Executive Board of the European Central Bank, University of Bonn (on leave), #NieWiederIstJetzt

6 subscribers

How to get URL link on X (Twitter) App

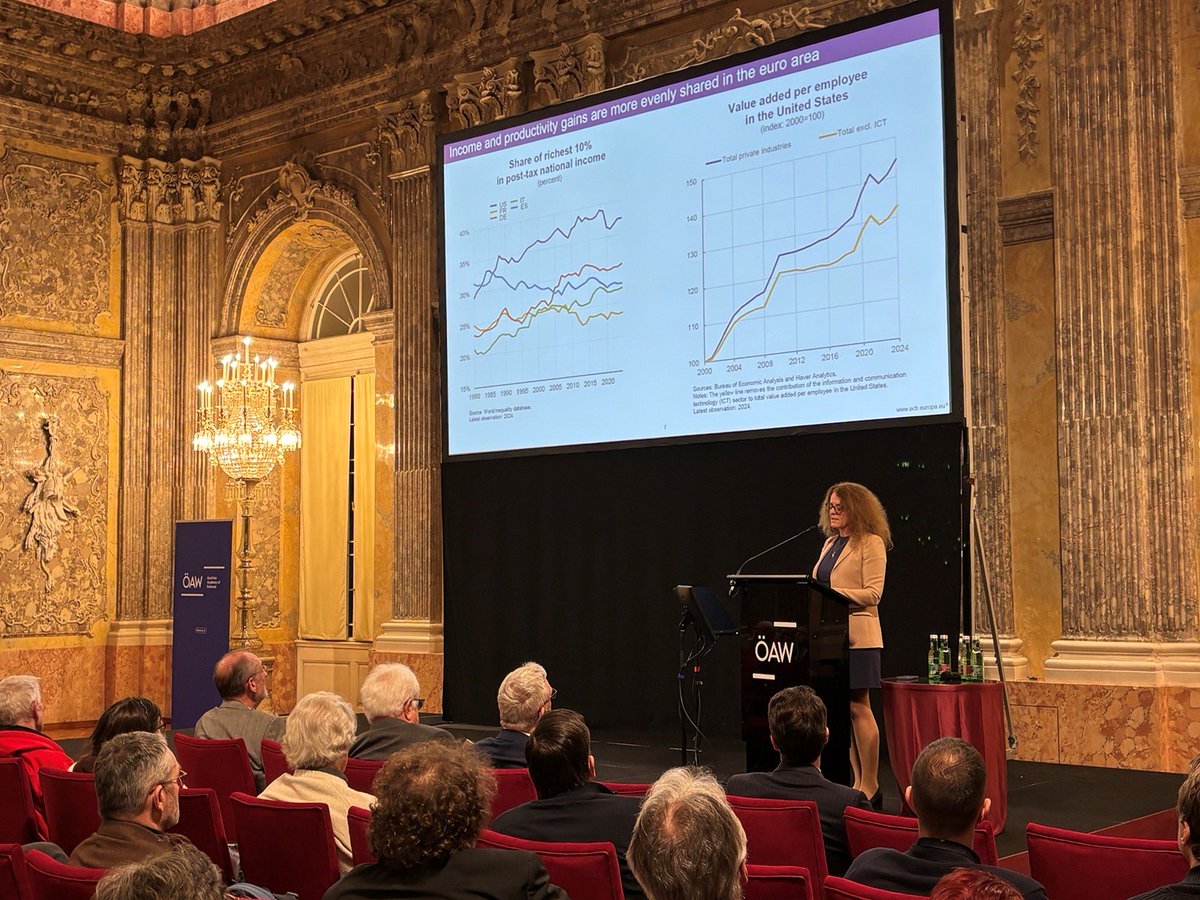

Europe stands out globally for its quality of life. Happiness and life satisfaction in Europe consistently rank among the highest in the world. 2/20

Europe stands out globally for its quality of life. Happiness and life satisfaction in Europe consistently rank among the highest in the world. 2/20

https://twitter.com/ecb/status/1841518881476694022Weak growth reflects the exceptional shocks that hit the euro area economy in recent years as well as the tightening of monetary policy. Yet, although the peak impact of monetary tightening is likely to be behind us and real incomes are rising, growth remains shallow. 2/25

https://twitter.com/ecb/status/1795334239933915161According to the signalling channel, asset purchases signal a commitment to a period of low interest rates, made credible by central banks’ exposures to duration risk. But this has not stopped central banks from raising rates when inflation surged, weakening this channel. 2/19

https://twitter.com/EUI_EU/status/1758429155476066632At the turn of the millennium, the euro area was operating at the global productivity frontier. But in the following years, it fell behind other economies like the United States and has not been able to recover from this loss of competitiveness. 2/20

https://twitter.com/ecb/status/1744344025019093406We thereby benefit from the respective advantages of the two data sources: the timely and comprehensive coverage of aggregate wealth in national accounts, and rich distributional information in the HFCS. Linking micro & macro data is a promising step for closing data gaps. 2/6

https://twitter.com/ecb/status/1720207162167746958Headline inflation in the euro area declined rapidly to 2.9% in October from its peak of 10.6% one year earlier. The bulk of this large drop reflects the substantial decline in the contributions from energy and food inflation. 2/23

https://twitter.com/ecb/status/1706326262589898800Cross-sectional and time series evidence have for a long time provided strong support in favour of a stable long-run relationship between money and prices. Across countries, the long-run averages of inflation and excess money growth fall near the 45-degree line. 2/23

https://twitter.com/ecb/status/1659573926681296897We have seen a fundamental change in the macroeconomic environment. After years of low inflation and low interest rates, inflation has come back with a vengeance, and central banks have raised interest rates in a rapid and synchronised fashion. 2/30

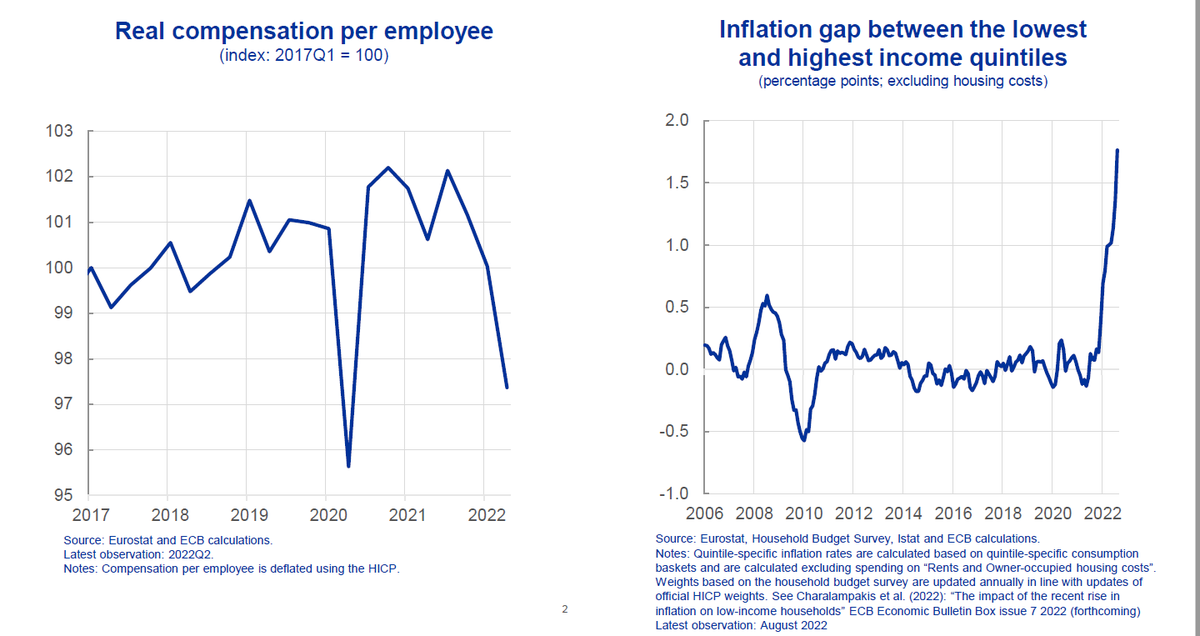

https://twitter.com/ecb/status/1650519784058937346We are seeing a change in the drivers of inflation. It started with supply-side shocks – bottlenecks and rising energy prices –, which are now fading, while at the same time demand-side factors are gaining importance. The macroeconomy has proven quite resilient. 2/15

https://twitter.com/ecb/status/1640368392669478914The launch of asset purchases and TLTROs in response to a long period of low inflation and to the pandemic resulted in a strong balance sheet expansion that was significant in historical and international comparison. 2/22

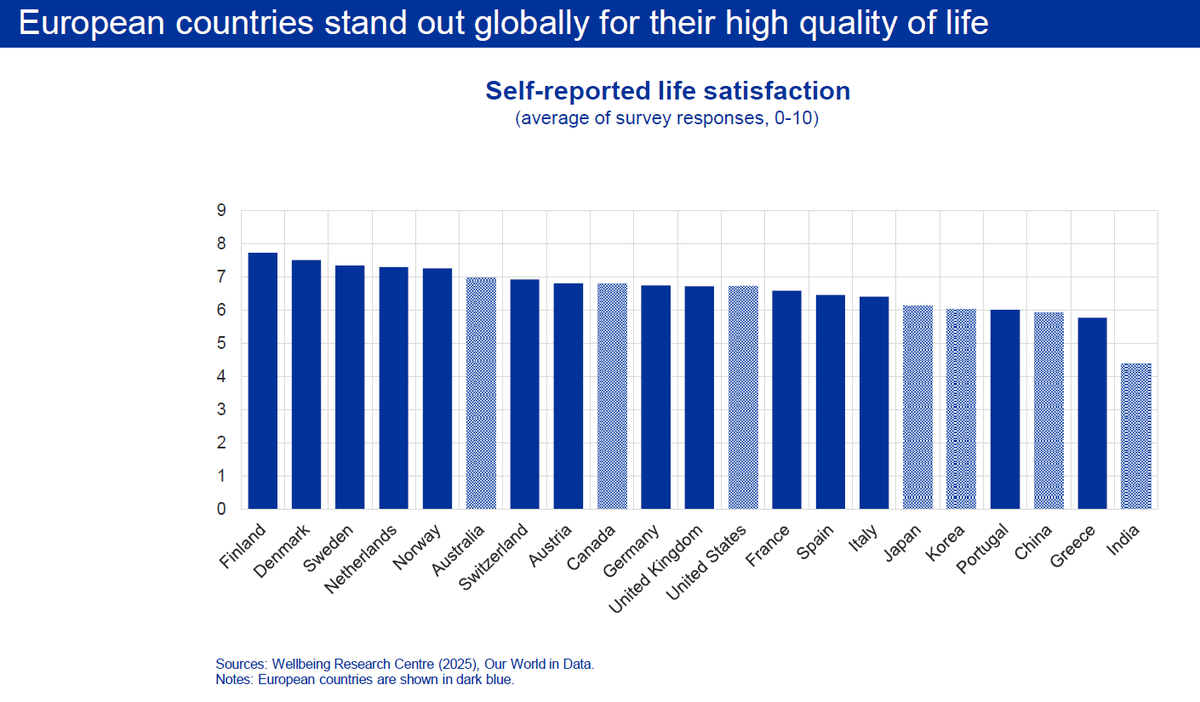

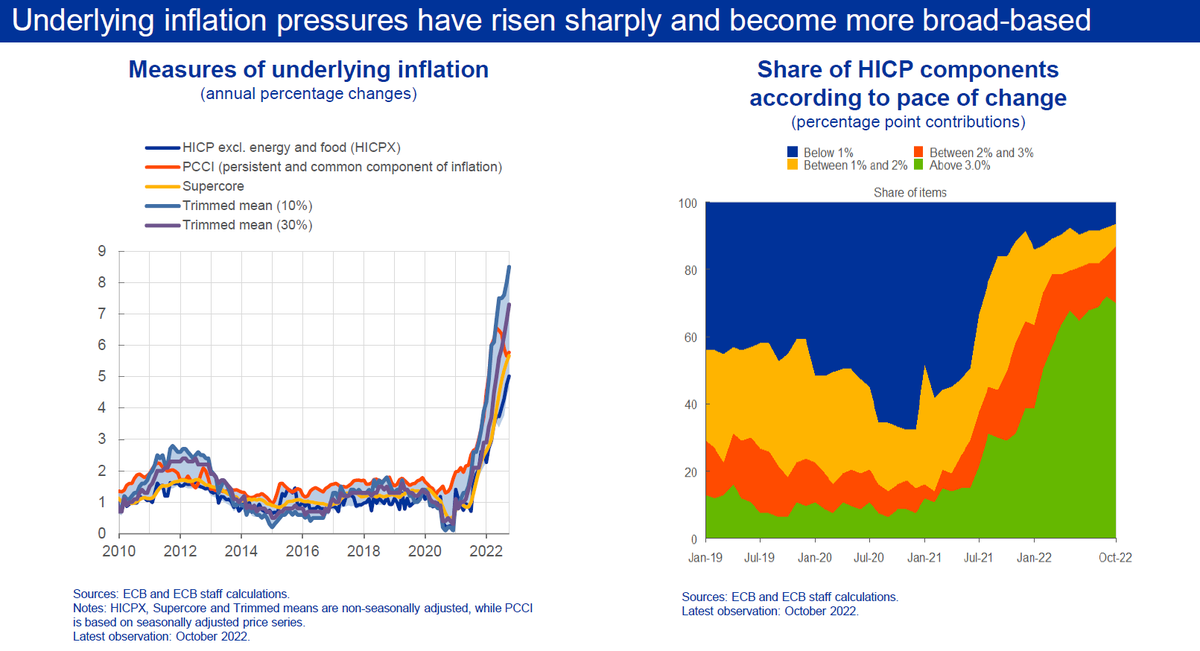

https://twitter.com/ecb/status/1595764981890424832In the recovery from the pandemic, demand started to outpace supply, putting upward pressure on prices. This was reinforced by a surge in energy and food prices after Russia’s invasion of Ukraine. Inflation broadened substantially, pushing up underlying inflation. 2/19

https://twitter.com/ecb/status/1575869503367680000High inflation means that many people are suffering a concerning loss in their purchasing power as their real, that is inflation-adjusted, wages are declining. My speech discusses what this decline in real wages means for monetary policy. 2/15

https://twitter.com/ecb/status/1524364388320399360In the euro area, the exceptional surge in energy prices is the main contributor to headline inflation. But core inflation, too, is at a record high, accelerating at a pace more than twice as much as the pre-pandemic historical average. 2/13

https://twitter.com/ecb/status/1510173468154806273Thanks to the response of fiscal and monetary policy during the pandemic, the euro area was on track for one of the fastest recoveries in history before the invasion: from trough to peak, euro area real GDP expanded by 17.5% until year-end 2021. 2/16

https://twitter.com/ecb/status/1395273222011113478Chapter 1 explains the concept of inflation and why it matters. You can look at the inflation rate in a particular country for a particular category of goods and services, which gives an impression of the heterogeneity across countries and goods. 2/8

https://twitter.com/ecb/status/1380401551961944064As we are still far from reaching our inflation aim of below, but close to, 2%, a sustainable rise of inflation in the direction of 2% would be good news. That would mean that the economy is gaining momentum and aggregate demand is increasing. 2/14