1/The Fed released its Financial Stability Report for Nov 2020. It is always interesting to read the Fed's take on markets and its degree of self awareness. federalreserve.gov/publications/2…

2/Asset Valuations

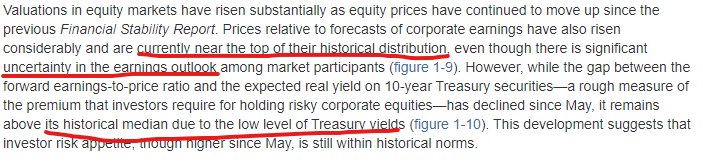

-Asset prices have generally increased since May, and, when adjusted for low interest rates, valuation pressures appear roughly in line with their historical norms

Seems correct. When expected future cashflows are discounted at these rates, the PV isn't insane

-Asset prices have generally increased since May, and, when adjusted for low interest rates, valuation pressures appear roughly in line with their historical norms

Seems correct. When expected future cashflows are discounted at these rates, the PV isn't insane

3/Asset Valuations

-Asset prices remain vulnerable to significant declines, given a high degree of uncertainty around the course of the pandemic and the pace of the recovery

Lack of awareness that the Fed can be the greatest source of instability if they ease liquidity.

-Asset prices remain vulnerable to significant declines, given a high degree of uncertainty around the course of the pandemic and the pace of the recovery

Lack of awareness that the Fed can be the greatest source of instability if they ease liquidity.

4/Treasury Yields

-Treasury yields are near historical lows

File this under: "No kidding Sherlock Holmes..." Though no comment about the curve or recent rising long yields.

-Treasury yields are near historical lows

File this under: "No kidding Sherlock Holmes..." Though no comment about the curve or recent rising long yields.

5/Corporate Debt

-Corporate debt market spreads returned to historical norms, market functioning improved, and issuance resumed

Mention travel/leisure still at wide spreads, but fail to acknowledge their intentional role in managing this 'market'.

-Corporate debt market spreads returned to historical norms, market functioning improved, and issuance resumed

Mention travel/leisure still at wide spreads, but fail to acknowledge their intentional role in managing this 'market'.

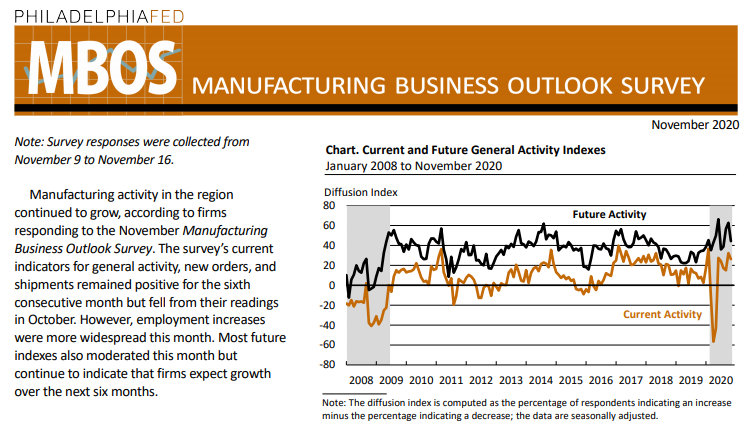

6/Equity Prices (the good stuff)

-Equity prices rose sharply, with higher valuations supported, in part, by low interest rates

A lot to unpack in the comments here, with no acknowledgment of their role in yields impacting equity prices.

-Equity prices rose sharply, with higher valuations supported, in part, by low interest rates

A lot to unpack in the comments here, with no acknowledgment of their role in yields impacting equity prices.

End/The report continues and includes comments on CRE, Farmland and other real estate. It is worth a read, but mostly tells us what we already know. The tone is that these valuation levels are organic and not a result of Central Bank financial repression.

• • •

Missing some Tweet in this thread? You can try to

force a refresh