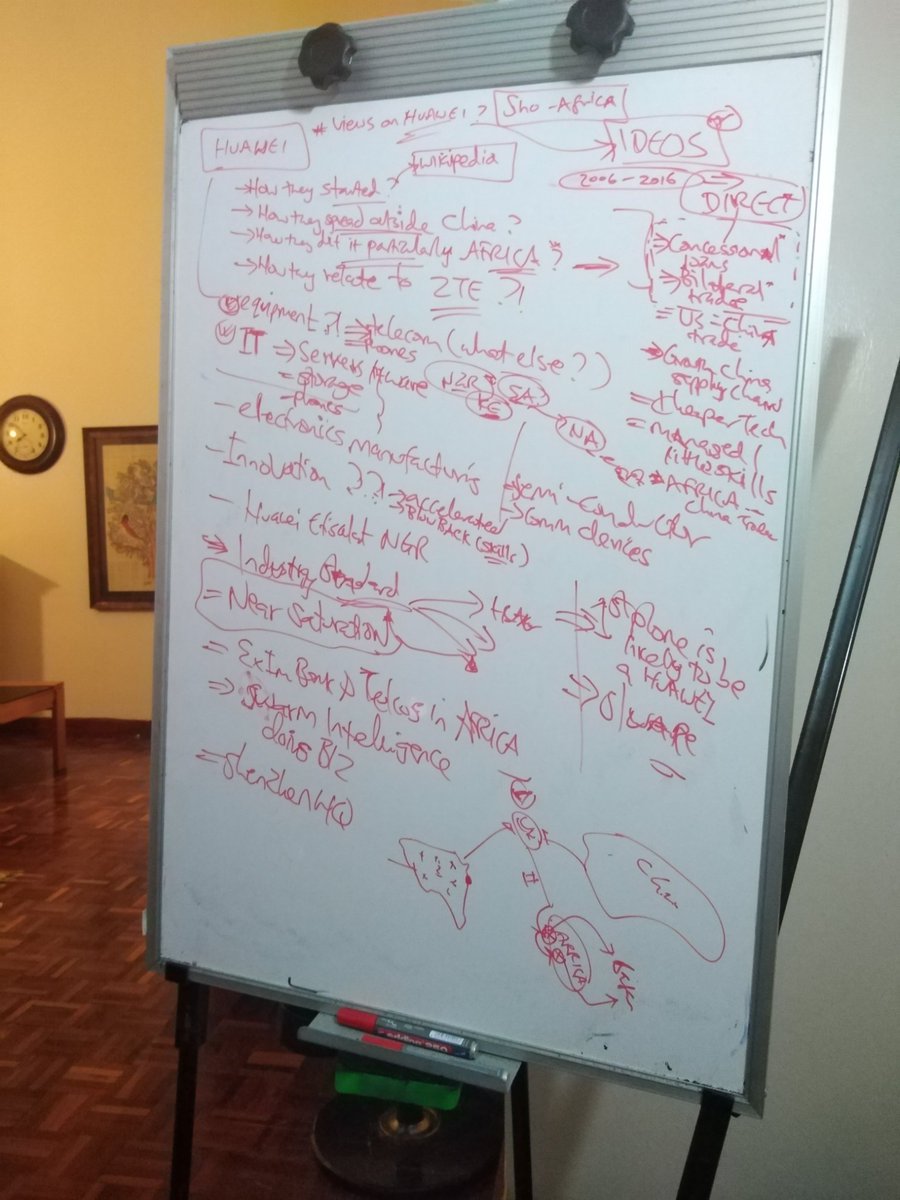

I just had one of the best masterclass on how 🇨🇳 China's Huawei conquered Africa's mobile networks thanks to @maorwed

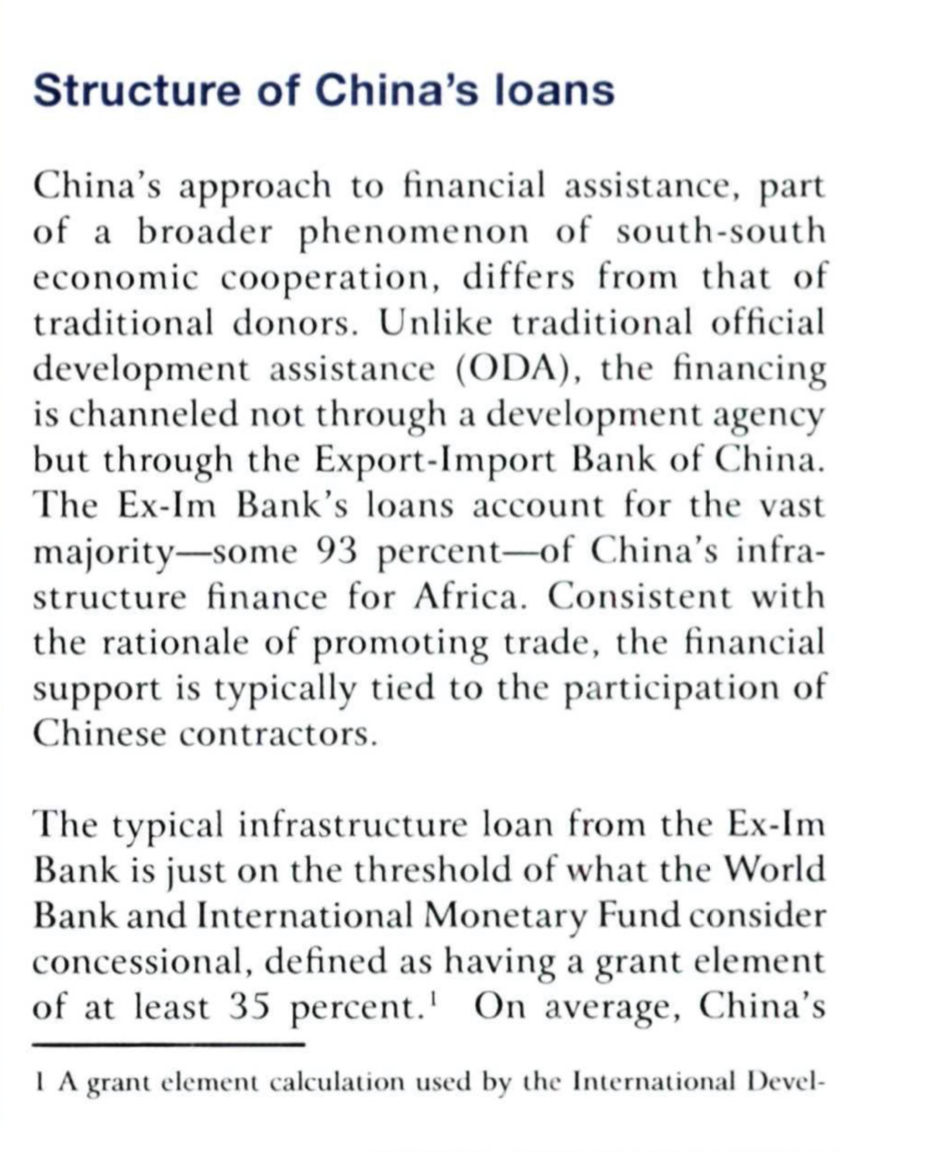

“Concessional loans tied to the purchase of Huawei equipment have proved a highly successful way to win contracts in developing countries.“

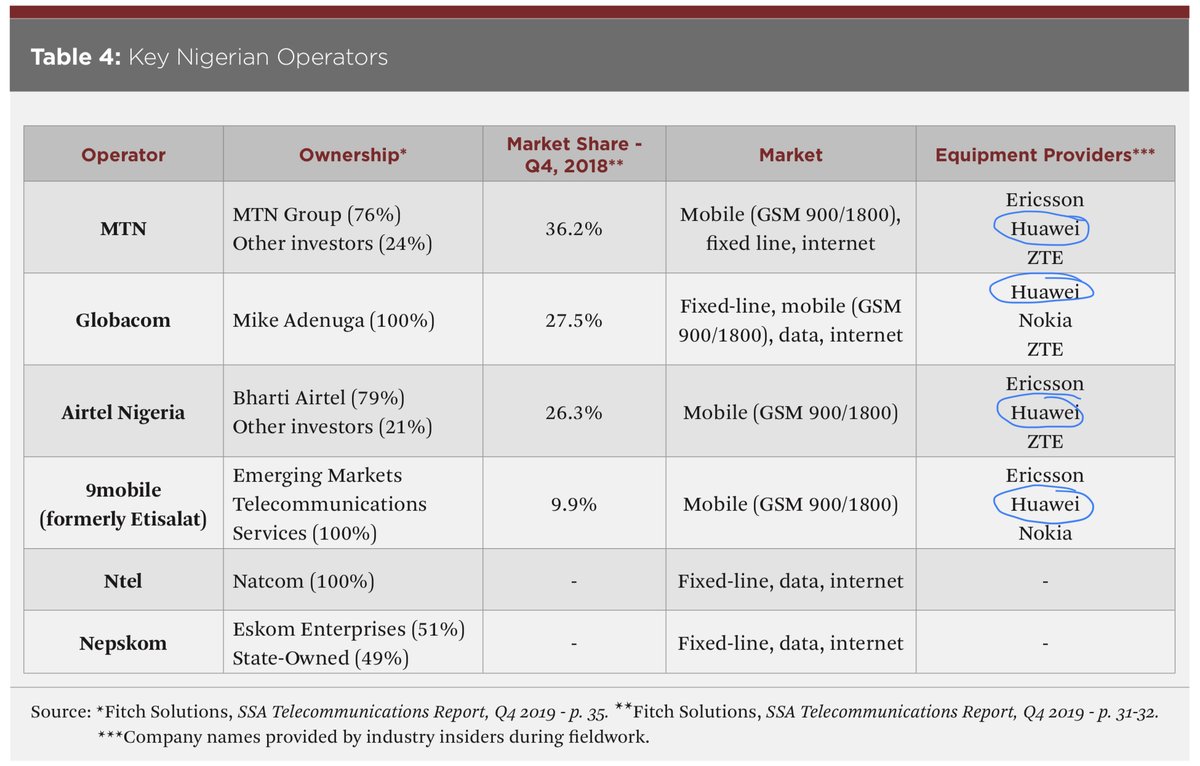

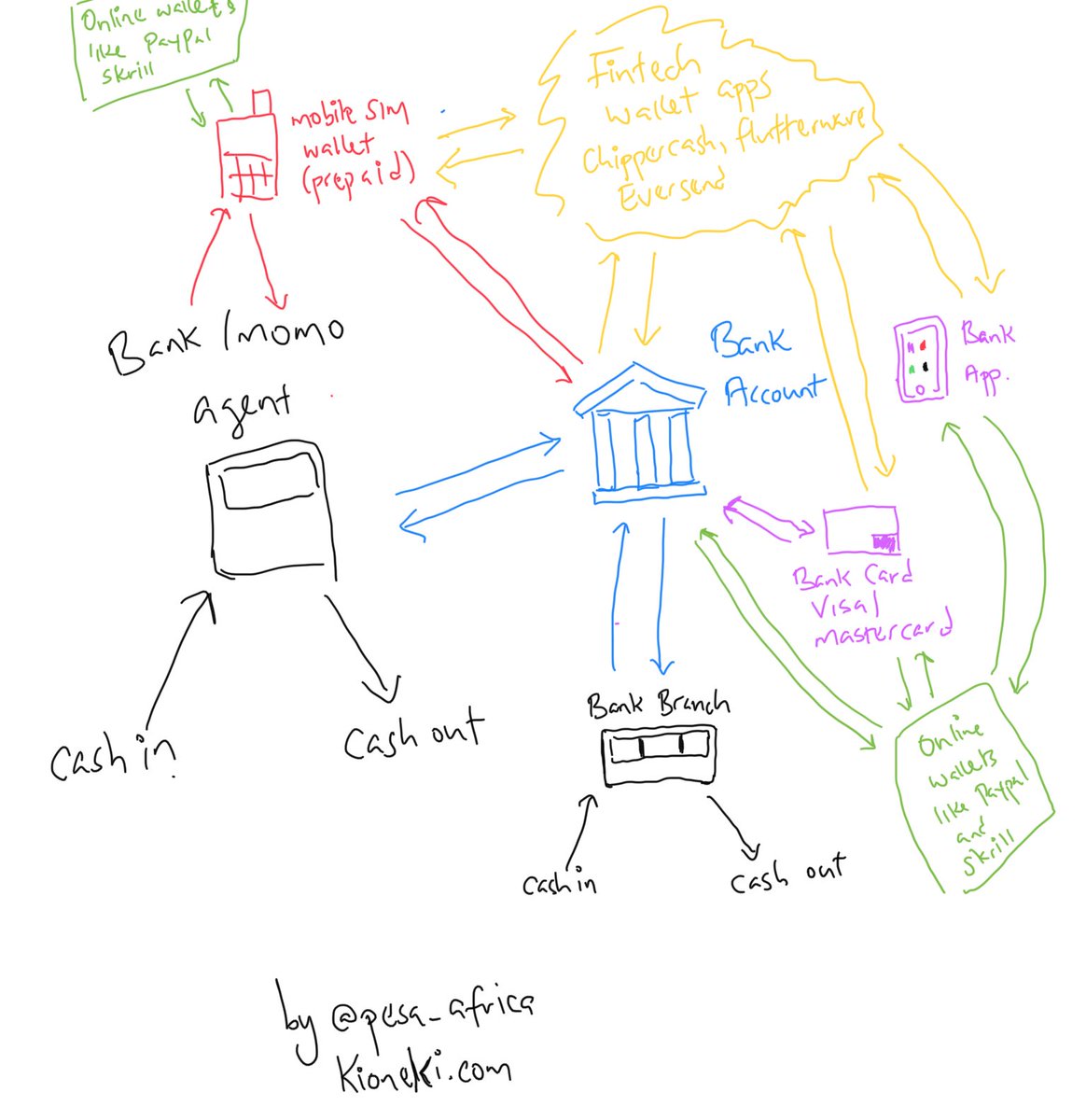

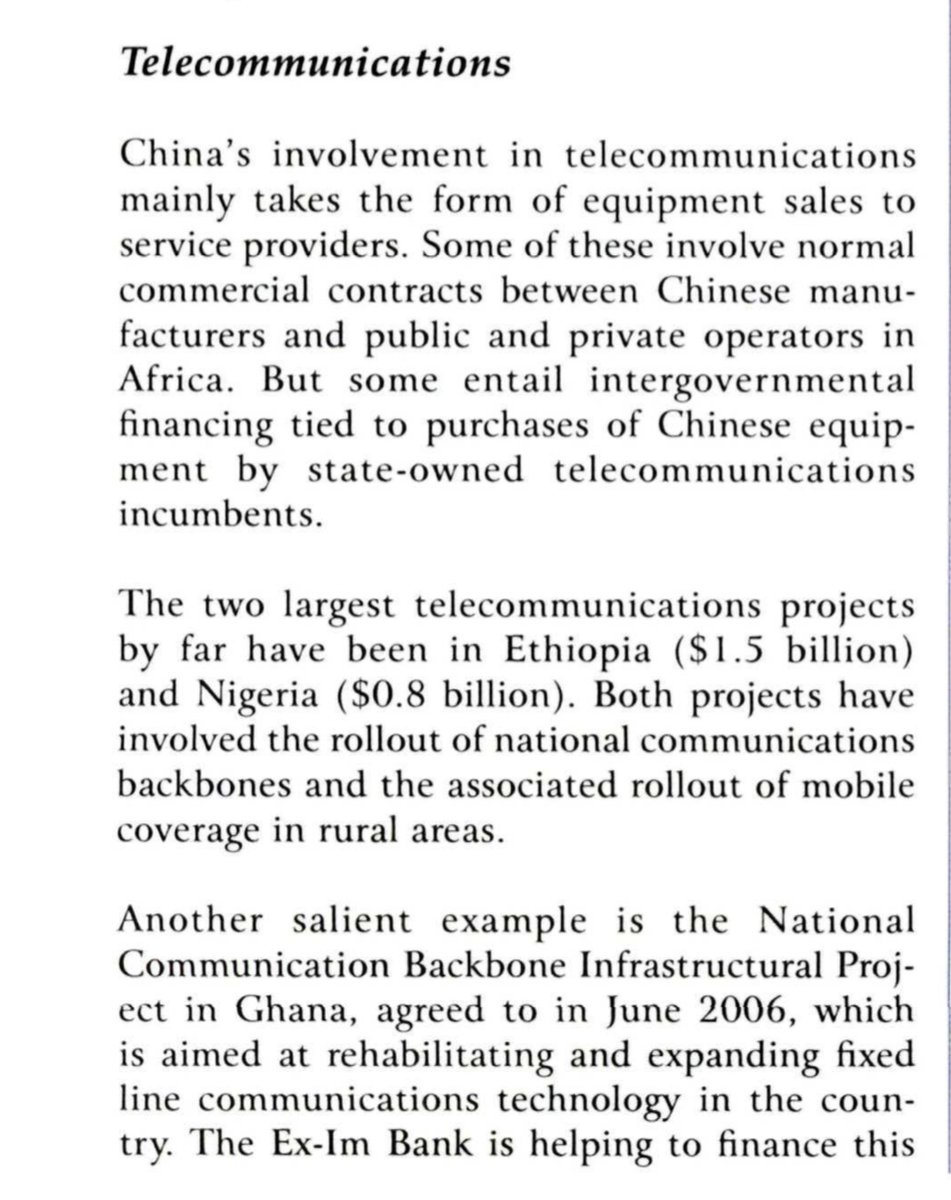

“China’s involvment in telecommmunications mainly takes the form of equipment sales to service providers. Some entail intergovernmental financing tied to purchase of Chinese equipment by state owned telecommunications incumbents”

“In 2004, the Chinese Development Bank loaned the major telecommunications firm Huawei $10 billion for overseas expansion, and Nigeria took $200 million in loans to buy Huawei equipment.”

“In 2012, Huawei was awarded a tender to build a national fiber-optic network in Kenya worth $60.1 million, a deal financed [by] the China EXIM Bank. The China EXIM Bank also gives cheap capital to state-owned firms to bid for large infrastructure projects.”

“one key difference between Huawei and its Western competitors is that Huawei has been awarded large lines of credit from the China Development Bank (CDB) and China EXIM Bank.”

“These loans allowed Huawei to outcompete Western firms on price by offering vendor financing options (e.g. grace periods on repayments for equipment) and it also allowed Huawei to invest in R&D.“

Kenyan information Minister, Joseph Mucheru told a press conference in Nairobi the country would make its own decisions on the Huawei issue

”Our policies are not driven by US policies as far as technology is concerned. We pick what is best for us”

”Our policies are not driven by US policies as far as technology is concerned. We pick what is best for us”

“according to the China-Africa Research Initiative database, there are 49 Huawei projects in 22 African countries that have received roughly US$ 2.9 billion worth of loans from China’s EXIM Bank since 2004.”

“Since 2000, ZTE has also received roughly US$ 3.9 billion from China’s EXIM Bank for projects in 16 African countries“

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh