1/18

$TSLA's S&P 500 inclusion is finally here, and it's shaping up to be a truly unprecedented inclusion. I outlined a few of the reasons why $TSLA's inclusion is so special in this blog post a few months ago:

teslainvestor.blogspot.com/2020/07/teslas…

$TSLA's S&P 500 inclusion is finally here, and it's shaping up to be a truly unprecedented inclusion. I outlined a few of the reasons why $TSLA's inclusion is so special in this blog post a few months ago:

teslainvestor.blogspot.com/2020/07/teslas…

2/18

The actual announcement has made it clear that the committee is also aware of the unique nature of this inclusion, because I've never heard of an inclusion quite like $TSLA's for two reasons.

The actual announcement has made it clear that the committee is also aware of the unique nature of this inclusion, because I've never heard of an inclusion quite like $TSLA's for two reasons.

3/18

Reason #1: There are five weeks between the announcement and when the actual inclusion takes place (Dec 21st). This time usually ranges from a few days to about 10 days at most in cases like $FB's, but I have never seen such a long period between announcement and inclusion.

Reason #1: There are five weeks between the announcement and when the actual inclusion takes place (Dec 21st). This time usually ranges from a few days to about 10 days at most in cases like $FB's, but I have never seen such a long period between announcement and inclusion.

4/18

Reason #2: The possibility of the inclusion being split in two. I have also not heard of this happening ever before. The main reason as to why this could make sense is because most of the buying index funds do is usually concentrated in the days surrounding the...

Reason #2: The possibility of the inclusion being split in two. I have also not heard of this happening ever before. The main reason as to why this could make sense is because most of the buying index funds do is usually concentrated in the days surrounding the...

5/18

actual inclusion, even though index funds are free to accumulate the shares they need anytime from announcement until a few weeks after the inclusion. By splitting the inclusion into two, perhaps the committee will be able to split this concentrated buying into two as well.

actual inclusion, even though index funds are free to accumulate the shares they need anytime from announcement until a few weeks after the inclusion. By splitting the inclusion into two, perhaps the committee will be able to split this concentrated buying into two as well.

6/18

Some interesting context to this S&P inclusion is the information coming out of the 13Fs. We already knew Baillie Gifford sold off a fair amount of its $TSLA stake during Q3, but it now turns out that Baillie wasn't the only institutional investor who did so.

Some interesting context to this S&P inclusion is the information coming out of the 13Fs. We already knew Baillie Gifford sold off a fair amount of its $TSLA stake during Q3, but it now turns out that Baillie wasn't the only institutional investor who did so.

7/18

Although Baillie was the biggest seller far and away, many institutional investors significantly reduced their positions during Q3. So where did these shares go? That's what's so curious about the 13Fs. It gives no clear answer to where the shares ended up.

Although Baillie was the biggest seller far and away, many institutional investors significantly reduced their positions during Q3. So where did these shares go? That's what's so curious about the 13Fs. It gives no clear answer to where the shares ended up.

8/18

I was fully expecting to see a (new) institutional investor that amassed a massive stake in $TSLA during Q3, and effectively scooped up Baillie's (and others') shares. However, unless this investor missed the official deadline for filing its 13F, that is not the case.

I was fully expecting to see a (new) institutional investor that amassed a massive stake in $TSLA during Q3, and effectively scooped up Baillie's (and others') shares. However, unless this investor missed the official deadline for filing its 13F, that is not the case.

9/18

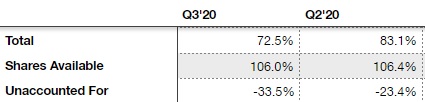

My spreadsheet, in which I keep track of TSLA's biggest holders, went from 23% of shares being unaccounted for in the hands of smaller institutionals, retails, etc. to 33% being unaccounted for. More details on this spreadsheet in this blog:

teslainvestor.blogspot.com/2020/08/tsla-h…

My spreadsheet, in which I keep track of TSLA's biggest holders, went from 23% of shares being unaccounted for in the hands of smaller institutionals, retails, etc. to 33% being unaccounted for. More details on this spreadsheet in this blog:

teslainvestor.blogspot.com/2020/08/tsla-h…

10/18

So where did these shares go? Some might've wound up in the hands of Citadel for delta hedging purposes, and it's possible smaller institutionals hold more shares, but these won't add up to 100M shares. I think there was likely somebody big buying leading up to the split.

So where did these shares go? Some might've wound up in the hands of Citadel for delta hedging purposes, and it's possible smaller institutionals hold more shares, but these won't add up to 100M shares. I think there was likely somebody big buying leading up to the split.

11/18

In my opinion, the three most likely theories are:

1) There is a new big institutional holder of TSLA shares, but he somehow hasn't filed 13F yet.

2) There were a large number of unaccounted for, naked shorts, that covered their positions leading up to the stock split.

In my opinion, the three most likely theories are:

1) There is a new big institutional holder of TSLA shares, but he somehow hasn't filed 13F yet.

2) There were a large number of unaccounted for, naked shorts, that covered their positions leading up to the stock split.

12/18

Although I've been skeptical of the naked shorts theory, because all other evidence is imo quite weak, I think this gives more credibility to it, because these 100M shares that went missing must've ended up somewhere.

Although I've been skeptical of the naked shorts theory, because all other evidence is imo quite weak, I think this gives more credibility to it, because these 100M shares that went missing must've ended up somewhere.

13/18

3) A large number of index funds speculated on the S&P 500 inclusion in Q3, before any official announcement happened.

Index funds don't file 13Fs, but NPORT-Ps. These have different deadlines, and are usually not filed until much later.

3) A large number of index funds speculated on the S&P 500 inclusion in Q3, before any official announcement happened.

Index funds don't file 13Fs, but NPORT-Ps. These have different deadlines, and are usually not filed until much later.

14/18

Although in my S&P 500 blog I showed a prospectus of an index fund stating it could not buy ahead of an official announcement, I have since seen a prospectus of a different S&P 500 fund that can buy ahead of an announcement, thereby speculating on future inclusions.

Although in my S&P 500 blog I showed a prospectus of an index fund stating it could not buy ahead of an official announcement, I have since seen a prospectus of a different S&P 500 fund that can buy ahead of an announcement, thereby speculating on future inclusions.

15/18

You might think that, if theory #3 is true, this means the S&P inclusion will be lackluster for the stock, but keep in mind that a minimum of 130M+ shares will have to be bought by index funds at any price, and some of the 100M shares that went missing in Q3 will have...

You might think that, if theory #3 is true, this means the S&P inclusion will be lackluster for the stock, but keep in mind that a minimum of 130M+ shares will have to be bought by index funds at any price, and some of the 100M shares that went missing in Q3 will have...

16/18

ended up in the hands of market makers for delta hedging purposes.

Moreover, even if index funds have already accumulated half of the shares they will need, it led to a rally from ~$1,350 to $2,700, a 100% increase. A similar rally today would boost the stock to $800+.

ended up in the hands of market makers for delta hedging purposes.

Moreover, even if index funds have already accumulated half of the shares they will need, it led to a rally from ~$1,350 to $2,700, a 100% increase. A similar rally today would boost the stock to $800+.

17/18

All in all, the next 5-6 weeks should be very interesting to watch for people who own $TSLA. I think $600 is quite likely, especially if the company continues to execute on Q4 deliveries, MiC MY, Berlin, and Austin. But time will tell.

All in all, the next 5-6 weeks should be very interesting to watch for people who own $TSLA. I think $600 is quite likely, especially if the company continues to execute on Q4 deliveries, MiC MY, Berlin, and Austin. But time will tell.

18/18

I've also compiled this tweet thread into a small blog post, for people who prefer that format:

teslainvestor.blogspot.com/2020/11/tslas-…

I've also compiled this tweet thread into a small blog post, for people who prefer that format:

teslainvestor.blogspot.com/2020/11/tslas-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh