#Bitcoin TA Trader Mixing Old School & New School Tricks. Helping Future Traders Fish For Themselves. Always FREE Telegram link: https://t.co/UXPJxdDffW

11 subscribers

How to get URL link on X (Twitter) App

Since the beginning of time every wise piece of literature warned about envy.

Since the beginning of time every wise piece of literature warned about envy.

In the 1970's they said we were headed to another ice age(Global Cooling).

In the 1970's they said we were headed to another ice age(Global Cooling).

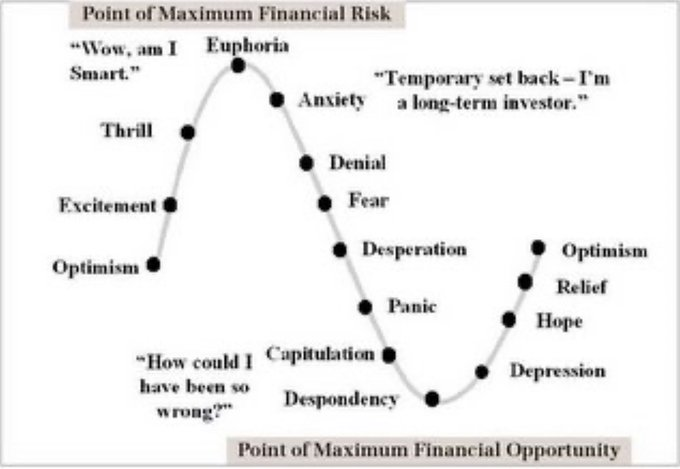

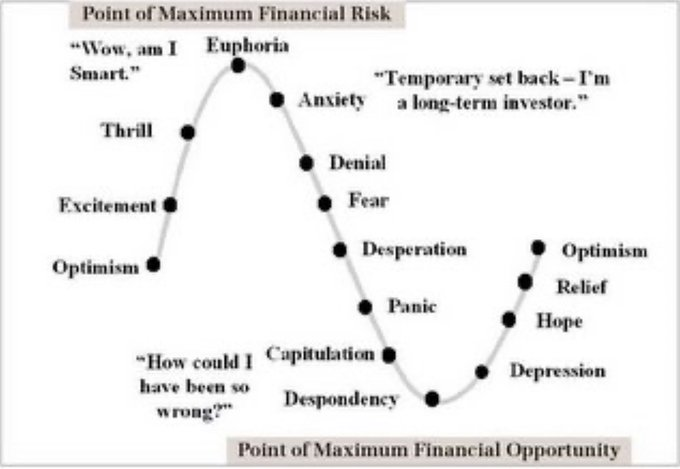

Thrill – At this point, we cannot believe our success and begin to comment on how smart we are

Thrill – At this point, we cannot believe our success and begin to comment on how smart we are

One unique feature about the "Training wheels" setting that talented traders will love is that it allows you to utilize a much Higher TF Anchor(Directional Bias)

One unique feature about the "Training wheels" setting that talented traders will love is that it allows you to utilize a much Higher TF Anchor(Directional Bias)

#BTC Weekly

#BTC Weekly

$ZIL H1, M30 $ONE M5, M15 True Vibration Signals

$ZIL H1, M30 $ONE M5, M15 True Vibration Signals