THREAD (1/7) Quick take on 10 point green plan: Serious set of net zero commitments that show PM wants to make his record on green jobs central to the Tory platform at the next election. Further detail will be needed on delivery, but this is an important step-forward on net zero.

(2/7): Ambitious targets for key tech fits the way PM operates (e.g. mass testing) – set a demanding goal that will require huge changes to deliver. Clear that this approach can work (offshore wind). 2030 commitment to phase out ICE vehicles was unthinkable just a few years ago.

(3/7): To support new deployment targets, PM has announced significant new public funding in a number of areas to drive forward more rapid progress (CCUS, hydrogen, batteries). While some will argue the ££ isn’t enough, its a serious down payment when fiscal backdrop v tough.

(4/7): Particularly good news that the focus is on technologies where the UK can seize the economic edge. Major commitments on advanced nuclear, hydrogen and clean transport will mean ££ being channelled to key regions across the country, including key to levelling-up agenda.

(5/7): But now comes the hard bit. Political reaction to the plan will focus on levels of public investment, ultimately it will be for the private sector to deliver climate action. Focus must now turn to mobilising investment to deliver multi-billion pound projects by 2030.

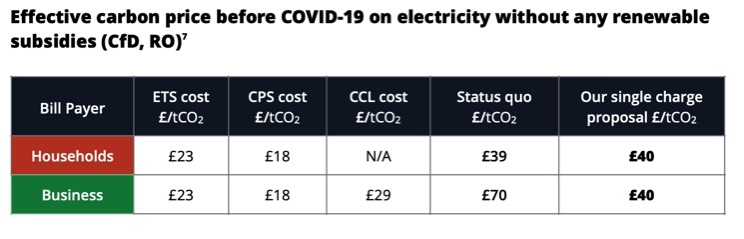

(6/7): While the plan starts to get into the trickier bits of net zero, such as decarbonising homes, it doesn’t solve the challenge of how to create compelling offers that consumers will actually want. There are also a few notable gaps, such as carbon pricing and flexible power.

(7/7): But the detail can come in due course. Must see today for what it is – PM laying out the broad building blocks of his net zero strategy (hydrogen, nuclear, offshore wind) that if implemented well, stand to create thousands of green jobs and help position UK before COP26.

• • •

Missing some Tweet in this thread? You can try to

force a refresh