal

[33/34]

The @Transition46 Fed team is solid @MehrsaBaradaran @amandalfischer @LevMenand @drlisadcook @AndyGreenSF @DennisKelleher @DamonSilvers @ProfAggarwal

[33/34]

My final recommendation is Andrew Brimmer’s oral history. The first Black Governor at the Fed. Nothing short of an incredible life. federalreserve.gov/aboutthefed/fi…

Does diversity at the Boards of Directors matter? He thought so: fraser.stlouisfed.org/title/federal-…

Thanks for reading

[34/34]

Does diversity at the Boards of Directors matter? He thought so: fraser.stlouisfed.org/title/federal-…

Thanks for reading

[34/34]

• • •

Missing some Tweet in this thread? You can try to

force a refresh