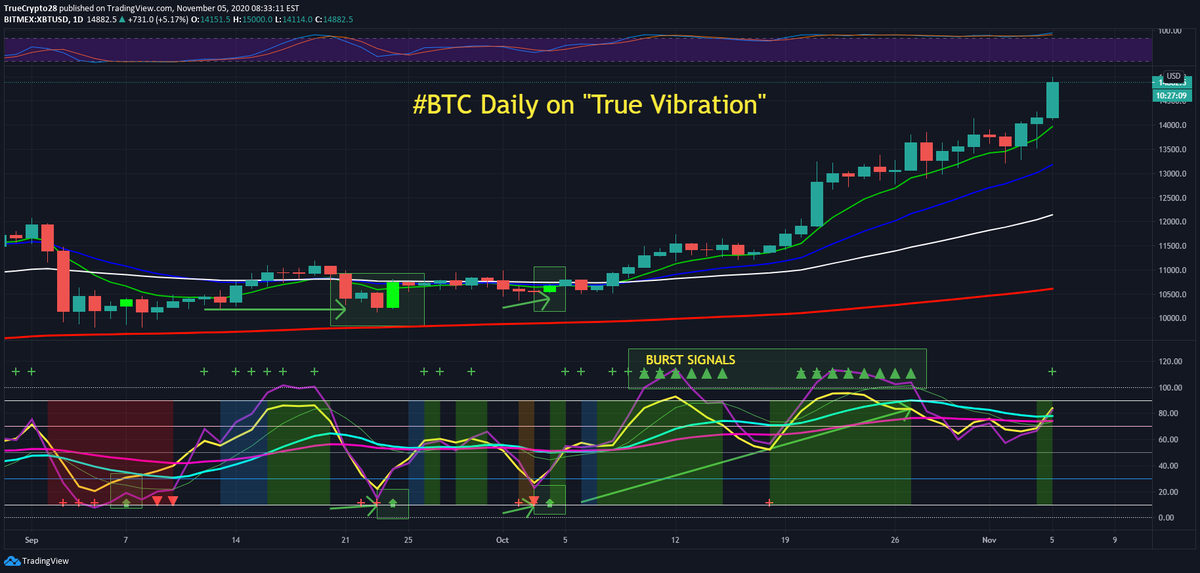

#BTC H1 On "True Vibration 2.0"

Sometimes it's so easy that it feels like stealing... This has been one of those times

Active traders that are interested in free access can inquire by Liking, Retweeting, & then DM'ing me for details. Expect delays in response

Enjoy the views!

Sometimes it's so easy that it feels like stealing... This has been one of those times

Active traders that are interested in free access can inquire by Liking, Retweeting, & then DM'ing me for details. Expect delays in response

Enjoy the views!

#BTC H2 On "True Vibration 2.0"

#BTC H4 On "True Vibration 2.0"

#BTC H6 On "True Vibration 2.0"

• • •

Missing some Tweet in this thread? You can try to

force a refresh