Busy Econ Day:

-UI Claims, will it reflect new restrictions?

-Philly & KC Fed

-Existing Home Sales

-LEI

-EIA Nat Gas, late injection

-Benchmark TIPs Auction $12B Reopening, yesterday's 20yr was rough

-POMO: $3.6B 7-20's

-Bill & Note Announcements, Treasury's needs important

-UI Claims, will it reflect new restrictions?

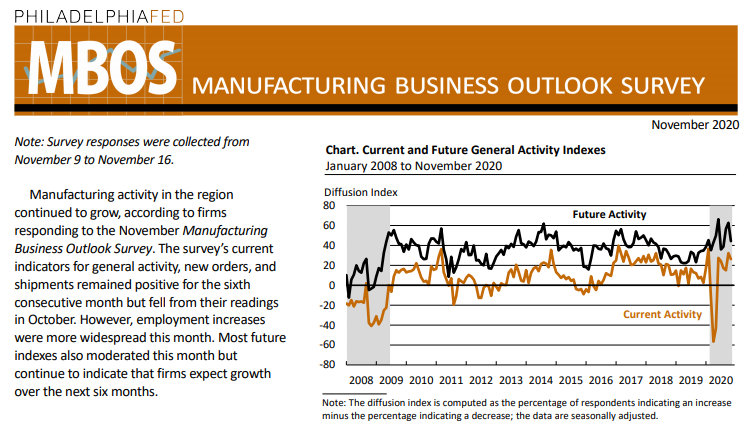

-Philly & KC Fed

-Existing Home Sales

-LEI

-EIA Nat Gas, late injection

-Benchmark TIPs Auction $12B Reopening, yesterday's 20yr was rough

-POMO: $3.6B 7-20's

-Bill & Note Announcements, Treasury's needs important

The EU merits attention today. Three (3) Bundesbank speakers and rumors of Madame LaGarde getting on the mic.

Big print on Existing Home Sales. Thank You @Fullcarry

https://twitter.com/Fullcarry/status/1329439594606157826?s=20

KC Fed prints 2 points lower at 11 vs. 13.

• • •

Missing some Tweet in this thread? You can try to

force a refresh