Large-scale government & central bank interventions in the COVID-19 crisis have revived the debate on the alleged "zombification" of the economy if unviable firms are kept alive. In our recent VoxEU column with @laeven_luc & @gschepen, we survey the existing literature. 1/14

https://twitter.com/laeven_luc/status/1326832934578515973

Why would banks lend to "zombie firms"? On the dark side, low-capitalised banks may engage in the "evergreening" of loans to avoid loss recognition. On the bright side, banks may lend to preserve valuable relationships, which can also avoid disruptions of supply chains. 2/14

A "zombification" of the economy can lead to a drop in productivity through credit misallocation: either mechanically by reducing aggregate productivity, or through a crowding-out effect when "zombie lending" tightens the credit constraints of high-productivity firms. 3/14

Government support schemes provide relief to cash-strapped firms and allow illiquid but viable firms to survive, but they can impede creative destruction & generate moral hazard when there is no efficient sorting mechanism to ensure that the right firms receive support. 4/14

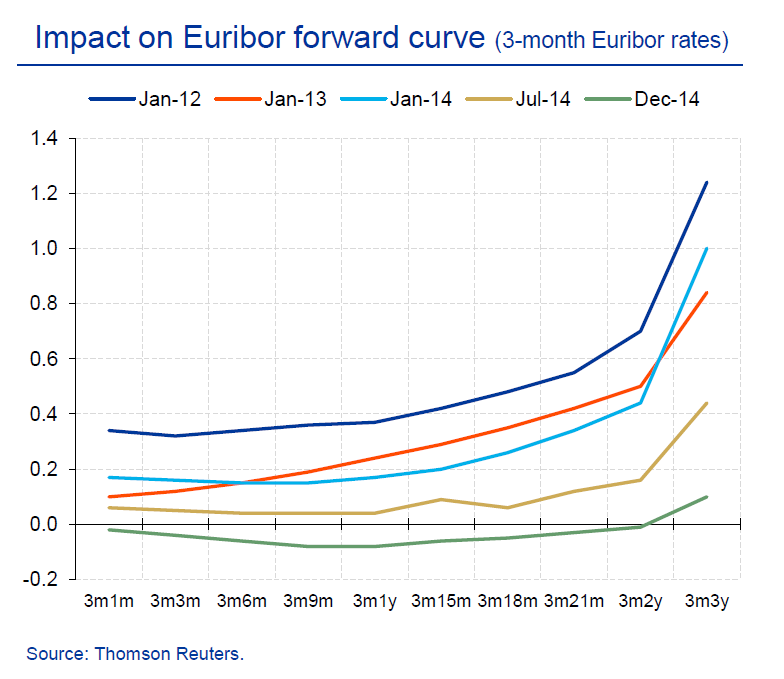

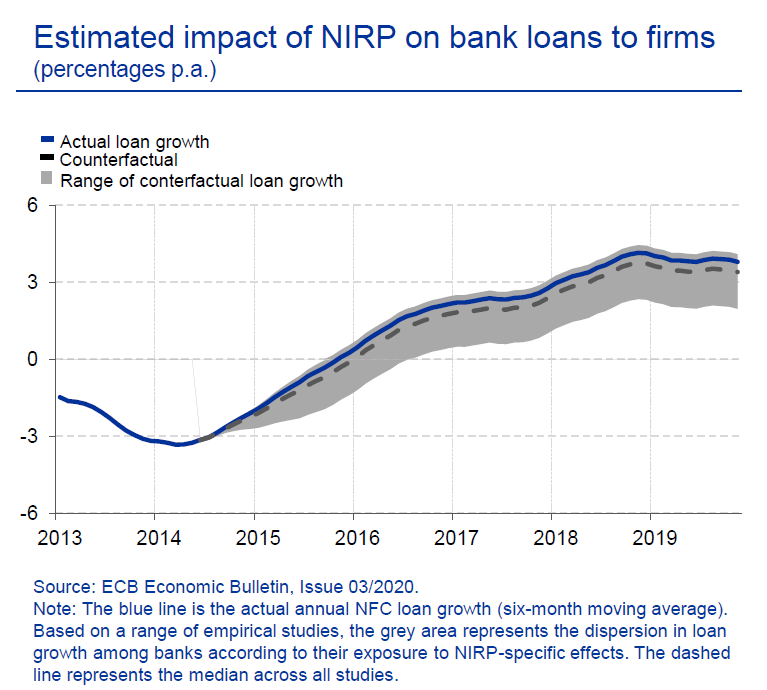

Similarly, the provision of central bank liquidity & low interest rates support illiquid but viable firms. However, this may prevent an orderly restructuring of firms. But the literature has not found a clear link between the level of interest rates and "zombification". 5/14

The COVID-19 pandemic has given rise to unprecedented policy support to firms, which has intensified the debate on a potential "zombification" of the economy. There are at least three reasons to believe that this time may be different. 6/14

First, the pandemic is hitting firms in sectors that are generally viable. The shock was not caused by excessive risk-taking by firms or banks, as in previous financial crises. Many sectors that have gone into (partial) lockdowns will rebound after the pandemic. 7/14

Second, banks have high capital positions, which implies that they are able to absorb loan losses to a larger extent. This should reduce adverse incentives. Third, the exceptionally large-scale government support has mitigated the risk that illiquidity turns into insolvency. 8/14

So many firms classified as "zombies" are in fact viable firms. They are experiencing temporary liquidity squeezes because the lockdowns have led to a collapse in aggregate demand. Banks will therefore play their part to preserve valuable lending relationships. 9/14

This shock clearly calls for broad-based government intervention to avoid unnecessary bankruptcies. But it is hard to distinguish illiquid from insolvent firms. Government intervention faces a trade-off in supporting the economy at the risk of funding some insolvent firms. 10/14

Research suggests four policy areas to reduce the scope for zombie lending. (1) Government support needs to be fine-tuned to direct the funds as much as possible to viable firms. One has to reflect on how & when to exit credit guarantee schemes while avoiding cliff effects. 11/14

(2) Supervisory authorities need to ensure that banks maintain sound capital positions because especially low-capitalised banks are prone to zombie lending. Recent recommendations for banks to temporarily halt dividends & share repurchases are to be welcomed in this light. 12/14

(3) Supervisory authorities need to ensure that banks provision adequately for loan losses on a forward-looking basis. Moreover, there is a need to promptly tackle the build-up of non-performing loans in case of rising corporate defaults. 13/14

(4) In the longer term, it is important to improve insolvency frameworks. Within Europe, this calls for further efforts to harmonise these frameworks across countries. This will help put the zombies to rest rather than having them haunt the economy for a long time. 14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh